Tokenization on public blockchains will transform global capital markets

by Anies Khan, Felix Albert and Felix Machart, Aug. 30; last updated: Sep.11

We at Greenfield believe blockchains and tokenization will transform global capital markets via an emerging internet-native financial system. To be fair, while there have already been several hype waves promising great advantages, we have yet to see any significant adoption by traditional financial institutions and their clients. The increasing demand for traditional assets on-chain is so far primarily driven by early crypto adopters who want to benefit from the current high-interest rate environment. However, with infrastructure maturing and regulatory clarity in sight, there is renewed interest beyond these early users who value the financial sovereignty they receive from decentralized financial protocols and self-custodial solutions.

This research effort is the first in a series to illustrate the motivations, advantages, challenges, and solutions that define the emerging transformation in global on-chain capital markets. We start things off by _1 framing problems in the traditional financial markets on a high level that led to _2 the emergence of public blockchains, the critical advantages of which for capital markets will be laid out. Furthermore, _3 challenges for realizing these advantages will be discussed, while _4 arguing that the space has made significant progress since previous hype cycles.

TL;DR

- Tokenization on public blockchains will transform global capital markets by enhancing efficiency and transparency, reducing counterparty and systemic risks, offering increased surface area for innovation, and catering to underserved target audiences vs. TradFi.

- Public permissionless blockchains as credibly neutral infrastructure can be the Schelling point for the strongest and most diverse buy-in and, therefore, produce the strongest liquidity network effects vs. private-permissioned networks (akin to Internet vs. Intranets).

- Various traditional assets (often framed as real-world assets – RWAs), including real estate, commodities, stocks, bonds, and more, can already be traded and settled on public blockchains, streamlining processes and allowing for a composable and transparent financial stack.

- Challenges such as regulatory fragmentation, standardization, interoperability across platforms, and security concerns need to be addressed.

- On-chain demand for traditional assets has risen due to increasing interest rates, while financial institutions are becoming more open to tokenization to leverage efficiency gains and reach new target users (up to $16T in assets – 10% of global GDP – forecasted to be tokenized by 2030).

- European regulation is leading the way in providing a clearer framework for the industry, fostering institutional confidence.

- The required technological infrastructure, including scalability, privacy, compliance tools, and secure custody, is rapidly developing.

- Overall, this shift toward an internet-native financial system (IFC) holds the promise of more secure, accessible, and efficient global capital markets integrated with on-chain cash flows of real economic activity – a shift we are looking forward to seeing materialize.

Looking ahead, there is a growing belief that a wide spectrum of assets – not only native crypto assets such as BTC or ETH but also all types of traditional off-chain assets (often framed as “real-world assets” or RWAs) – will be traded and settled on public blockchains. These include but are not limited to tangible assets such as real estate, commodities, and collectibles, as well as intangible assets such as bonds, equities, funds, and carbon credits. Besides us, crypto-native investors, various traditionally-minded players predict significant parts of the global economy to be tokenized (see section 4).

_1 Taking a step back: We need an overhaul of the financial system – it is too concentrated and expensive for the overall economy

The financial services sector overall has not become more efficient concerning the share of income spent as part of the overall economy in the past decades. After all, finance should allocate capital and risk efficiently to enable a plethora of other goods and services to blossom – goods and services that can actually be consumed. In the end, no one can find shelter under a loan, eat stocks, or drink cash – financial institutions are a means to an end. However, the share of income of the finance sector of overall GDP has risen continuously over decades, even as technological and financial innovation has progressed. Since the financial sector should just be an enabler for other industries to thrive, every percentage point increase in income flowing to finance means that products and services in those other industries are more expensive by that margin. A significant increase in intermediated financial assets can partly explain this rise. However, on a unit-cost basis, the financial sectors in the US and Europe have, at the very least, not become more efficient over long periods (see Philippon & Bazot).

In a slightly different vein, emerging economies still have a large part of their population unbanked (24% globally) and far from having access to global investment products. They would greatly benefit from a more efficient financial infrastructure to leapfrog the current systems.

