Introducing State of European Crypto Report

by Markus Hujara, May 3, 2023

How is Crypto Europe doing? To find out exactly that and take the pulse regularly, we have launched the State of European Crypto Report. The key message of the first edition: Regulation is the core topic for 2023 – and is likely to boost the European ecosystem.

Why this report?

Greenfield is a European crypto investment firm. We are long-term backers of early developer teams building toward an open, decentralized, and more robust architecture of tomorrow’s web. In line with our profound operational approach, we engage with our portfolio companies and other protocols in the crypto ecosystem very early and regularly to learn about the current challenges and in which areas and ways we can make a significant contribution.

We want to share and discuss some of our ongoing learnings and analyses with this report.

Fortunately, there are already several excellent reports on global crypto development. What we have noticed, however, is that regional crypto reports are still scarce. We believe looking at regional specifics is quite helpful – particularly concerning the issues we address in this report:

- how founders of protocols and companies with a deep European footprint view the current and future state of crypto overall – and the role of Crypto Europe in it;

- what talent pool they can access in Europe;

- what tailwinds or obstacles the environment offers relative to other crypto markets;

- how active and successful European protocols are on the developer front.

We are still in the early days of crypto. That’s why we look less at adoption indicators in this report. Now is the time to build. The focus lies on the founders and developers, their environment and their progress.

You can easily download the full report here.

tl;dr

We asked founders of projects with a deep European footprint for their assessments, analyzed developer activity of relevant protocols and companies in the European ecosystem, and looked at the actual movements in the crypto talent market. These are our six key findings:

1. After the most challenging year many founders have experienced, confidence prevails when looking ahead to 2023 and the future of Crypto Europe.

Describe your expectations for crypto 2023 in one word.

In retrospect, 2022 is seen as a cleansing year that further strengthened the building ethos of crypto (“The year the fakers went to jail”). A comeback is expected for 2023 and, in the long term (until 2030), nothing less than the “ubiquity of crypto”.

