Greenfield leads $2.1m funding round of Sovryn, a Bitcoin-native DeFi platform

by Greenfield, Dec. 16

We are excited to announce today that we have recently led the oversubscribed $2.1M seed round of Sovryn, with participation from Collider Ventures, Monday Capital and a couple of angels from the Bitcoin community.

Sovryn is the first Bitcoin-native DeFi platform. Users can trade bitcoin in a permissionless, non-custodial and censorship-resistant way using Sovryn’s lending and margin trading platform built on Bitcoin-backed RSK. RSK is the second strongest chain after Bitcoin and the most secure smart-contract platform in terms of thermodynamic security by leveraging Bitcoin’s proof of work via merged-mining.

Trustless and non-custodial BTC-native trading introduces a new DeFi paradigm with a large addressable market. Let’s elaborate.

The DeFi Craze

DeFi platforms allow people to lend or borrow funds from others, speculate on price movements on a range of assets using derivatives, trade cryptocurrencies, insure against risks, and earn interest in a completely decentralized and trustless manner. One could easily argue that 2020 is the year of DeFi on Ethereum. Stablecoins, decentralized lending protocols and margin trading platforms have seen a massive boost this year. Specifically, liquidity mining programs (also known as yield farming) on Ethereum drove both usage and token prices to all-time highs in Q3 as the space was flooded with increased capital and attention.

As of today, over $14.8 billion is deposited in various decentralized finance protocols on Ethereum, which represents more than a tenfold growth compared to the beginning of the year. One remarkable moment was Uniswap overtaking Coinbase Pro in daily volume in late August. Also, DEXs continue to grow at a much faster rate than its centralized counterparts, with Uniswap dominating the AMM market share with 58% as of today.

