Br3akthroughs #8 – Welcome to the Age of Crypto

by Markus Hujara – Januar 23, 2025

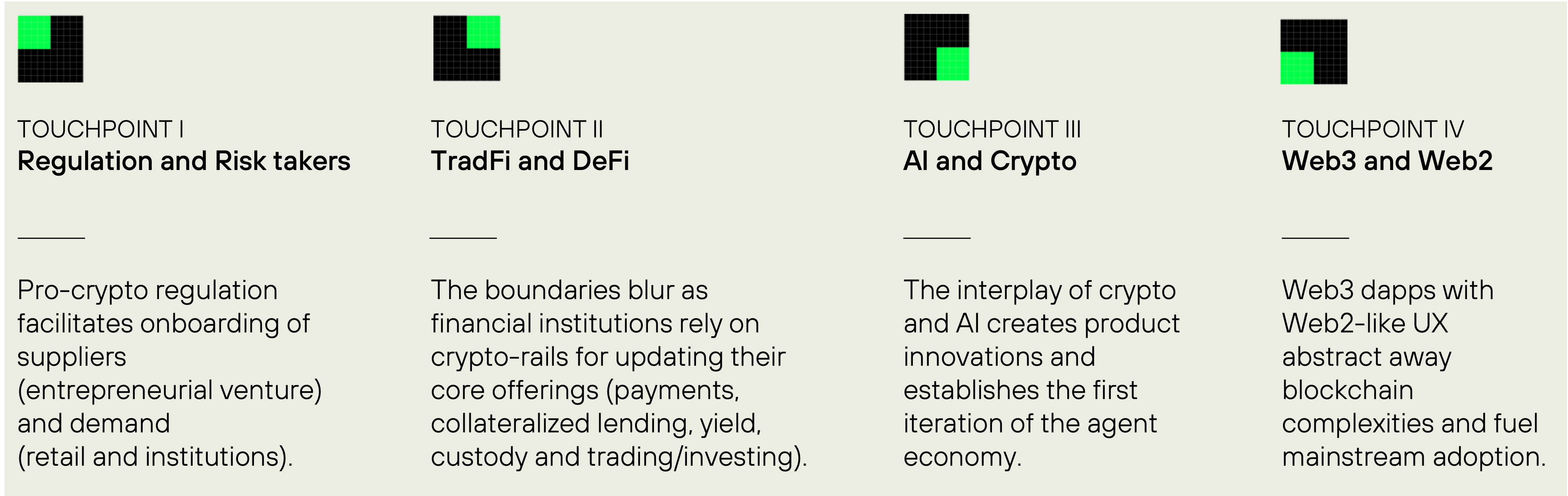

Welcome to the age of crypto! On Monday, the most crypto-friendly administration in US history took office. The hours leading up to it were a worthy prelude, with new ATHs for Solana and Bitcoin and a Memecoin launch that marks probably the largest single mass onboarding event for crypto ever. However, 2025 will not only be an inflection point regarding regulation. We are excited about three further catalysts for broad disruption and mainstream adoption: blurring boundaries between TradF and DeFi, the interplay of AI and crypto, and Web3 in the guise of Web2.

Let’s dive into Br3akthroughs issue #8:

- Backing: Cow Protocol

- Building: Spectra

- Broadening: Greenfield Predictions 2025 | Statistical Arbitrage

- Community: Driving Competitiveness of the German and European Crypto Industry

Don’t miss out on portfolio updates and recent research publications: Subscribe to Br3akthroughs here.

_Backing

DEFI | Execution is all that matters – our investment in CoW Protocol

We’ve built a strategic position in CoW Protocol – and facilitated CoW Swap’s own TWAP feature for this investment. CoW Swap’s dominance in the intent-based trading space has grown to 63%, outperforming competitors like UniswapX or 1inch Fusion. Since its implementation a year ago, a free switch has delivered steady revenue growth.

CoW Protocol’s latest innovation, CoW AMM, tackles onchain inefficiencies (namely MEV, short for maximal extractable value) and drastically reduces CEX-DEX arbitrage losses. As DeFi grows, addressing the MEV problem becomes crucial to ensure a fair, transparent, and efficient trading environment for all participants, regardless of their technical sophistication or trading volume. With CoW Protocol, we invest in the well-positioned innovator and solution provider for these goals at an app level.