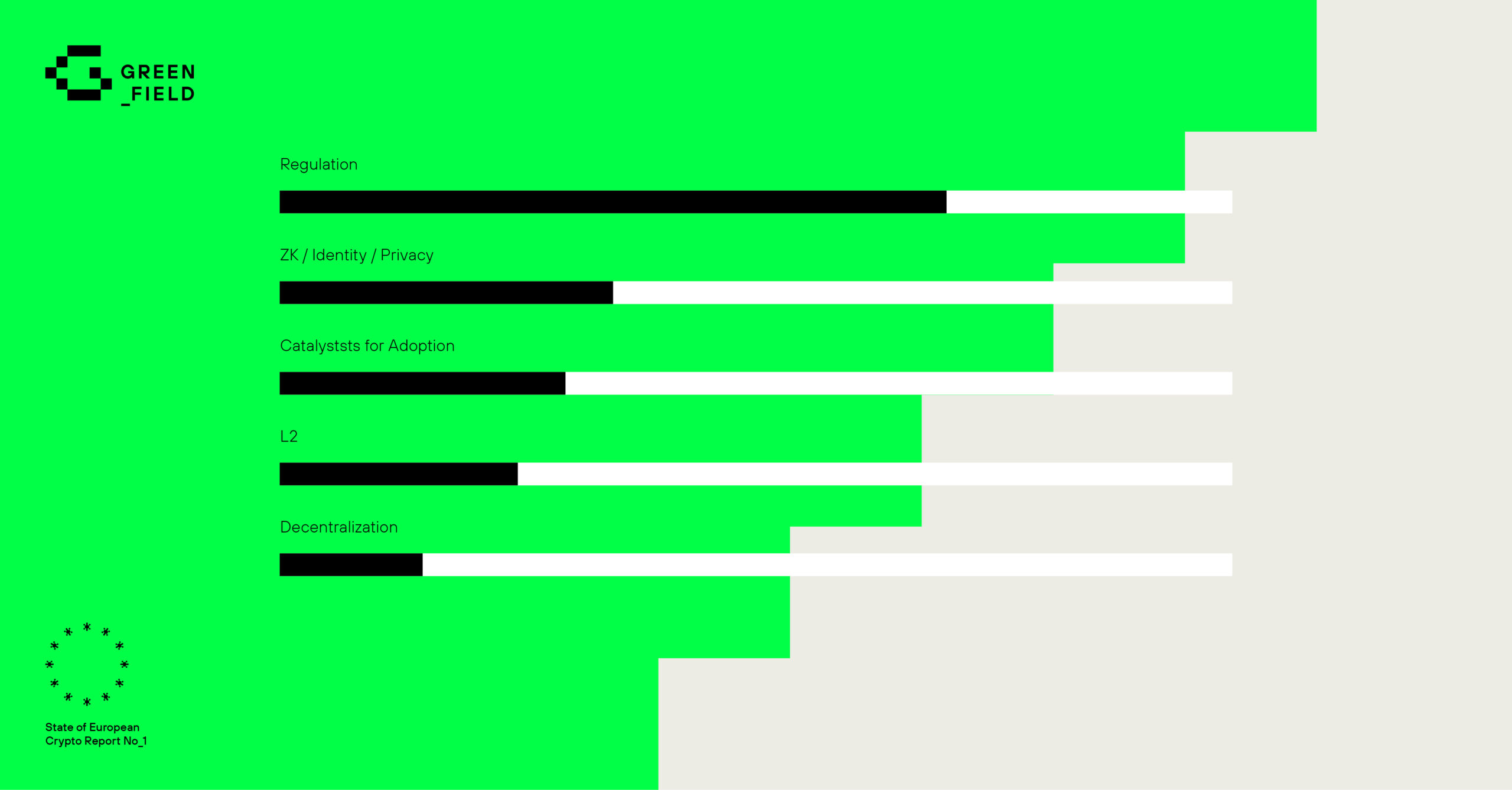

2. Regulation is considered by far the most influential topic of 2023 – Europe takes the lead.

What are the most important developments in crypto in the course of 2023?

The founders regard Europe – especially the EU with MiCA as a comprehensive and differentiated framework – leading the way. Clarity thus seemingly outweighs any restrictions on specific business areas and practices. This result indicates the significance of regulatory differences and approaches for future competition among regional ecosystems.

