Backing Centrifuge – The leading on-chain ecosystem for RWAs

by Felix Machart and Henry Krause, Apr 17, 2024

We are excited to co-lead the $15M Series A of Centrifuge together with ParaFi Capital. Other investors include Circle, IOSG Ventures, Gnosis, Arrington Capital, The Spartan Group and Wintermute. In this article, we share why Centrifuge’s position in the tokenizing real-world assets (RWAs) market is unique and primed for further massive growth. This mainly boils down to 1) the solid and efficient infrastructure they have built that 2) enables differentiated service lines Centrifuge Prime and Fund Tokenization Platform and 3) the stellar team that has proven to execute at an incredibly high level for many years, which allowed them to build a strong reputation and network across decentralized finance and traditional players.

We have previously laid out our thesis on how tokenization on public blockchain will transform global capital markets.

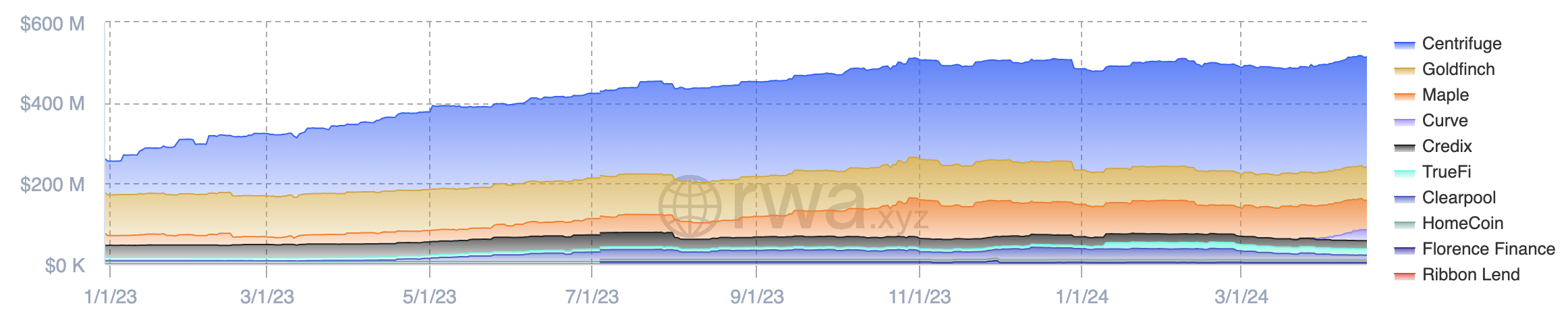

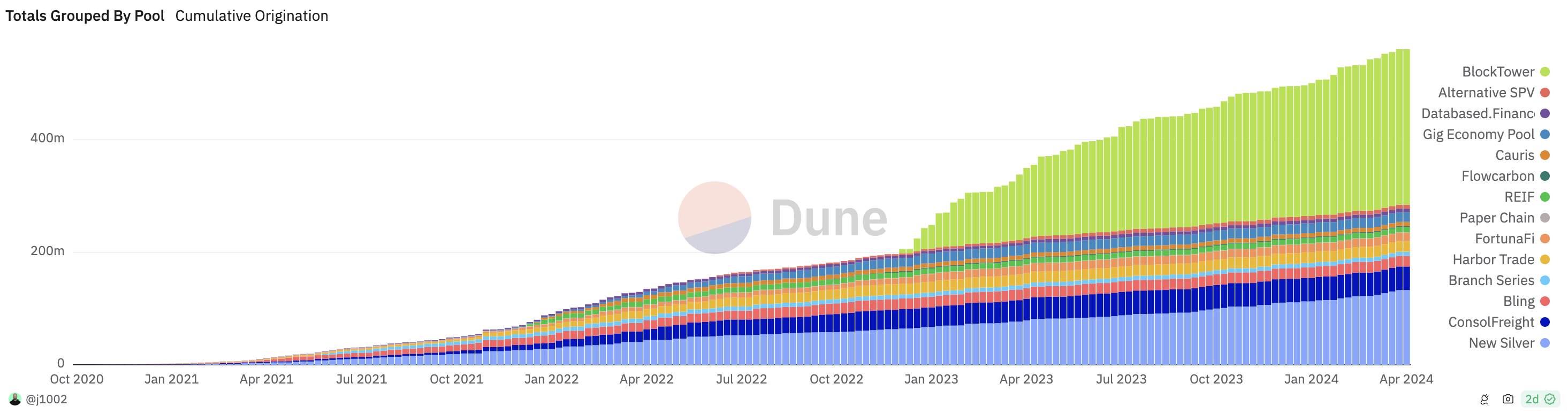

Since 2020, Centrifuge has been developing its Centrifuge Chain, enabling the tokenization of RWAs like invoices, mortgages, consumer loans as well as entire funds. Centrifuge has established itself as a market leader for providing access to high-quality RWAs, such as US Treasuries, for decentralized autonomous organizations (DAOs). Notably, their principal client, MakerDAO, maintains a significant portion of its RWA reserves supporting the stablecoin DAI on Centrifuge’s infrastructure. Presently, Centrifuge is the clear market leader, with a total volume of active loans of approximately $280M and a cumulative origination exceeding $520M.

