Bitcoin and the Lightning Network – latest developments

by Jendrik Poloczek, June 30, 2023

Bitcoin-related projects are an integral part of our pipeline and our portfolio – such as Sovryn and Foundation Devices. Over the last months, we have extensively looked into the Lightning Network space. In this post, we highlight the latest Bitcoin and Lightning Network developments. A special focus is placed on recent enablers and catalysts, introducing some relevant players, and discussing outstanding challenges that now offer particular opportunities for builders.

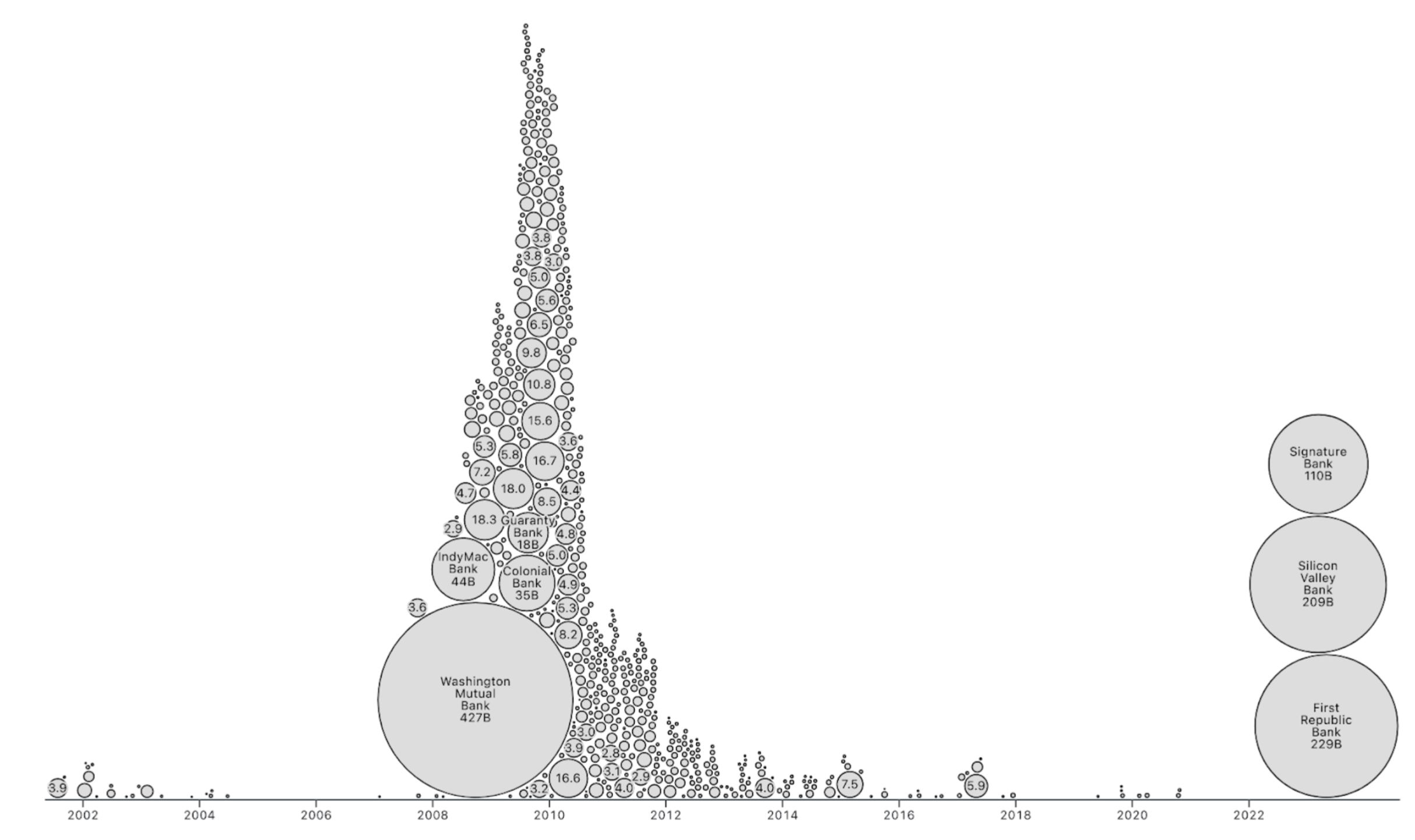

Fig.1: FDIC-reported banking collapses from 2002 to 2022. Source: Mike Bostock

Re-discover Bitcoin: a different category

Bitcoin was created in the turmoil of the banking crisis in 2009. Satoshi inscribed the message “The Times 03/Jan/2009 Chancellor on brink of second bailout for banks.” into the first block, referencing these turbulent times. Back then, the US bank Washington Mutual Bank failed with $307B in assets. From then until now, 14 years later, we’re seeing US bank failures again with Silicon Valley Bank with $209B in assets. And the following failure of Signature Bank with $110B, see Fig 1 (this infographic is reproducible with this notebook by Mike Bostock). These numbers are inflation adjusted.

In the meantime, Bitcoin gained strength in an antifragile manner from various regulatory attacks such as straight-out explicit bans e.g. China, Qatar, Saudi Arabia, and various implicit bans, to mining bans in e.g. China, to exchange bans, and technical attacks such as forking the chain, e.g. Bitcoin Cash in 2017 and others. This young asset has proven to be resilient over the last 14 years with a 100% uptime, a higher hash rate than ever before, countries adopting it as legal tender e.g. El Salvador in 2021, Central African Republic in 2022, and more and more people holding bitcoin for the long-term, see Total Amount of Holders Chart. With it came institutional adoption such as companies and funds taking Bitcoin onto their balance sheet e.g. MicroStrategy, Tesla, Block Inc. and many others. And just this month BlackRock filed for a spot Bitcoin ETF, and Fidelity is planning to do the same.

Some figures and facts illustrate Bitcoin’s special position: Bitcoin is…

- …currently at a 48.7% dominance with a roughly $600B market cap in a $1.2T crypto market;

- …in the top dozen assets worldwide in terms of market cap;

- …the asset mainstream primarily invests in when first getting exposure to crypto currency assets;

- …the most liquid asset when traded;

- …by far the most adopted cryptocurrency for payment.