Too big and centralized to fail

At the same time, we have seen numerous bank failures where governments had to step in to rescue these entities, which had taken risks to reap private gains (potentially excessive risks given the knowledge that they would be saved since they were too big to fail), on public accounts. The most recent banking crisis, including Silicon Valley Bank, has again led to an erosion of faith in the banking system (raising consciousness for the counterparty risks involved); still dwarfed, however, by the global financial crisis (GFC) of 2008 in which lack of transparency played a major role. The complex financial instruments that were created from mortgages (collateralized debt obligations/mortgage-backed securities), in principle, served a very useful role. They allowed risk slicing so that individual investors could build a highly diversified portfolio. However, the lack of transparency needed to grasp the complete web of interrelated financial relationships exacerbated the uncertainty and risks in the financial system. Investors, including banks and institutional investors, were often unaware of the true nature of the assets they were holding or the risks they were exposed to. This lack of understanding and information magnified the impact of the crisis when the true extent of the housing market collapse and the associated defaults became evident.

_2 Public permissionless blockchains

“Chancellor on brink of second bailout for banks”

– The Times 03/Jan/2009

It is now widely known that when Bitcoin launched as the first public permissionless blockchain and cryptocurrency in the context of the GFC, the above message was engraved in its Genesis block. As the theory goes, Bitcoin aimed to remediate the potential for monetary debasement that followed the rescue of centralized, private financial institutions on public budgets and economic stimuli via monetary expansion. It should provide an alternative currency and payment method sheltered from the systemic risk of legacy finance. Indeed, it created a programmatic issuance policy that is drastically more independent than that of any central bank. Whether it makes for a better currency as a result or rather a digital commodity next to being a payment network is highly debated and not the focus of this article (see our latest research update on the BTC & Lightning ecosystem here). It is, however, relevant to mention that it has become a focal (Schelling) point as a widespread digital asset due to its property of social scalability.

Social scalability is the ability of an institution…to overcome shortcomings in human minds… that limit who or how many can successfully participate.

– Nick Szabo, https://nakamotoinstitute.org/money-blockchains-and-social-scalability/

Nick Szabo, who is often cited as the first to ideate the concept of smart contracts, argues that the shift from relying on traditional financial professionals like accountants, regulators, investigators, police, and lawyers to securing vital financial network functions through computer science enhances security and transitions from manual, local processes to automated, global ones. Keeping a record of all kinds of assets and transactions (including cryptocurrencies and smart contracts) on public blockchains can replace the need for numerous costly bureaucrats with a network of computers. As such, public blockchains offer distinct benefits, including independence from existing institutions for their operation and the capacity to function seamlessly across borders.

Particularly, their independence allows for social scalability across diverse sets of geographies, jurisdictions, value systems, and private networks. Cryptographic verifiability of immutable records enables various parties to continuously inspect and rely on shared infrastructure in a trust-minimized manner and thus maximizes the number of connections that can be established and maintained securely.

Cryptographic verifiability, transparency & composability

In essence, cryptographic verifiability underpins the trust and security of public blockchains. It enables participants to prove ownership, validate transactions, and maintain the integrity of the blockchain without relying on central authorities. On blockchains with smart contract functionalities such as Ethereum, transactions can involve complex chains of operations. Assets can be pooled and structured while always maintaining the possibility of verifying the exact chain of commands cryptographically, which means that there is full transparency over the state and distribution of assets (note: there are privacy enhancing technologies [PETs] that aim to maintain the beneficial qualities of verifiability while keeping important aspects about transactions and asset ownership private). Complex structured products such as collateralized debt obligations can be built and distributed on-chain, while it is at any point possible to verify the exact composition of base assets and thus their underlying and aggregate risks (given sufficiently advanced analytics tools). Programmatic enforcement of smart contracts limits counterparty risks, which become ever more powerful as all kinds of payment flows, rights, and liabilities are represented in standardized forms on-chain.

We anticipate that increasing proportions of cash flows and instruments such as invoices will be represented on-chain. This will open up the huge opportunity of automatically enforcing claims on on-chain free cash flows for equities and bonds that are natively issued on-chain. This level of integration will arguably happen much further in the future, though. As a result of these high levels of automation and transparency, idiosyncratic and systemic risks can be significantly reduced compared to the financial legacy system.