Demand for DeFi on Bitcoin

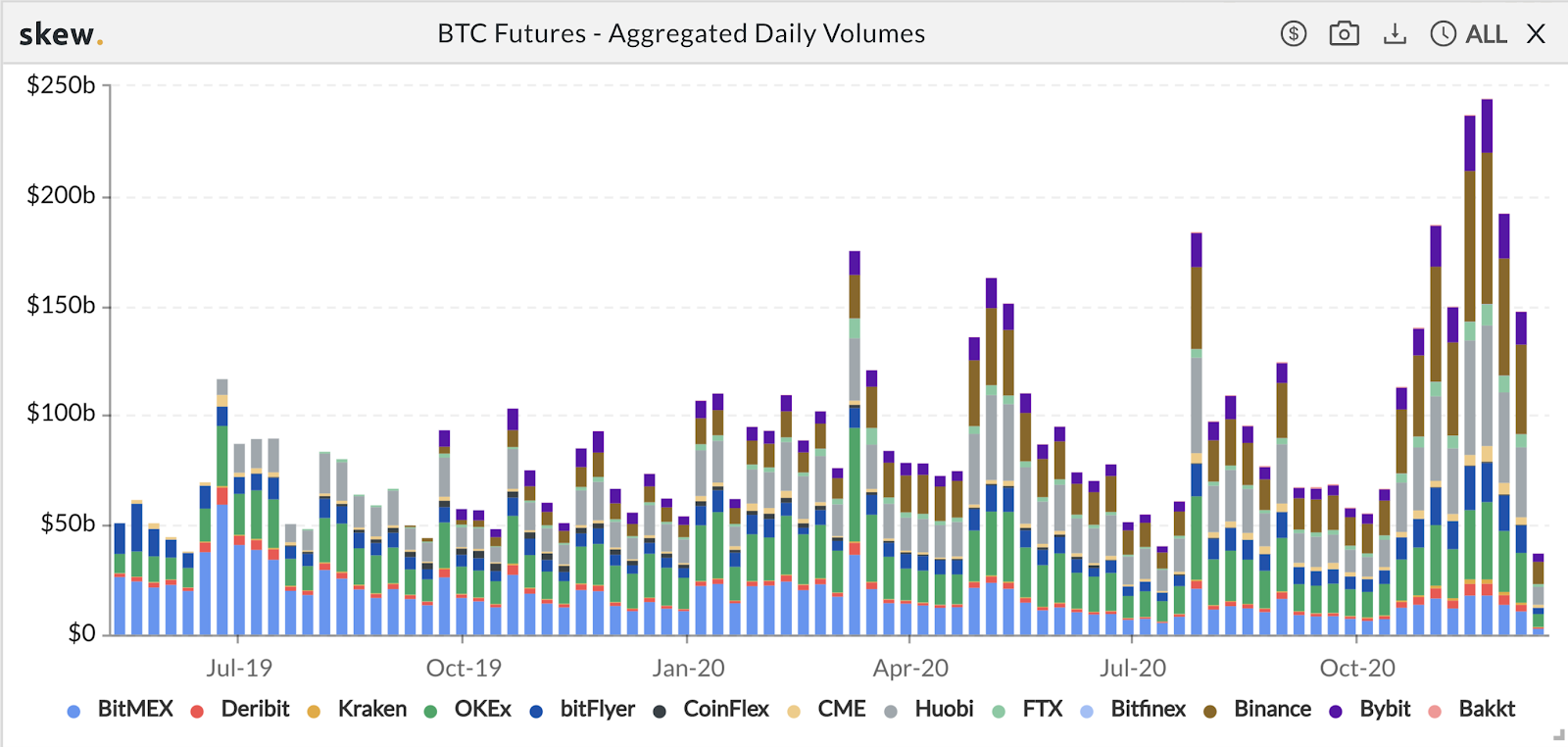

Massive trading volumes in bitcoin futures indicate demand for margin trading

As public interest for crypto assets and bitcoin specifically has been growing significantly over the past years, not least due to macro tailwinds, also demand for leveraged products has spiked. Trading volumes of bitcoin futures on centralized platforms have been growing tremendously over recent months, surpassing $200 billion per week in November on average (see chart below). Notably, an overwhelming use-case for BTC futures is trading with leverage.

Taking BitMEX as a specific example, user demand for bitcoin-collateralized products with leverage of 5x (supported in Sovryn’s current release), as well as 20x (supported in an upcoming release) becomes clear. Trading with such leverage factors has driven close to $400M for 5x and close to $1B for 20x products in average daily volumes respectively over the past year on BitMEX alone (source: Greenfield One analysis based on publicly available statistics regarding the average use of leverage). However, as crypto has shown with countless instances in the past, trusting centralized counterparties and trading environments with custody over assets can come with significant risks. These include security risks such as hacks, data breaches of personally identifiable information (based on KYC data) as well as regulatory challenges that are involved with custodial solutions which are prone to attacks from various angles as recently seen with BitMEX and the looting of $440m by a senior executive.