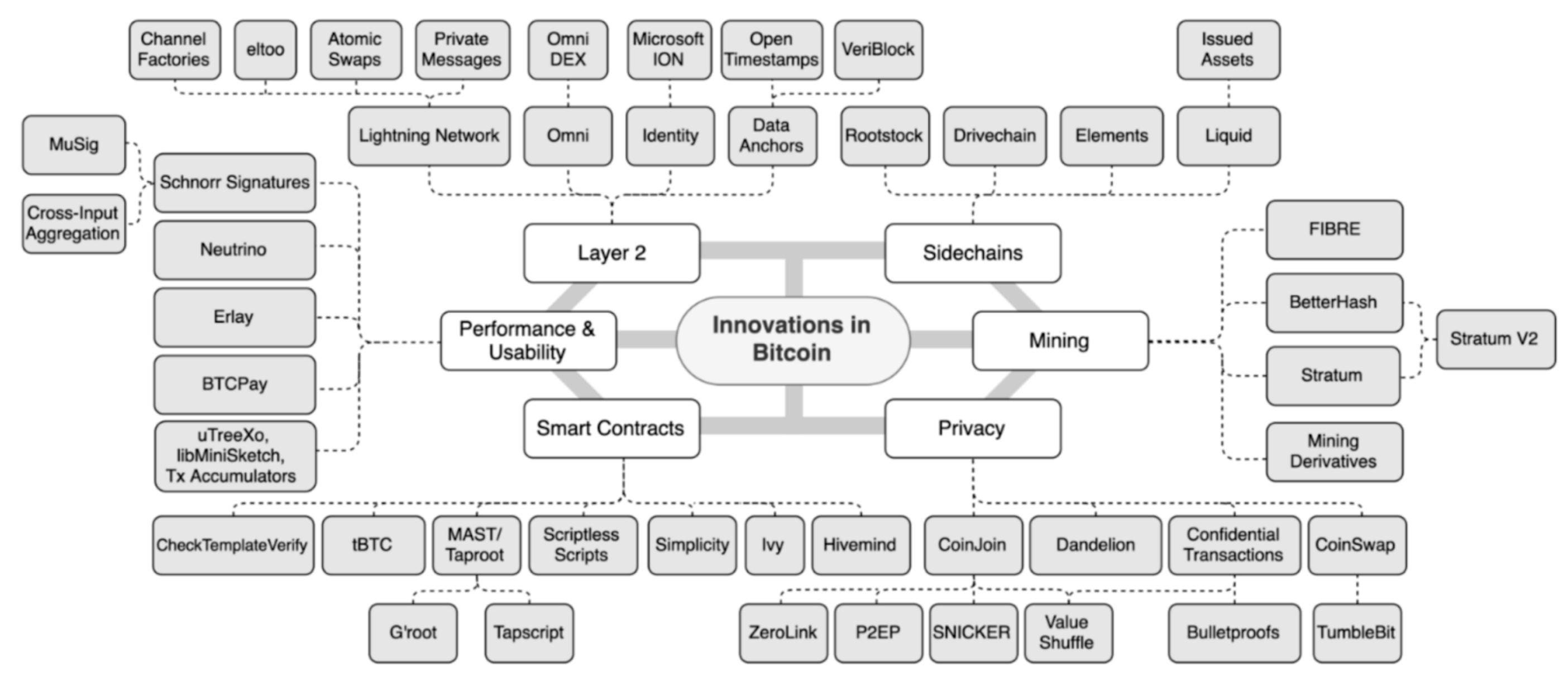

Innovations around Bitcoin. Source: Lucas Nuzzi - A Look at Innovation in Bitcoin’s Technology Stack

Why Bitcoin stands out

Regardless of these impressive figures, why is Bitcoin so entirely different from the common conversations around Web3 and crypto? Multiple important factors differentiate it into a fundamentally different category:

- It has a single focus as a robust global permissionless censorship-resistant settlement layer with a fixed maximum supply of 21M bitcoin. This makes Bitcoin a form of virtual gold (with some people’s argument of being better than physical gold), that can be used as a store of value in the use cases of an inflation hedge or reserve asset.

- Changes to the protocol are deliberately slow. The employed Nakamoto consensus rules with Proof-of-Work haven’t been changed much since 2009. Proof-of-work enables objective consensus and requires physical energy to produce bitcoin.

- Compared with most other projects, the founder Satoshi Nakamoto disappeared, and the network is run by Bitcoin core developers, miners and around 17,000 full nodes. Simple stakeholder governance is executed by running different versions of the code.

These aspects support the importance of Bitcoin in the long term and we are very much committed to investing in the Bitcoin ecosystem, particularly in the layers that make use of Bitcoin as a base asset and its canonical security. In the past, we led the seed round of Sovryn, a DeFi one-stop-shop on Rootstock (RSK), a merged-mined sidechain of Bitcoin and Foundation Devices, an open-source Bitcoin hardware wallet. We’re excited about recent developments regarding ZK rollups, space chains, discreet log contracts (DLCs), Ark and Fedimint – see Fig.2. A good way to stay updated with these advancements is the Bitcoin Optech newsletter. One of the areas we are particularly interested in is the Lightning Network (LN) and major advancements, like Taproot Assets, among others, built on top of it.