What is more, composability allows financial innovators to build novel products on top of existing primitives and assets – many of which we probably cannot imagine yet. Automated market makers, for example, have already enabled the creation of markets for various long-tail assets in a non-custodial and thus socially scalable fashion. Even though this does not automatically imply that those markets are liquid, the universal accessibility and verifiability have allowed access to a global audience, which can lead to increased liquidity of niche or previously illiquid assets.

In addition, the open-source nature of most software components involved enables significantly accelerated innovation cycles, as developers can build on the shoulders of giants while thousands of eyes can inspect the underlying code, which should lead to a more reliable system (note: some projects use commercial software licenses, while still opening up code for inspection).

Smart contract automation and marginal costs

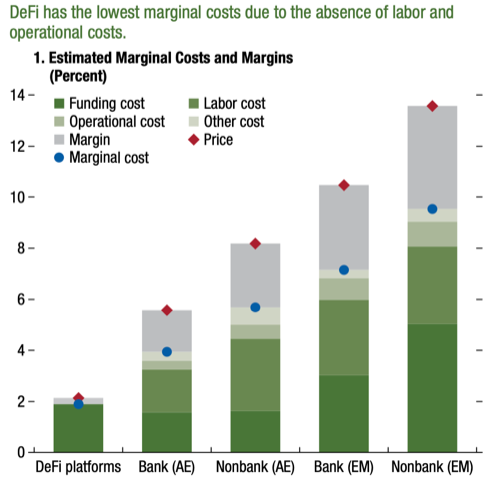

Smart contract-based financial applications also offer great potential for efficiency gains via automation due to significantly lower labor and operational costs. The IMF Financial Stability Report draws the same conclusion, showcasing how traditionally-minded organizations have increasingly recognized their potential.

The low marginal costs of DeFi reflect its automated and unregulated operation, which contrasts with the high share of labor and operational cost of traditional financial institutions, including (at least in part) costs related to regulatory compliance. However, DeFi bears high funding costs that likely reflect higher risks, such as lack of access to central bank liquidity support, AML/CFT risks, and legal and jurisdictional uncertainties. | Source: IMF Global Financial Stability Report April 2022

Several tasks of the tokenization/securitization value chain will still require a fair amount of human labor (such as risk underwriting – albeit increasingly augmented and driven by machine learning). But, significant parts of the process that currently involves numerous third parties, a patchwork of pdf/excel files, and manual payment flows can be automated by smart contracts. Moreover, composability allows the wider ecosystem to be relied upon for repackaging and building further financial products in a low-cost, accessible (and, again, transparent!) manner (see e.g., Idle’s yield tranches solution). All of this should lead to more efficient systemic risk management and lower costs of capital while assets are distributed to individual investors and automated, diversified portfolios. When it comes to compliance overhead, it is to be expected that requirements will increase. But when designing solutions for compliance in the blockchain age, a tremendous amount of automation, including smart contract-based enforcement (regulation as code) and real-time auditability, can keep costs significantly lower than in traditional finance.

As a result, labor and operational costs are expected to rise to some extent when compared to the current unregulated decentralized finance stack. Conversely, however, the higher funding costs driven by risks stemming from e.g. implied regulatory risk and limited access to institutional capital are expected to decline in a maturing and thus de-risked market. One of the most exciting aspects of these significant reductions in marginal costs is that retail users, as well as un- and under-banked users, can receive access to financial services that were previously reserved for more affluent client bases. Besides automation, the beauty of tokens is that they can be easily fractionalized into any denomination, also reducing barriers to access to products such as illiquid asset funds.

The internet prevailed over intranets & liquidity network effects

Since the emergence of the first blockchain – Bitcoin – traditional financial institutions have recognized the potential of a distributed ledger for digitizing and streamlining their financial stack. However, the public permissionless nature has left them worried about a lack of control in the ledger’s operations as well as regulatory and reputational concerns around the permissionless character. Everyone can participate, including potentially bad actors (which is also true on the internet generally). Private-permissioned alternatives have been introduced as a result. They are more akin to classic distributed databases and have their merits for certain use cases (such as streamlining accounting/ERP processes among a clearly defined and limited set of participating companies/parties). Still, they lack the innovation that their public permissionless counterparts have brought to the world: a neutral infrastructure for all types of players – even competitors – to collaborate on.