In the next sections, we will briefly explain Centrifuge Chain and two service offerings built on top of it, Centrifuge Prime and the On-chain Fund Management platform.

Centrifuge Chain

Centrifuge Chain is the infrastructure that facilitates the creation of “Centrifuge Pools,” which are liquidity pools that allow asset originators (borrowers) to pledge tokenized RWAs as collateral in return for financing from investors.

Key aspects include:

- Base Layer: Centrifuge chain is built with the substrate framework as its own blockchain as part of the Polkadot ecosystem, which allowed them to optimize their runtime for their specific use-case and thus significantly reduce fees.

- Privacy Layer: Centrifuge has a peer-to-peer network that allows confidential asset data to be shared securely with authorized parties while anchoring hashes of the data on-chain for transparency.

- Asset Tokenization: Asset originators can mint NFTs representing their RWAs on Centrifuge Chain. The Centrifuge Credit Group performs Due Diligence at originator onboarding. These tokenized assets can then be used as collateral in Centrifuge Pools.

- Centrifuge Pools:

_Revolving Pools: Enabling flexible investment and redemption by investors based on available liquidity and a fair epoch-based mechanism.

_Tranching: Centrifuge Pools support multiple tranches (e.g., senior and junior) with different risk/return profiles, allowing investors to choose and diversify their exposure.

_On-Chain Valuation: Asset valuations are calculated on-chain using configurable methodologies tailored to different asset classes, supporting accurate pricing for pool tokens.

_Default Management: Centrifuge has mechanisms for representing and managing defaults, including write-off schedules and manual write-offs by third parties. - Cross-Chain Integration: Liquidity Pools are deployed across multiple chains (e.g., Ethereum, Arbitrum, Celo) and communicate with the Centrifuge Chain using cross-chain messaging layers such as Axelar.

By tokenizing RWAs, providing a privacy layer, supporting tranching, and enabling cross-chain integration, Centrifuge Chain allows these tokenized assets to be composed with various DeFi protocols and services, unlocking new financing opportunities and enhancing liquidity for real-world asset classes.

On-chain Fund Management

In collaboration with Blocktower, Centrifuge has brought the first $220M credit fund on-chain. Now they offer a Fund Management Platform for others to follow suit to integrate into decentralized finance and save on operational overheads. Further advantages include a reduction in yield spreads (BIS research shows potential for around 25 bps reduction) and an increase in liquidity (HKMA research shows potential for improvements of 5.3% – 10.8%).

Centrifuge Prime

With Centrifuge Prime they offer their clients a one-stop shop for buying tokenized RWAs in a regulatory-compliant manner. DAOs specifically benefit from this offering by having full legal recourse against RWA issuers, without requiring their own legal entity. Next to their largest client MakerDAO, they already have onboarded other well-known DAOs, incuding AAVE, FRAX, Gnosis and Celo.

Given the momentum of recent events surrounding Blackrock launching a tokenized money market fund called “BlackRock USD Institutional Digital Liquidity Fund” (BUIDL), we expect this market segment to grow heavily as more traditional players will start paying attention.

The team making it happen

Founded in 2017, the Centrifuge team was among the first teams building in the newly birthed decentralized finance space with a vision that explicitly involves financing real-world businesses via public blockchain infrastructure.

It turned out to be too early for “real-world” DeFi at that time but they persevered. In 2020 however, Markus decided to hand over the CEO role to Lucas, since the space they were operating in has been much more technical than previously imagined and they deemed him being a better fit. Philip wanted to take a break to reflect how to maximize his impact on the planet, seeing DeFi being predominantly virtual at the time (read more on the backstory & previous companies here – Markus and Philip are now running a climate tech / ReFi fund called Earth).

Co-founders Lucas, Martin & Cassidy continued to push the project forward and made Centrifuge the first and category defining protocol in the RWA tokenization space as it stands today. Having worked together for many years across several companies (including Taulia that was sold to SAP) they have proven to be a well oiled team combining the successful founder track records of Martin and Lucas, Lucas’ deep insights in and vision for technical and other trends in crypto and DeFi overall as well as Cassidy’s drive to align ecosystem participants and bring value capture to the token, for which she benefits from her Economics background and strong network across the crypto space.

Tech development is led by experienced founder & CTO Joroen, with strong protocol and smart contract development teams.

The team has developed a culture around self-management to facilitate building with agility and speed while allowing to innovate to much greater extents than in a traditional hierarchy. k/factory is the employee-owned development entity that is tasked to further develop the Centrifuge protocol.

To learn more about Centrifuge, check out their website, Twitter, blog and documentation to see how you could leverage their stack. If you want to be part of the movement to bring credit on-chain, join the Discord server and governance forum.