Greenfield backs Vega to develop decentralized derivatives protocol

by Greenfield, Oct. 03

We are really happy to share today that we have joined Vega’s recent $5M seed round alongside Pantera Capital, Hashed, Xpring (Ripple), gumi Crypto, Rockaway Blockchain, Monday Capital and a few others.

Vega is building the first decentralized derivatives protocol designed for safe and non-custodial margin trading, with sophisticated risk management rules enforced by the network. Traders can operate and participate in peer-to-peer markets that guarantee open access, transparent rules and the freedom to innovate.

Let’s elaborate.

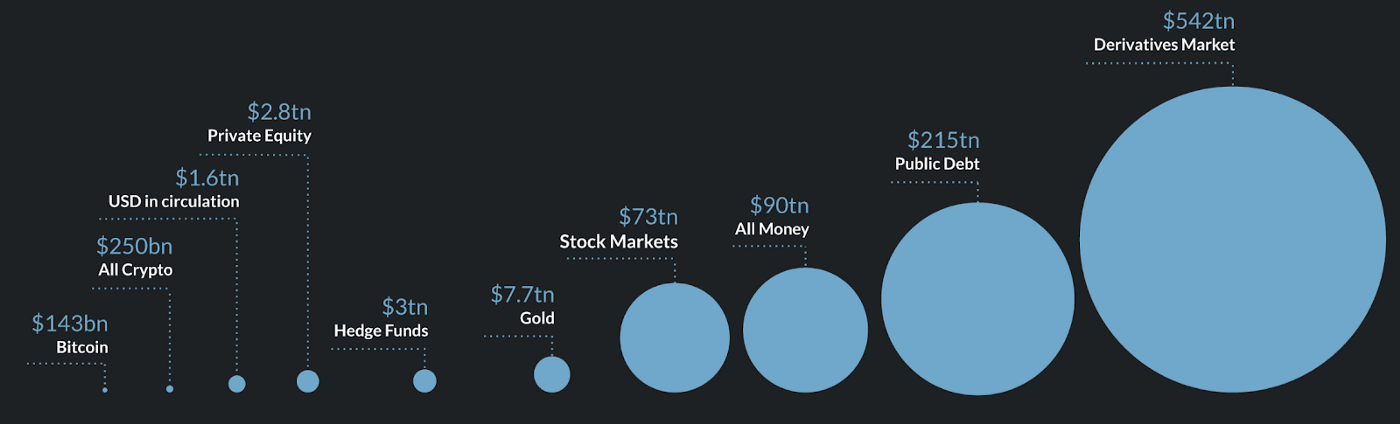

The global derivatives market is of a massive size: more than 7 times the size of the global stock market, 70 times the size of all global gold reserves and almost 340 times the size of all USD in circulation.

At the same time 85 % of all actively traded assets still have no readily accessible liquid derivatives market, legacy infrastructure is driven by closed systems, centralized gatekeepers and liquidity silos, leaving large parts of the market still underserved, in particular in developing countries. Only 10 % of the global derivatives turnover is in contracts denominated in the currency of an emerging market economy, and what is traded is disproportionately over-the-counter and limited to a narrower set of instruments.

Thus the opportunity for Vega encompasses a huge derivatives market with strong growth potential from underserved and novel markets by building a network that enables efficient and safe trading between peers without a central party — low barriers to create innovative and potentially long-tail products serve developing markets and will attract liquidity from a potentially global pool of traders as well as market makers.

Within the crypto ecosystem trading crypto-native assets has obviously always played a key role from the very beginning and we have seen large centralized (spot) exchanges emerging over the years. Recently, trading started going beyond spot markets and we are also seeing crypto-native derivative products like Bitcoin futures with strong traction, while mostly being centrally traded and settled though.

With the emergence of DEXes (decentralized exchanges) spot markets started moving from centralized to decentralized infrastructure — almost exclusively built within the Ethereum ecosystem, thus facing challenges in scaling and leaving many without any significant traction. Other teams have even tried going beyond spot markets and built L2-based decentralized derivatives products on Ethereum, but ran into similar challenges:

The lack of deterministic order execution with PoW based blockchains technically allows for front-running (getting in front of earlier transactions) by spending higher fees — similarly given issues around throughput, latency and finality with transactions on existing DEXes, professional traders have not really adopted and come in yet.

When Binance, the largest centralized crypto-asset exchange by volume, announced plans to launch their own, Tendermint based purpose-built blockchain for performant trading with high throughput, low latency and fast finality, it felt like a very obvious and logical evolution within the space — given the general benefits of decentralized financial infrastructure and the struggles various teams were facing when trying to build such a system on existing general-purpose and PoW based blockchains.

Vega extends this logical evolution by going beyond spot market trading and targeting the derivatives market, which is (outside of crypto) many times larger than its spot counterpart. Developing a purpose-built blockchain with a focus on one specific market and use case does not only allow them to build towards a more performant trading experience, but also design their tech stack towards market-specific requirements like dynamic liquidity incentives, which go beyond fee rebates and running complex risk models for derivatives, which require heavy compute.

Vega can be seen as a decentralized CCP (central counterparty), in that it is the network that holds collateral/margin, maintains insurance funds, applies risk management and settles trades. Traders can use Vega’s protocol pseudonymously and be rewarded by other participants for creating new products and providing liquidity. Open and decentralized infrastructure allows for easy integration and composability, enabling permission- and borderless innovation on top of the protocol.

What also stands out about Vega is the team that both founders Barney Mannerings and Ramsey Khoury have brought together — a unique combination of senior team members with significant experience in trading, market infrastructure, financial math, cryptography, software engineering, blockchain technology, strategy and business development. The Vega team has successfully built and exited business within as well as outside of the crypto ecosystem in the past and we couldn’t be more excited to be able to work with them going forward.

If you want to learn more about Vega download their protocol whitepaper and technical overview or follow them on twitter and medium.