Lightning Network: the superior crypto payment system

In 2015, Joseph Poon and Thaddeus Dryja proposed the Bitcoin Lightning Network (LN): Scalable Off-Chain Instant Payments. This layer is built on top of Bitcoin to allow for instantaneous, private off-chain settlement in a decentralized way while leveraging Bitcoin’s security and asset. It is horizontally scalable since it’s not using a ledger, but rather a P2P network in which payments are routed. Instant settlement, low fees (<$0.01) and its privacy traits make it attractive for (micro) payments and for companies in the payment space to build on top of to compete with e.g. Visa and Mastercard, the world’s biggest payment processing networks. In a world of IoT and smart grids, the LN can be leveraged as a machine-to-machine payment system. For an analysis of its viability as a substitution for traditional global payment networks, we refer to Lyn Alden’s A Look at the Lightning Network. The initial development of the Lightning Network involved collaboration with various industry players, including:

- Blockstream ($424M in total funding): building the LN implementation Core Lightning (previously c-lightning);

- Lightning Labs ($82.5M in total funding): building (among other things, such as Taproot assets, see below) the widely used LN implementation LND;

- ACINQ ($9.7M in total funding): has been working on another early implementation called Eclair, most known nowadays for its user-friendly non-custodial wallet Phoenix.

These companies were among the first to work on implementing the protocol in an open-source fashion. Very similar to the full node and validator implementation diversity in blockchain networks it’s great to see that the above companies are actively developing and maintaining clients.

Lightning network's latest enablers and catalysts. Source: Greenfield

Enablers and Catalysts for the Lightning Network

In the period from the year 2015 of the inception of the idea until 2021, LN was only used by enthusiastic early adopters. The biggest obstacles were running an own Bitcoin full node, running a LN implementation, finding peers in the network to manually connect to and manually balancing lightning channels including finding a source for inbound liquidity. That’s a lot of friction considering almost nobody was accepting LN payments. With this in mind, let’s have a look at what has changed and led to the explosion of renewed interest in the LN:

-

- Massive reduction of payment failure and an increase in connectivity:

River Financial states in its latest report that in the early days of Lightning in 2018, due to limited liquidity needed for routing payments through channels, people had failed $5 transactions around ~48% of the time. In 2021 however, the network grew to 1,000 BTC of liquidity. By now, this has increased to even more than 5,500 BTC, a rough 5x growth within two years. River states that nowadays payment failure has dropped below 2%. Other growth metrics besides total channel capacity include channel count (but important to keep in mind channel quality over quantity) and. For total capacity and channel count, Coinmetric’s dashboard provides live data.

- Advancements in UX and developer experience:

On the user side next generation non-custodial wallets such as Phoenix and Breez (also a PoS solution) allow for frictionless user onboarding to Lightning by leveraging Lightning Service Providers (LSPs) for both automatic and instant (zero-confirmation) LN channel opening. The fundamental problem of inbound liquidity to receive funds has only been partially solved however, see the challenges below. Custodial wallets, such as Wallet of Satoshi (predominantly used in El Salvador), and CashApp and Strike are other important catalysts for the usability of LN (while the use of custodial wallets is debatable). On the developer side, SDKs such as BDK and LDK, Breez SDK, River Financials’ API accelerate the development of nodes, wallets, and services sending/receiving lightning payments. Other UX improvements include new transaction types such as the BOLT12 offer type allowing users to receive (instead of sending) payments by scanning a QR code among others.

- Renewed interest in Bitcoin through experimentation and Taproot assets:

This year the so-called Ordinal Theory enabled the issuance of inscriptions (think of it as NFTs + on-chain content, more than >13M) on the Bitcoin base chain. It is a standard on how to interpret the existing blockchain data, without any modification, and attribute a new meaning off-chain to individually tracked on-chain satoshis. Another idea, the BRC-20 concept, leveraged inscriptions to enable fungible asset transactions on top of Bitcoin. Its market cap is by now >$100M. Both approaches are more of a hack, an experiment, rather than a serious proposal to extend Bitcoin but they proliferated new interest in Bitcoin. An upcoming and serious proposal to extend Bitcoin to support custom assets is Taproot Assets (formerly known as Taro). These custom assets enable issuance on the Bitcoin blockchain and the use of them in LN (while using the critical mass of liquidity of bitcoin locked in the network). A similar effort is RGB. Both enable centrally-issued stablecoins on Bitcoin and LN, which currently is a large chunk of liquidity settled on e.g. Ethereum. The ability to have stablecoins on Bitcoin/LN is another controversial topic for the community.