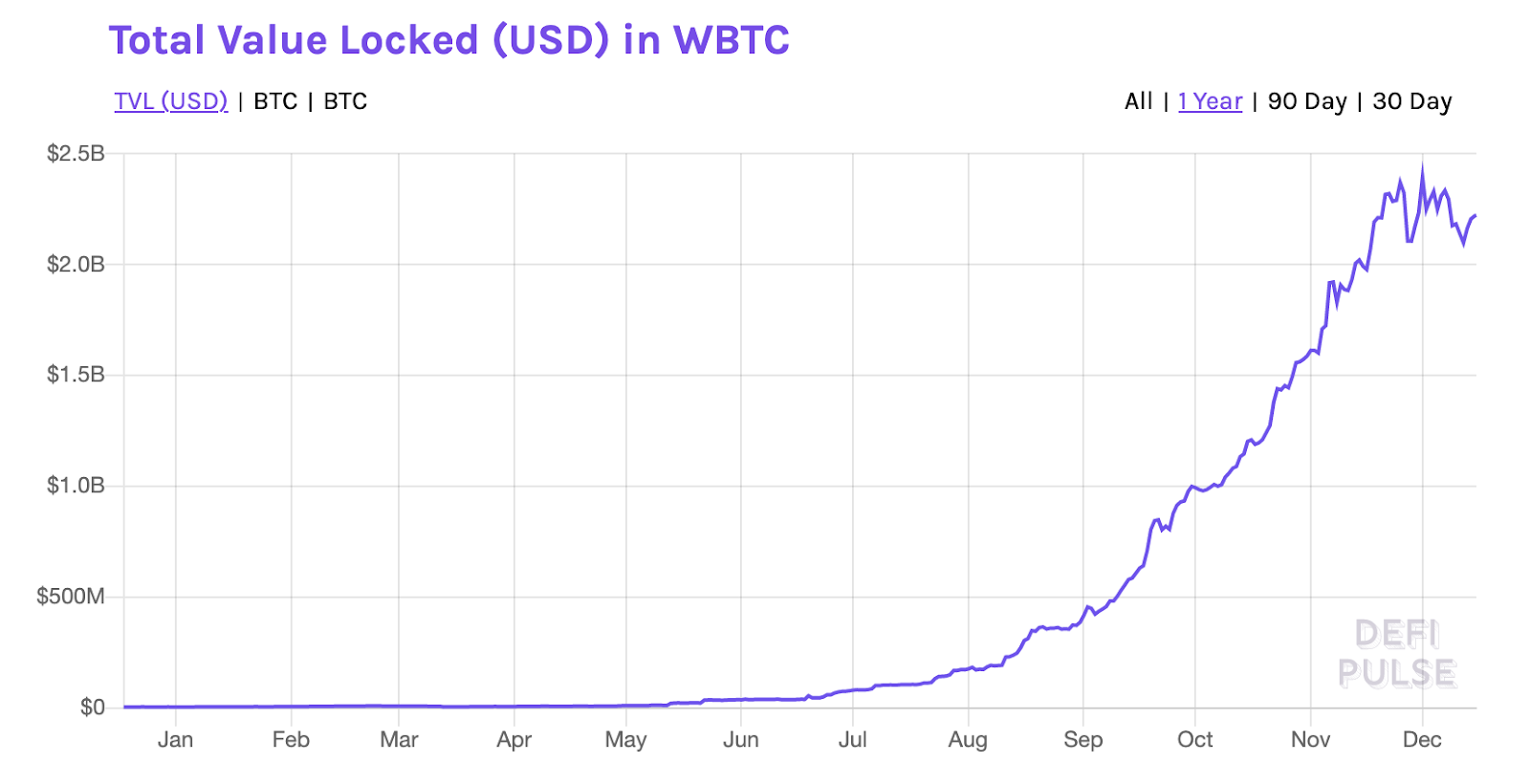

Bitcoin on Ethereum

Given the lack of decentralized alternatives for BTC-native trading, we also saw the emergence of tokenized BTC on other chains this year, mainly on Ethereum. Bitcoin on Ethereum has been growing significantly with wBTC reaching outstanding liquidity of >$2B across all protocols and 81% in market dominance at the time of writing.

Primary use cases appear to be trading (against ETH and arbitrage trading among different versions of tokenized BTC) and borrowing/lending demonstrating obvious appetite for DeFi applications within the Bitcoin community despite existing friction of moving assets over to a different ecosystems and their respective bridges, which either rely on centralized custodians (BitGo and others for wBTC) or on over-collateralization in non-BTC assets (tBTC and renBTC). Besides having to trust the security paradigm of different chains, transaction fees are being paid in a non-BTC asset creating even more friction, which is where RSK comes into play.

