Building_a decentralized derivatives layer with Vega

by Christoph Rosenmayr, Jun. 16

Vega is a crypto derivatives protocol built on top of a performance-optimized, application-specific blockchain that aims to allow truly decentralized trading without sacrificing aspects that impact the experience like latency. In this article, we cover the characteristics which make Vega well-suited to become the derivatives layer for crypto: The occasion for this update is solemn: the launch of the Vega Mainnet!

With the “Building”-series we pay tribute to portfolio companies that have recently achieved a significant milestone or breakthrough, contributing to an open, decentralized, and more robust architecture of tomorrow’s web.

Decentralizing a huge market

The Global derivatives market is seven times the size of global stock markets. Derivatives allow more efficient exchange of value between different economic actors and underpin our global financial system. Consistent with the crypto ethos of decentralizing the financial system, we believe a decentralized derivatives layer, like Vega is proposing, will play a key role in this effort.

We are proud to have backed Vega since their 2019 seed round and contribute to their decentralized system by running a Vega validator.

Vega is an app-chain built on the Tendermint proof-of-stake consensus mechanism. This means that the blockchain has been built from the ground up, with the main goal of creating an environment best suited to enable the trading of crypto derivatives.

This is very different from general-purpose blockchains like Ethereum. Those chains always have to compromise – and in some cases still require very different network architectures, Just think of the different requirements of the use-cases buying and holding an NFT over many years and high-performance derivatives trading.

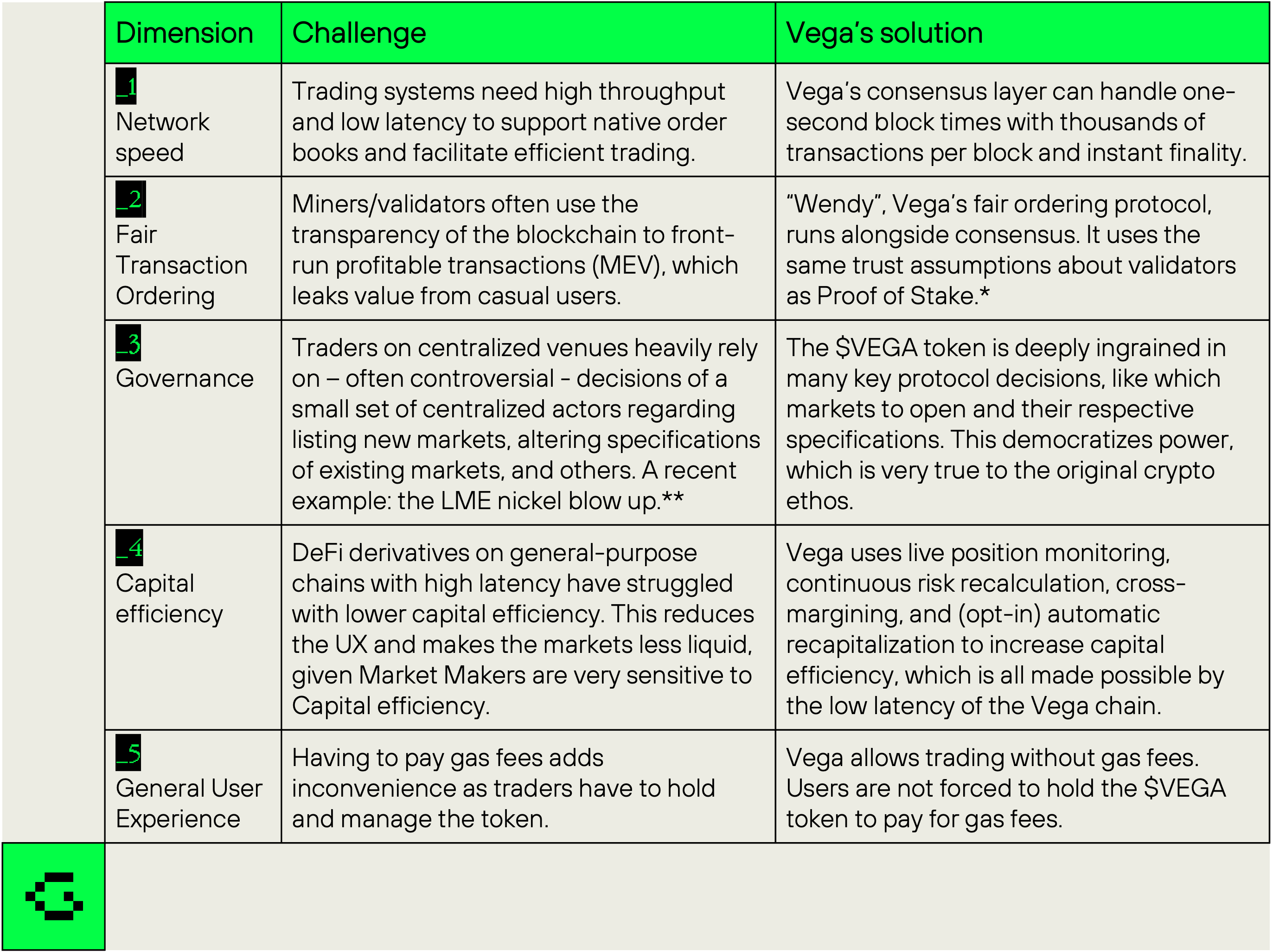

Vegas network architecture is optimized for derivatives trading on several dimensions:

Those dimensions combined result in a user experience similar to a centralized exchange like Binance performance-wise, all while never giving up custody of your assets (which prevents debacles like seen with FTX).

Further reading:

*_2: See our detailed blog post on fair access to derivatives markets.