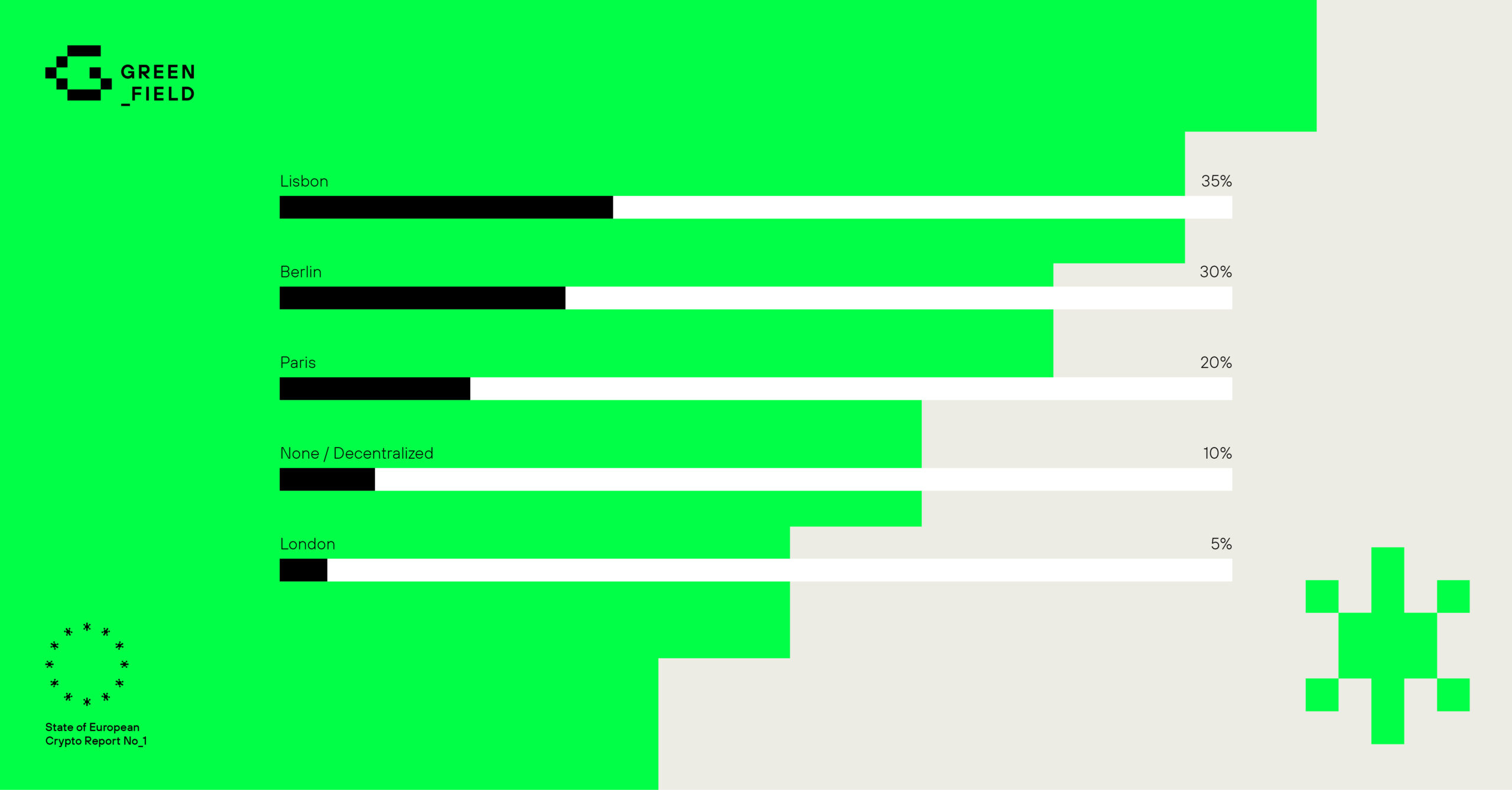

3. Lisbon is crowned the Capital of Crypto Europe – and beyond.

Overall, what is Europe’s most relevant crypto hub?

The founders of protocols and companies with a deep European footprint regard Lisbon as the world’s most important crypto hub, followed by New York City and Berlin. Paris (in 7th place) is the third European metropolis in the top ten.

According to the respondents, Lisbon earns its position because of its profound DeFi scene. Many companies and projects are also drawn to the Portuguese capital for tax reasons. Besides the talent influx from other parts of Europe, Lisbon benefits most from what some founders consider a US crypto brain drain.

“Lots of American crypto migrants here in Lisbon.”

New York City, however, still offers good access to venture capital and Tier1-conferences. Berlin stands for European startup culture, a remarkable crypto track record, and one of the world’s finest and most active developer pools. Paris is highlighted for its thriving crypto-summit scene and strong Web3 and NFT ecosystems.