Analogously, proprietary corporate intranets emerged in the 90s. But the open internet dwarfed those private, permissioned networks in magnitude and economic importance. Strong network effects lead to the value for each user increasing exponentially with further users (incl. firms) joining since the number of possible connections increases exponentially (see also Metcalfe’s law). Today, it has become viable to make a living by being a content creator in a very constrained niche, for which there would have never been a sufficient interested audience when constrained to one’s local geography. Due to a global network like the internet, one can reach a global audience though.

The same should hold true for global capital markets.

Suppose individual financial institutions or nations try to develop their own standards and make everyone else use them. In that case, it will be tough to converge on a shared system since various players will be hesitant to join someone else’s system while trying to push their own. However, a credibly neutral platform or protocol can be the Schelling point for the strongest and most diverse buy-in and, thus the strongest liquidity network effects. Just like bitcoin has established itself as digital gold, based on its infrastructure layer the Bitcoin protocol, more expressive base-layer protocols and Layer 2s have become infrastructure for decentralized finance, laying the foundation for wider capital markets. This is particularly due to a credible commitment to avoiding the typical fate of platforms and standards with strong network effects: a natural monopoly with its widely known negative consequences. This commitment is demonstrated by enabling permissionless participation of validators/operators and, thus, a competitive market for the provisioning of the platform service (see also our research piece on blockchains as an institutional and governance tech).

_3 Challenges

The tokenization of assets on public blockchains is poised to reshape global capital markets, paving the way in an era of internet-native finance. However, this transformation is not without its challenges. As this revolution gains momentum, several critical hurdles must be overcome to fully unlock its potential.

Regulatory challenges

The lack of consistent regulatory standards across jurisdictions creates roadblocks to the widespread adoption of tokenized traditional assets. In many jurisdictions, there is no legislative instrument permitting the native on-chain issuance of traditional assets and confirming their ownership status. This leads to a high degree of uncertainty regarding what the issuers of tokenized traditional assets are allowed to do, for instance, regarding the tax implications of issuances and secondary transactions as well as settlement finality.

Additionally, jurisdictions with existing regulatory frameworks may attract digital asset companies, but in order to serve a global customer base, they will still have to deal with regional differences and inconsistencies. Let’s take MiCA: the world’s first comprehensive framework for crypto assets by a major global jurisdiction is considered a major step forward and a competitive advantage for Crypto Europe ( see Greenfield’s State of European Crypto Report). However, a MiCA-regulated token may still not be compliant in the US, therefore requiring solutions that can adapt to different requirements. Existing legal frameworks might also be ambiguous regarding the (timing) of the asset ownership: Does the token holder own the asset when the token is transferred or when it is settled in the books or records?

Compliance with existing regulations is especially challenging considering public permissionless blockchains. For example, how can compliance with GDPR be ensured while also ensuring KYC and AML compliance when it comes to trading on public permissionless blockchains? Ensuring the privacy of the users and other sensitive data (e.g., about internal operations and processes of the issuer) while still providing the necessary degree of transparency for regulatory compliance and risk mitigation on public blockchains is a complex task. We envision this challenge to be solved on the technical level, for example, by utilizing zero-knowledge proofs and other PETs.

Lack of technical standardization and interoperability

Solutions on private-permissioned infrastructure, including developer tools, token standards, and smart contract guidelines, often create interoperability challenges across financial institutions as well as the need for the harmonization of data across systems for reporting purposes. If these are not addressed, this likely will result in walled gardens with fragmented secondary market liquidity. This is why there is a growing inclination toward embracing solutions built on public permissionless blockchains.