- Massive reduction of payment failure and an increase in connectivity:

Companies building on top of the Lightning Network

While there is a massive amount of smaller early-stage companies building on top of LN, which we are also excited to see, here we present a list of big movers that are supporting the ecosystem in various ways:

- Block ($602.1M in total funding) is a large publicly listed company that includes several sub-companies:

- Strike is another custodial LN wallet and an impressive last round of $80M.

- Voltage is a cloud solution for on-demand Lightning Nodes, having raised $6M.

- River Financial is an API payment service for LN with a recent $35M round of funding. Like c= and Lightspark, they’re working on an enterprise-grade solution to solve liquidity and payment optimization.

- Lightspark which has long been in stealth uncovered working on an API solution and a wallet SDK to strive for the quickest and most cost-effective way to move bitcoin on LN by focusing on solving the challenge of inbound liquidity (mentioned in the following).

- Lightning Labs building Taproot Assets (formerly known as Taro).

- AMBOSS ($4M in total funding) operates the channel liquidity marketplace Magma.

- Bakkt, which has raised 932.5M in total and is publicly listed, has LN on the roadmap.

- Exchanges like Bitfinex have long supported LN for on-ramping assets, Kraken since last year, and more recently Binance.

These companies are working on big challenges that have been described briefly. There are however other new challenges that need to be addressed one way or the other going forward.

New challenges and opportunities for LN

This list is by far not exhaustive, but it should outline some of the challenges that might become relevant:

- Reliability / Interoperability between LN clients / Diversity in LN clients:

LND has by far become the de-facto standard when operating lightning nodes and routers. Users appreciate the tooling around it e.g. balancing channels and other management tasks. However, this homogeneity, similar to full nodes in blockchain networks, has the weakness to become the single point of failure for software bugs.

- Non-custodial scaling challenges:

With the adoption of Bitcoin’s base layer transaction fees increase, and in effect so do channel opening costs, to e.g. onboard a non-custodial wallet user to LN. And this effect would even become stronger as more people on-board to LN in a non-custodial way requiring heavier multisig transactions on the Bitcoin base chain. Further, the inbound liquidity problem is another challenge that is inherent to the design of LN. Solutions to this are Fedimint, a federated mint model based on blind signatures, to scale fractally and Ark. - Providing bitcoin liquidity to earn routing fees:

Routers’ role in the LN is to route payments through the network. Routers earn a base fee (flat fee) and a fee rate on each payment that gets routed through. Anybody can operate a router but doing so requires technical expertise, enough liquidity in bitcoin and good connectivity (a good position in the network to route payments). We’ve discussed companies like c=, River Financial and Voltage which are operating routers, but they use their own liquidity.

Conclusion

Bitcoin’s resilience, institutional adoption, and status as the most adopted cryptocurrency for payments and store of value make it a significant and differentiated player in the industry. The Lightning Network, built on top of Bitcoin, has emerged as a superior crypto payment system, offering horizontal scalability, low fees, and enhanced privacy. Recent developments in liquidity, connectivity, and user experience have fueled renewed interest and adoption of LN. However, challenges such as reliability, non-custodial scaling and easier ways to provide routing liquidity still need to be addressed.

Overall, Bitcoin’s unique attributes and the growth of the Lightning Network position them as transformative forces that might become, if challenges are accordingly addressed, in a couple of years time a viable alternative to upcoming centralized digital currency payment systems worldwide.