–> Backing post

_Building

DEFI | Building permissionless yield tokenization with Spectra

The yield derivatives protocol Spectra (rebranded from APWine) has made remarkable progress since launching their V2 in June 2024, recently reaching $200M TVL. Foremost, their deployment on Base is driving TVL growth, as Spectra is Base’s only yield tokenization protocol. Spectra has completed multiple full pool expiry cycles and implemented numerous product upgrades, such as a fee switch and an in-protocol bribing system. We increased our investment in Spectra Finance.

_Broadening

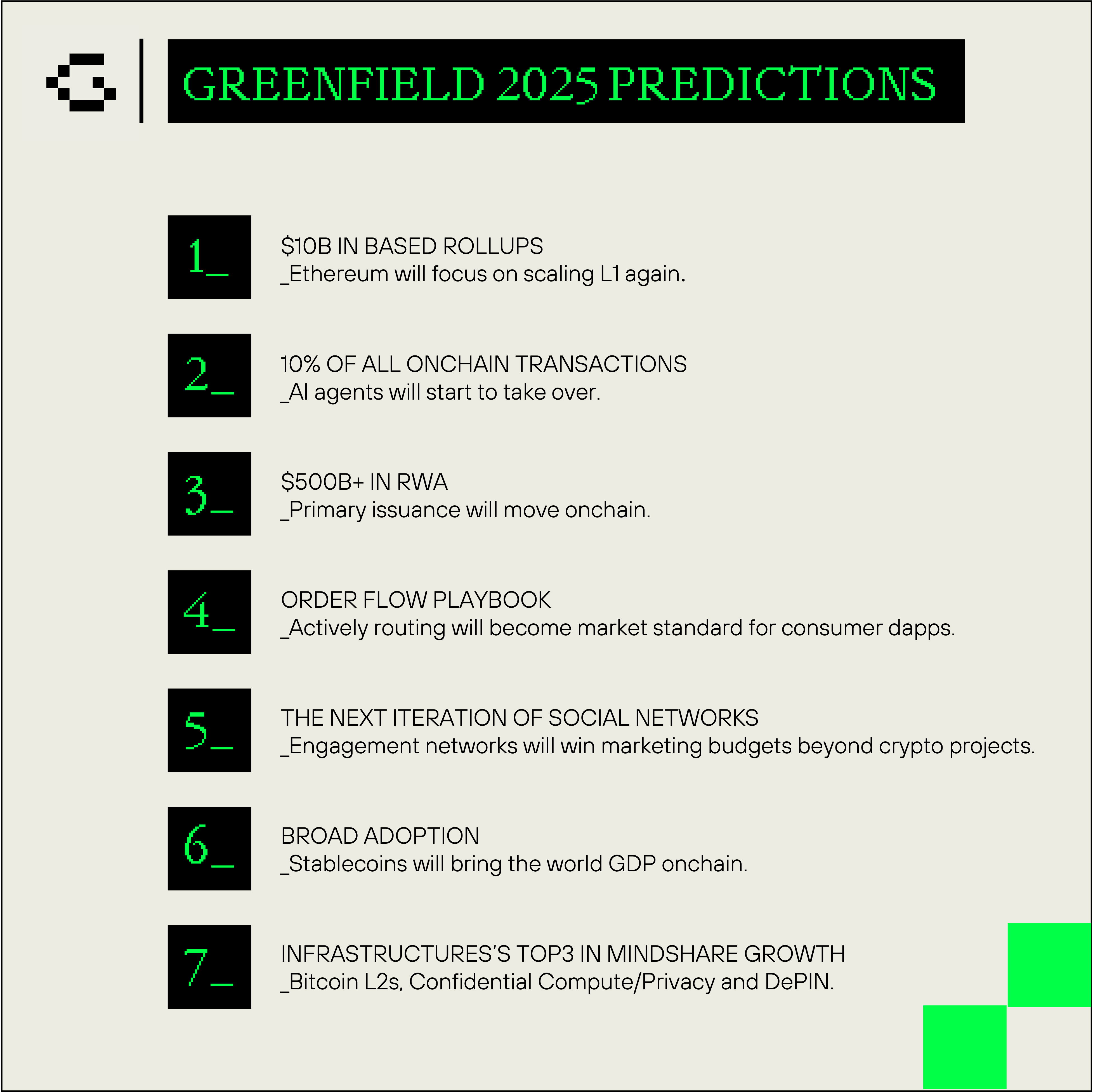

INFRASTRUCTURE / DEFI / CONSUMER | Greenfield Predictions 2025

Crypto is still a young breed. It grows new limbs almost every day. Our most critical and demanding job as fund managers is to assess which of these verticals could one day develop into leading narratives and significant market opportunities. No core list should prevent us from keeping our eyes open for new opportunities across the crypto stack. At the same time, it is essential to set a certain focus in the increasingly overwhelming crypto landscape. Our 2025 predictions represent verticals across the Infrastructure, DeFi and Consumer stack to which we generally attribute large and disruptive market potential.