RSK is evolving

Unlike previous efforts to implement DeFi on the Lightning Network (e.g. Discrete Log Contracts, Generalized Lightning), RSK, formerly known as Rootstock, is a merged-mined sidechain of Bitcoin and as a result of that, the second most secure chain in terms of thermodynamics by PoW, leveraging 50–60% percent of Bitcoin’s hash rate at the time of writing. RSK is not a competing chain but rather an upgrade to run smart contracts with a 1:1 bitcoin-backed native asset RBTC. Apart from its strong foundation with the Bitcoin network and asset, it also provides core components such as dollar-pegged and bitcoin-collateralized stablecoins Dollar-on-Chain (DoC) and the RIF Dollar (RDoC). Compared to Bitcoin with its block time of 10 minutes, RSK is transacting in 30 second intervals. Hence, RSK offers a faster and cheaper way to transact bitcoin. And in respect to Ethereum which can process up to 15 transactions per second, RSK promises to support 100 transactions per second. Due to EVM compatibility onboarding of established Ethereum protocols onto a more resilient chain is possible without rewriting code.

To move BTC onto the RSK sidechain one can use the 2-way hybrid peg. On the peg-in (from BTC to RBTC) it can make use of SPV (simple payment verification) proofs to function in a completely decentralized and trustless manner. On the peg-out, the security is backed by a smart contract, enforced by Bitcoin’s hash power, which crafts peg-out transactions (PowPeg), and a multi-signature group of 15 so called pegnatories that sign these transactions (incentivized) via a tamper-proof PowHSM device. The 2-way peg is fully trustless, even if all signatories collude they could not craft arbitrary transactions (all-or-nothing censorship resistance, see RSK). Further, the Sovryn team is in the process of developing compelling solutions to enable exit to Bitcoin mainnet in worst-case scenarios, thus providing full censorship resistance, even if a majority of HSMs get destroyed or captured. The Sovryn team is contributing to this with the RSK team and, notably, early Bitcoin developers such as Peter Todd and Luke Dashjr consult on the feasibility and improvement of the design.