It is essential to acknowledge that while EVM-based blockchains are clearly gaining ground, the interoperability of public blockchains can still pose challenges. This is because different standards and ecosystems might compete, albeit to a lesser extent, due to the dominance of EVM-based chains. Creating technological interoperability may introduce new risks, for example, due to the requirement of bridging. Moreover, aligning these blockchains with the existing systems of financial institutions can also present integration difficulties.

Additionally, due to regulatory uncertainty and the lack of technological interoperability with legacy systems, currently, there are often hybrid models with off-chain components in place.

Liquidity fragmentation

As mentioned above, the lack of interoperability results in fragmented liquidity. In contrast to established distribution channels used by wealth and asset managers, many tokenized assets are solely available on proprietary platforms of tokenization providers and cannot be transferred outside, limiting the emergence of global secondary markets and exit options.

Many of the abovementioned economic benefits of tokenized traditional assets only materialize at scale. This introduces a chicken-egg problem: For tokenized traditional assets to flourish, there needs to be sufficient liquidity to attract investors, and issuers need to perceive an adequate demand to issue assets. The challenge lies in building both sides simultaneously, as a lack of assets with secondary market liquidity discourages investors, while a lack of investors deters asset issuers.

Data overload, UX challenges

While blockchain offers transparency in theory, the vast amount of data generated can easily overwhelm users in practice. To make informed decisions, better tooling, analytics products, and user-friendly interfaces are necessary to help users navigate and process the wealth of available data.

The blockchain trilemma: Security, decentralization and scalability

The widespread adoption of tokenized traditional assets, especially on public blockchains, encounters the well-known blockchain trilemma of security, decentralization, and scalability.

- Security stands as a paramount concern, especially considering that the integration of traditional assets into on-chain environments can expose new vulnerabilities not prevalent in the traditional market infrastructure, potentially leading to unauthorized access, fraud, and data breaches.

- The decentralized nature of public blockchain networks also introduces challenges related to ensuring the balance between security and accessibility as well as tradeoffs between transparency and privacy regarding transactions, in particular when traditional assets and financial institutions are involved.

- Scalability is an important objective as well, especially for highly liquid traditional assets with large trading volumes. Blockchains must be able to accommodate large numbers of transactions and asset transfers without sacrificing speed or efficiency.

While there are many challenges, we believe that we are now close to overcoming most of these challenges and bringing tokenized traditional assets to a large audience soon, as described in the next section.

_4 The groundwork has been laid for capital markets to move on-chain

In sum, the formation and development of on-chain capital markets depend on the convergence of several key elements:

- readiness of financial institutions to issue digital assets (supply side),

- institutional and retail appetite for said assets (demand side),

- rules and regulations that provide a level playing field for all market participants through legal protections and contract enforcement mechanisms (regulatory playbook), and

- institutional-grade crypto rails to facilitate compliant and secure transactions in a scalable and partly privacy-preserving way (market infrastructure).

We believe that we have now arrived at such a point of convergence that will enable the much-anticipated emergence of an internet-native financial system.

Financial institutions are gearing up

According to a 2023 study by consulting firm EY, nearly half of all interviewed hedge funds and institutional asset managers are interested in tokenizing their own assets, with half of those planning to start within the next year. We are witnessing the initial substantial deployments of blockchain technology at the institutional level by major TradFi entities. This includes the introduction of digital asset custody services, the launch and adoption of stablecoins and tokenized deposits, as well as various pilot projects exploring central bank digital currencies (CBDCs). Other notable developments involve the issuances of government and corporate bonds on public blockchains, the tokenization of money market funds and private funds, and the utilization of blockchain technology for intraday repo transactions. Additionally, numerous TradFi organizations are actively advancing their efforts to expand digital asset offerings to cater to both their retail and institutional clientele. Most major banks and asset managers are investing in and partnering with companies building in the crypto space as well as forming their own digital asset teams and working on tokenization solutions.