**_3 The LME nickel blow up

Vega Mainnet is live!

Recently, Vegas community members approved a governance vote to kickstart trading and take its markets live on mainnet. This is a major milestone for the project, following four successful test net phases which have battle-tested their code to be resilient before enabling real usage.

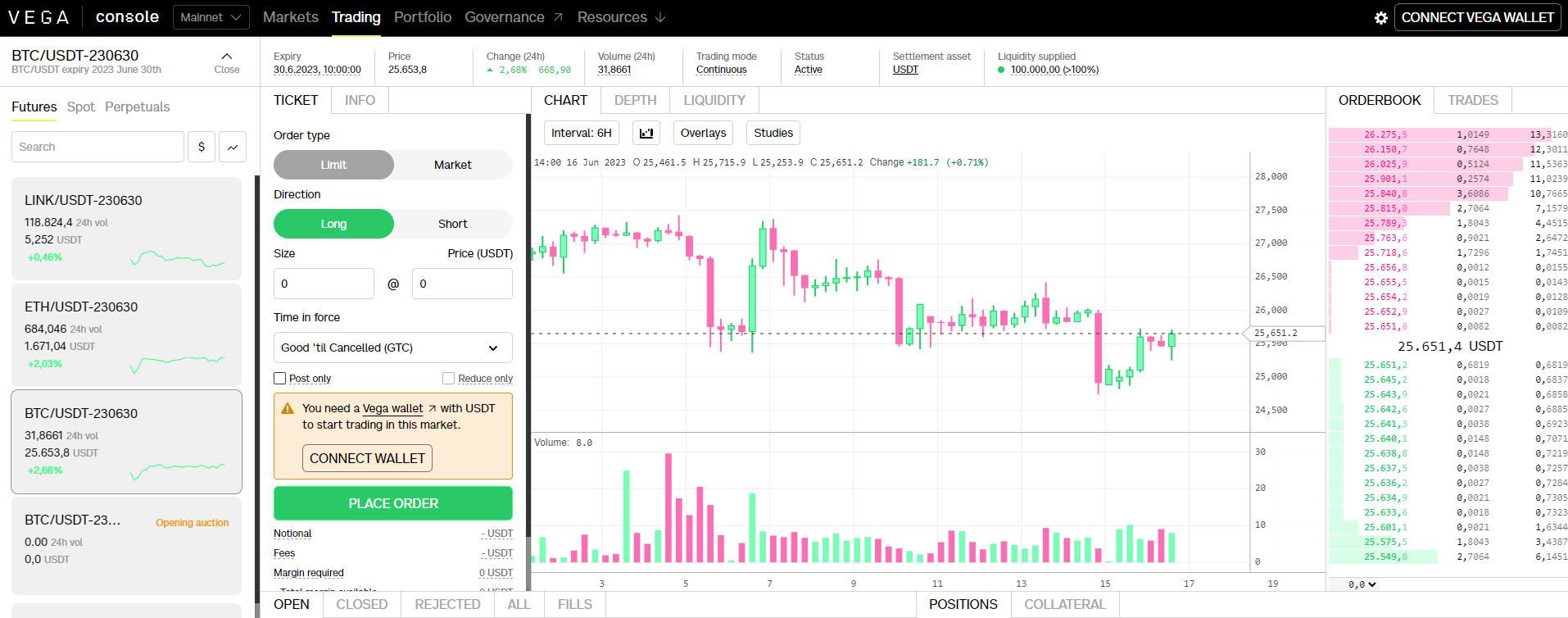

Vega Mainnet Trading Interface

For the start, the network only supports cash-settled expiring futures for BTC, ETH and LINK. However, due to governance being in full control over the listing process, there will likely be trading of other derivatives like perpetual futures, options, volatility products or interest rate swaps in the future.

The only bounds are the creativity and willingness of governance holders to list new markets, compared to the CME or even Binance acting as gatekeepers on listed assets/markets, with a small circle holding centralized power and sometimes even abusing that power (Coinbase listing insider trading case).

Vegas governance powers now include:

- creating new markets and updating existing markets

- adding and updating assets that can be used as collateral

- updating key network parameters like governance thresholds, validator parameters and more

- and voting on freeform (general) proposals

The actual governance process is similar for all types of proposals, with each having slight nuances. Generally, it follows a tried and tested approach of discussing and formalizing ideas in the community governance forums before the proposing and voting process happens fully on chain via the governance site.

To incentivize trading on Vega Mainnet market participants can receive trading rewards for desirable behaviour like placing market and/or limit orders that are filled, which increase overall liquidity on Vega Markets. This is similar to traditional maker rebate incentive structures, but with a key difference being that anyone can fund rewards for any market. This could be very valuable for token projects which desire to have more liquid markets for their token and could decide to incentivize trading of that market on Vega.

Currently, around 9,5k $VEGA tokens are distributed to traders on the three existing markets daily, which are split evenly depending on your share of volume eligible for rewards. Depending on your trading volume, this could make Vega a much cheaper place to trade, especially as fewer people are currently aware of the reward structure on the newly launched mainnet.

New features we are looking forward to are obviously the listing of new and interesting markets, which we believe can really set Vega apart from their competition. Furthermore, the transition from Vega’s wallet to a browser extension, new order types (stop-loss and take profit orders, trailing stops and one-cancels-the-other) and the integration of an Ethereum-based oracle for usage within Vega markets will all help to improve the UX even further.

Connect with Vega!

If you want to learn more about Vega, consider checking out their documentation or joining their Discord /Twitter. If you want to trade truly decentralized derivatives without giving up custody of your assets, visit Vega’s website.