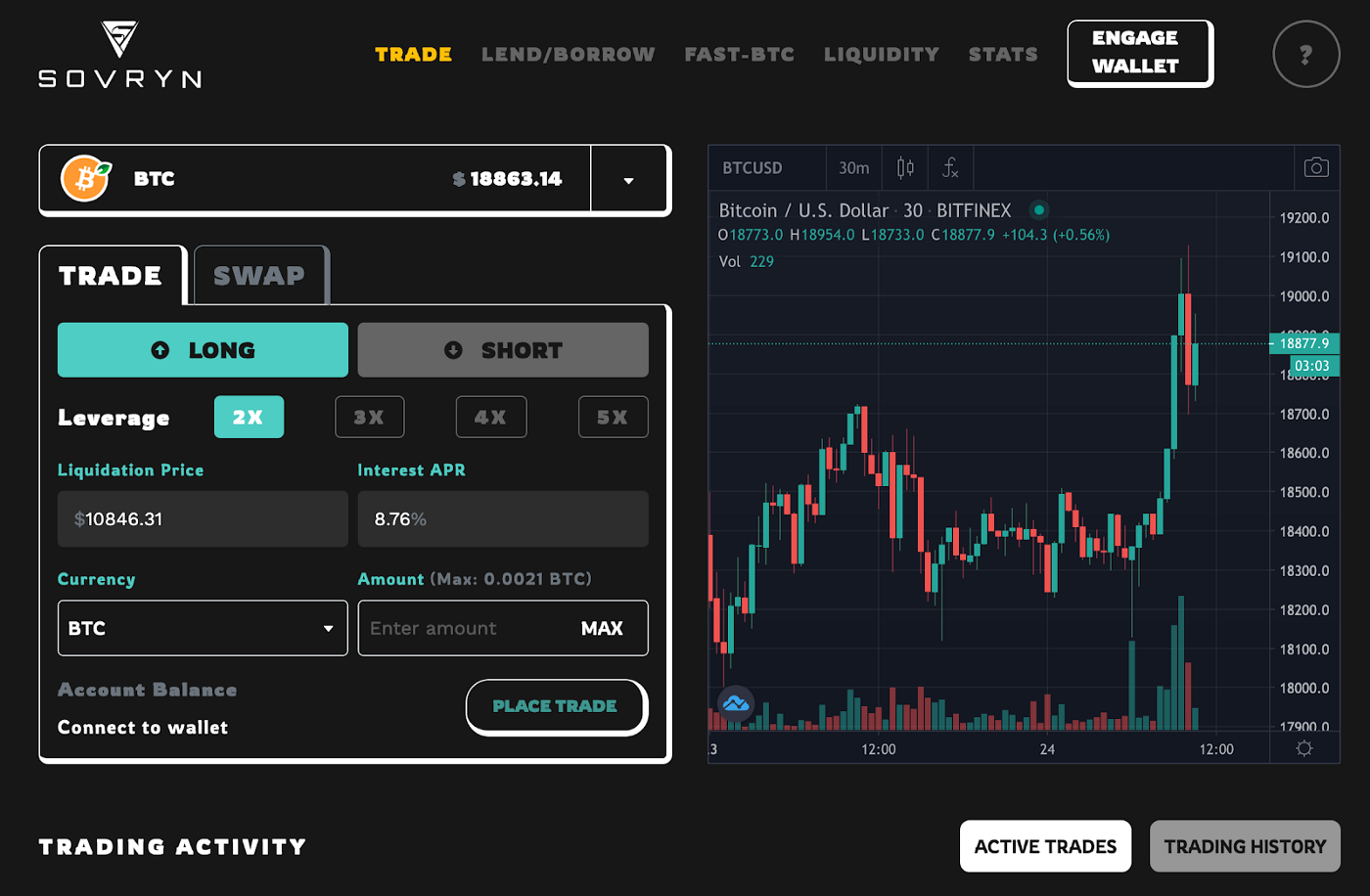

Enter Sovryn

Sovryn is the first decentralized censorship-resistant lending and margin trading platform on RSK. Sovryn is aiming to become a cornerstone of DeFi on Bitcoin. While leveraging the unique position of RSK as the second safest blockchain behind Bitcoin it introduces the primitives needed to attract an ever-growing DeFi ecosystem with bitcoin as the underlying currency for both transactions and stablecoins.

The product proposition evolves around spot- and margin trading. The former is implemented by a low-cost, low-slippage AMM based on the latest Bancor V2 code, see Bancor V2 differences. The latter is derived from the bZx base protocol V2 and Fulcrum. As mentioned, going up to 5x leverage is possible at the start of the platform and 20x leverage perpetual swaps are planned to be introduced in a coming release. As part of the margin trading protocol holders of BTC, USDT and bitcoin-backed DoC can earn interest by lending their assets. Furthermore, Sovryn is introducing sustainable decentralized governance rooted in Compound’s governance module. It is extended to support time-weighted token voting with Sovryn’s SOV token in order to align stakeholder interests for the long-term. Governance will mainly decide on model parameters which will ultimately solidify to constants over time.

From the security perspective, the code has been vetted by Pessimistic Security and Coinspect and prior to launch, the Sovryn community and core developers have also spent three months testing and auditing the platform themselves.

Early users of the Sovryn protocol will have exclusive access to the SOV token ‘Genesis’ sale expected later in Q1 2020. Further, Sovryn will offer a ‘bring-bitcoin-home’ incentive program that allows WBTC, tBTC, and renBTC wrapped-Bitcoin holders to convert to RBTC and receive onboarding rewards in the form of the SOV token. For this, Sovryn is using the recently launched and trustless RSK Ethereum Token Bridge that allows moving ERC20 tokens to RSK.

Team

Sovryn is initiated by entrepreneurs and brothers Edan Yago and Elan Nahari, as well as two pseudonymous contributors Ororo and Jamie. Edan and Elan are both early bitcoiners, organizers of Bitcoin conferences and part of the RSK ecosystems for a few years. They have worked together on CementDAO, a stablecoin aggregator and founded Epiphyte, a cross border payment service that uses Bitcoin as a settlement layer as well as BXIL, a blockchain payment solution company.

We are thrilled to be an active part of the Sovryn community and really excited to be able to work closely with Edan, Elan and other contributors.

Follow Sovryn

Sovryn is live on the RSK mainnet with its application. Also check out their Discord, Telegram and their Twitter account for more information and updates.