Demand for digital assets is growing

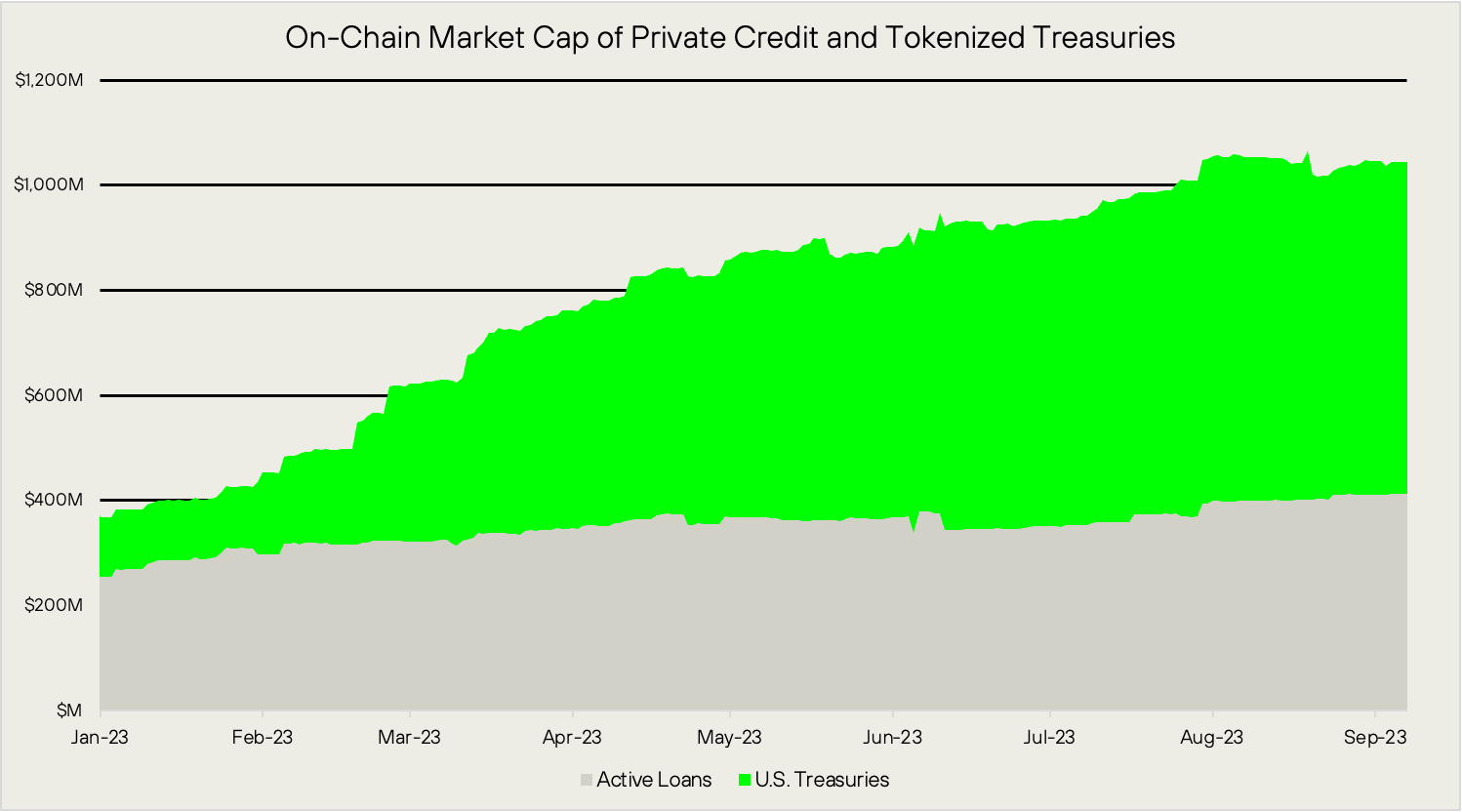

The current high-interest-rate environment has certainly been driving a lot of the recent demand for tokenized government securities by predominantly retail users and DAOs looking to diversify their on-chain portfolios and take advantage of attractive low-risk TradFi yields.