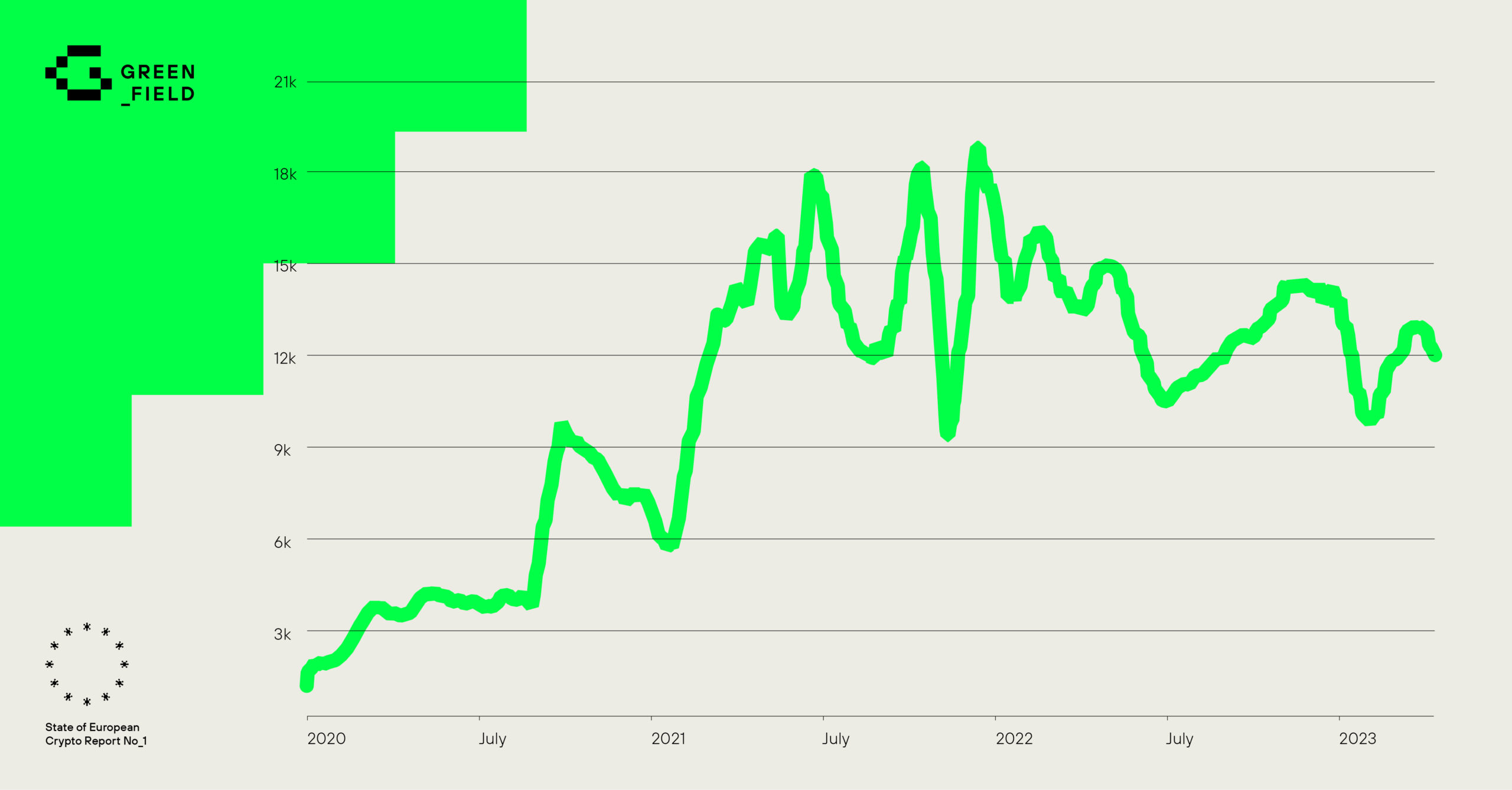

4. EDIC (European Developer In Crypto) Index at 11,600 points: Crypto Europe continues building despite its setback in market share.

The EDIC Index | Jan 2020 - Mar 2023

The EDIC Index we introduce in this report features 42 of the most influential crypto protocols and companies with deep European footprints. They count a total of 1,300 monthly developers in Q1 2023 (as measured by their GitHub repositories). This is 300 more than at the end of 2022, marking our database’s most substantial quarterly increase (Jan 2020+). This influx is remarkable, considering that the index members have continued to lose ground in terms of market cap compared to the broader market. The European selection now reaches less than $20B. This is just over 2.5% of the market cap of ETH and BTC combined. Due to solid developer growth despite declining market share, the index increased by 400 points compared to the end of 2022. From this, we can infer the sustainability of talent influx and retention, which is quite resilient to market movements.