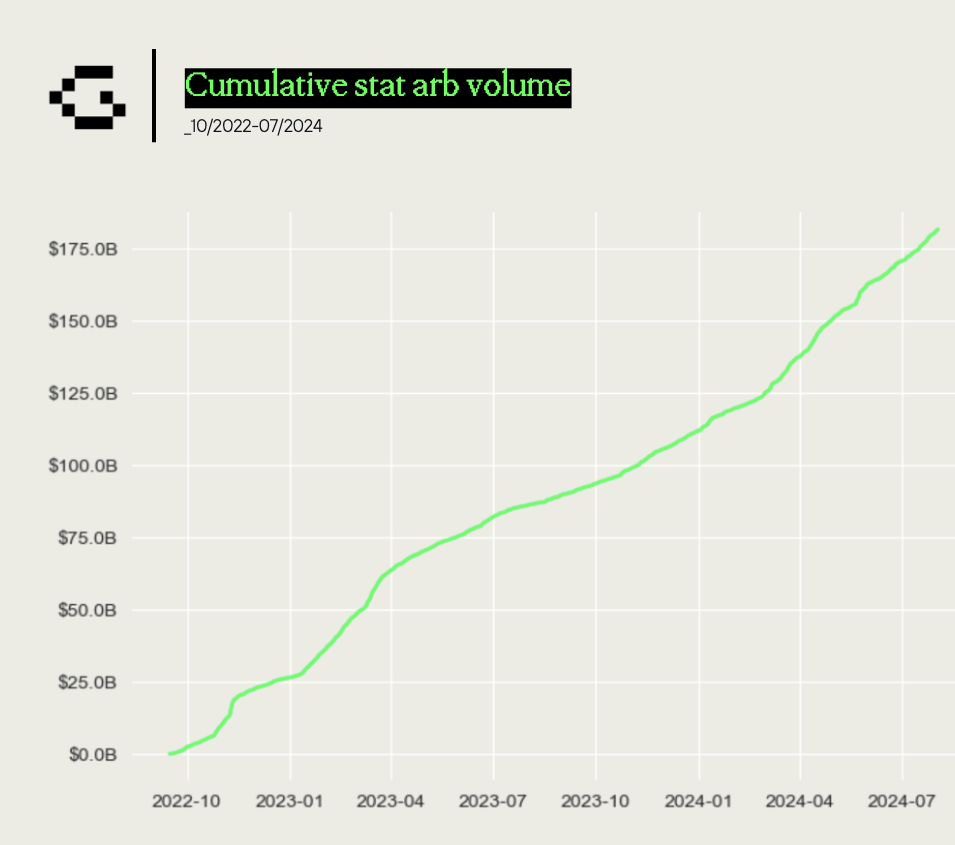

DEFI | Deep dive into statistical arbitrage

$175B+ result from statistical arbitrage (stat arb) transactions. It’s one of the main reasons for inefficiencies in crypto trading. In our recent in-depth onchain data-driven research, we explore stat arb on Ethereum and how it relates to and impacts block building via mev-boost. We also analyze the scope of the stat arb market and which parties win and dominate stat arb opportunities. Various protocols within our portfolio and network supported this research with insights and reviews (e.g., Titanbuilder, Liquorice, Warlock).

_Community

POLICY | Driving competitiveness of the German and European crypto industry

On 23 February, Germany will elect a new parliament. The election comes in a year when Germany and Europe need to set their decisive course as a leading hub for the crypto industry and blockchain as a key technology. Together with Areta, a Germany-based specialized investment bank for crypto and web3, we have compiled a position paper on the levers for innovation-friendly conditions and regulatory clarity for entrepreneurs, users and investors.

See also coverage by payment and banking | ntv | Capital