Demand for on-chain private credit loans and tokenized securities increased in 2023. | Data taken from: rwa.xyz

However, many other factors have raised investors’ appetite for traditional assets. Global macroeconomic trends, such as high inflation rates, the devaluation of currencies against the US dollar, and geopolitical tensions, have led many foreign investors to park their savings in USD-denominated stablecoins. We believe that the first emerging use cases of highly liquid low-risk assets, such as stablecoins, treasury bills, repos, and money market funds, will pave the way for adopting other asset classes. Borrowers globally, especially those with historically poor access to cheap credit, such as retail and SMEs, are already looking on-chain for cheaper costs of capital. On top of that, alternative assets have been gaining and are expected to continue gaining in importance in the portfolio construction of institutional and retail investors alike, not least due to the tried and true 60/40 portfolio booking the biggest cumulative losses in 2022 on both the equities and bonds side since the great depression. Enabling all types of investors access to alternative asset classes, including illiquid funds such as in PE, which have historically been available only to large institutional players, is one of the great promises of tokenization.

Forecasts range up to $16T in assets (10% of global GDP) to be tokenized by 2030. Liquidity is expected to pool in specific assets with clear opportunities and market readiness first (see GFMA Report: Impact of DLT in Global Capital Markets).

Regulatory clarity is on the horizon

Crypto is no longer a fringe movement for cypherpunks. It is now a topic of discussion among regulators and governments around the world. This might be partly due to the series of unfortunate events that undermined public confidence in the space in 2022 but also due to the sector’s growth in recent years. Its significance has made it impossible for regulators to ignore it further. Europe, in particular, has assumed leadership in passing multiple pieces of legislation that have brought with them increasing regulatory clarity, which has often been cited as the biggest barrier for institutional adoption. Regulators are trying to find a balance between encouraging growth, innovation, and competition in the space while protecting consumer interests and discouraging criminal activities. While the first iteration of any piece of legislation often brings with it points of contention, we believe that clear and robust guidelines are a net positive for the current ecosystem. With the US struggling to define crypto and to determine which agency has the mandate to regulate it, we expect other regulatory regimes to look toward Europe and its pioneering work (Swiss DLT Act, DLT Pilot Regime, DORA, MiCA) when coming up with their own frameworks.

The tools to bring capital markets on-chain are ready

Transforming capital markets requires institutional-grade infrastructure that is decentralized, secure, and scalable. Compromising on just one of these attributes can significantly dampen the value proposition of blockchain for real-world use cases. The sector has made big strides concerning all three attributes, especially the latter two. The degree of decentralization of ecosystems that institutional players want to transact in is highly dependent on the trading environment they choose (private vs. public). Many TradFi institutions are adopting public blockchains as they have seen scaling and privacy solutions come to fruition. The development of optimistic and zero-knowledge rollups on Ethereum has yielded a substantial increase in the network’s load capacity, making it a highly performant chain and potential base layer for capital market activity while preserving the pseudo-anonymity of all on-chain actors. The most promising scalability solutions have been Layer 2 blockchains, notably Arbitrum, Optimism, and Base, all of which offer promising methodologies to tackle scalability limitations, leveraging both off-chain constructs and the security of the Layer 1 blockchain. Furthermore, emerging Layer 1 blockchains exhibit significantly increased throughput capacities.

Next to various start-ups, even a professional services organization with global reach has made significant progress in developing privacy-preserving and scalable infrastructure on top of public Ethereum as an open-source project (see EY Nightfall). At the same time, compliance solutions enable the permissioning of transactions at the asset and protocol levels and satisfy regulatory requirements, such as revealing the identity of actors dealing in bad faith. Lastly, numerous institutional-grade custodians were granted licenses to help investors secure their digital assets.

Conclusion

We are convinced that tokenization on public blockchains will revolutionize global capital markets by making them more efficient, transparent, and secure. Tamper-proof and transparent records of all transactions allow for better idiosyncratic and systemic risk management, while programmatic smart contract execution reduces counterparty risk and cost. As a credibly neutral and socially scalable infrastructure that solves the problem of a natural monopoly by permissionless operations of its supply side, it allows diverse parties to converge on a common standard and thus improve market liquidity. While there are still challenges to be addressed, such as regulatory uncertainty, we look forward to seeing increasing adoption over the coming years. Just like the internet has digitized the world’s information, we are in a paradigm shift toward an internet-native financial system to bring the world’s assets on-chain, for an increasingly efficient allocation of capital and resources.