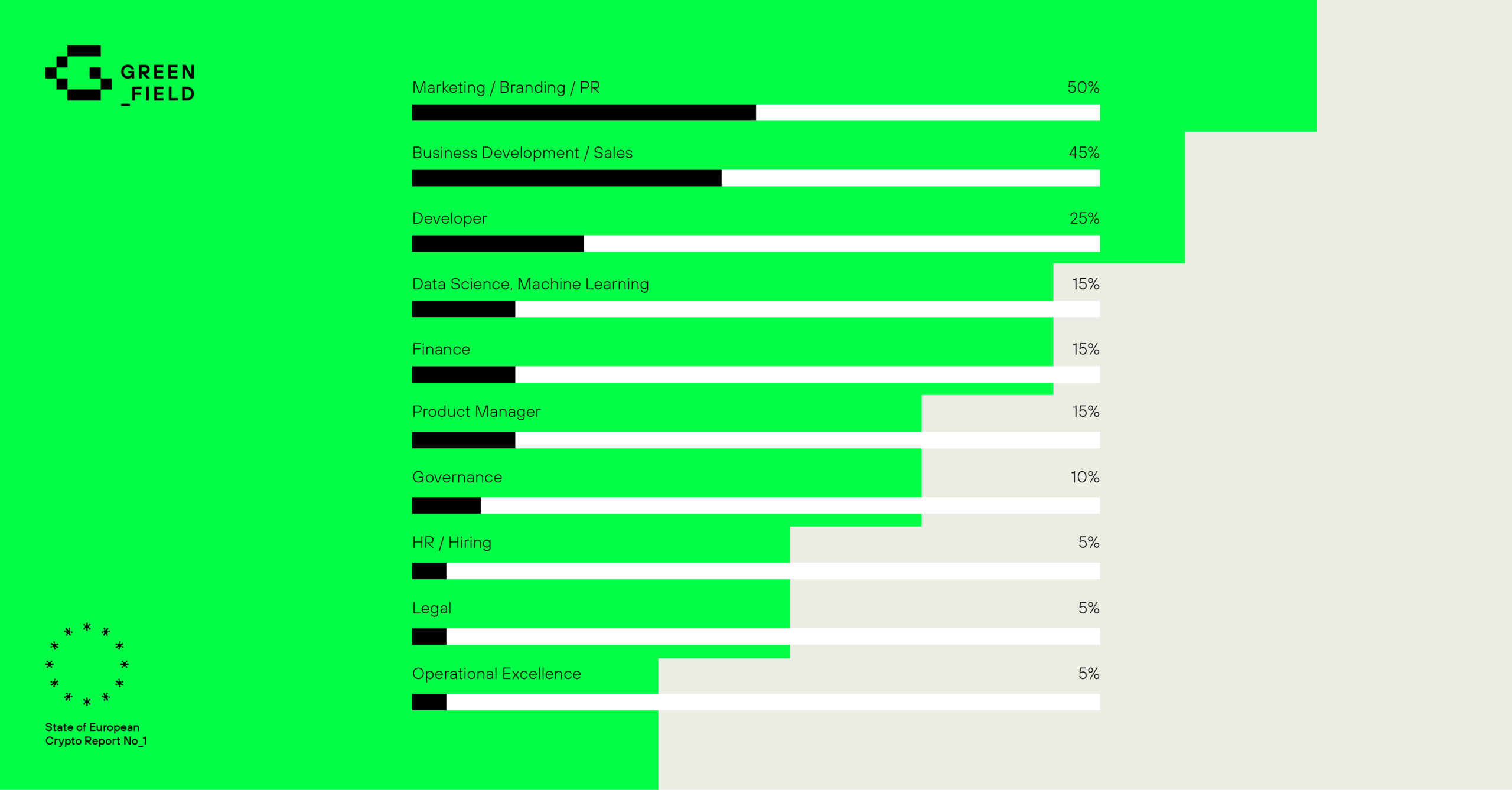

5. As more European crypto projects mature, shortages loom in commercial talent.

What are the top skills you want to add to your organization?

The founders surveyed said that in 2023 they would like to strengthen their team primarily with marketing and comms, as well as sales and business development professionals. This fits pretty well with another statement of the majority of the founders that “user awareness and adoption” is currently the biggest challenge of their crypto project. However, filling these positions is becoming increasingly challenging, as an analysis conducted for this report by our friends at Missing Link of advertised positions and actual hirings revealed.

6. European universities are coming up with dedicated crypto master’s degrees.

University crypto hubs are forming foremost in the UK, Ireland, and Spain. A veritable series of new programs are planned across the continent for the winter semester of 2023. Most current and future courses on offer relate to finance and economics. This makes it likely that more commercial talent will enter crypto in the upcoming years. At the same time, Europe must be careful not to neglect university education in crypto tech. The need for developers and architects will remain high for core technology. And when it comes to the core, as our survey shows, founders do not want to rely on external support at all costs.

You can access the complete list of master’s degrees within the report.

Crypto Europe, contribute!

Kudos to the contributors of our first report: Fabian (Missing Link), Martin (Bertelsmann Investments), Paul (TUM Munich) and various founders of the European crypto ecosystem.

Our goal is to expand and streamline the database of this report with the help of the community, to raise its profile with each new edition, and to create a barometer for the development of the European crypto space with a regular publication. We appreciate feedback, suggestions, additions or contribution ideas: europe@greenfield.xyz