Backing Panoptic – the perpetual, oracle-free options protocol

by Gleb Dudka and Henry Krause, November 20th

We are excited to announce that Greenfield is leading the latest $7M funding round for Panoptic, with the participation of L1 Digital, Gumi Crypto, HashKey, Phaedrus Labs, Heartcore Capital, ZeePrime and others. We believe that Panoptic is the next zero-to-one innovation in the DeFi realm. By building on top of Uniswap, Panoptic is not only trying to solve the trillion-dollar on-chain options problem but also enabling an entirely new set of possibilities to create novel financial products. Panoptic allows users to short LP positions and to long or short any on-chain asset via multi-leg options. It can ultimately increase the earnings of liquidity providers which deposit their LP positions into Panoptic to earn additional yield.

Panoptions as the new DeFi primitive

Panoptic’s main products are the so-called “panoptions”. Panoptions are a new kind of derivative product that has a similar payout structure to a traditional option but has some major technical differences. They are oracle free, have an instant settlement, no fixed expiry, can be minted at any strike price, for any assets, and have no up-front premium but instead a streaming fee, aka “stremia”.

By creating multi-leg options like buying a Put and selling a Call, Panoptic also enables traders to create perp-like payouts with up to x3-x5 leverage for any asset without additional oracle and spot-perp deviation risk.

Panoptic requires only 10% collateral for option buyers of the notional value. The collateral is required to guarantee the streaming fee payments in case of an panoption purchase. This low collateral enables market-leading capital efficiency in the derivatives space.

The core idea is that Panoptic smart contracts can reallocate liquidity between Uni v3 pools and a Panoptic pool to create perpetual options. Uniswap V3, therefore, becomes a de facto clearing house and settlement layer for Panoptic. How does that work?

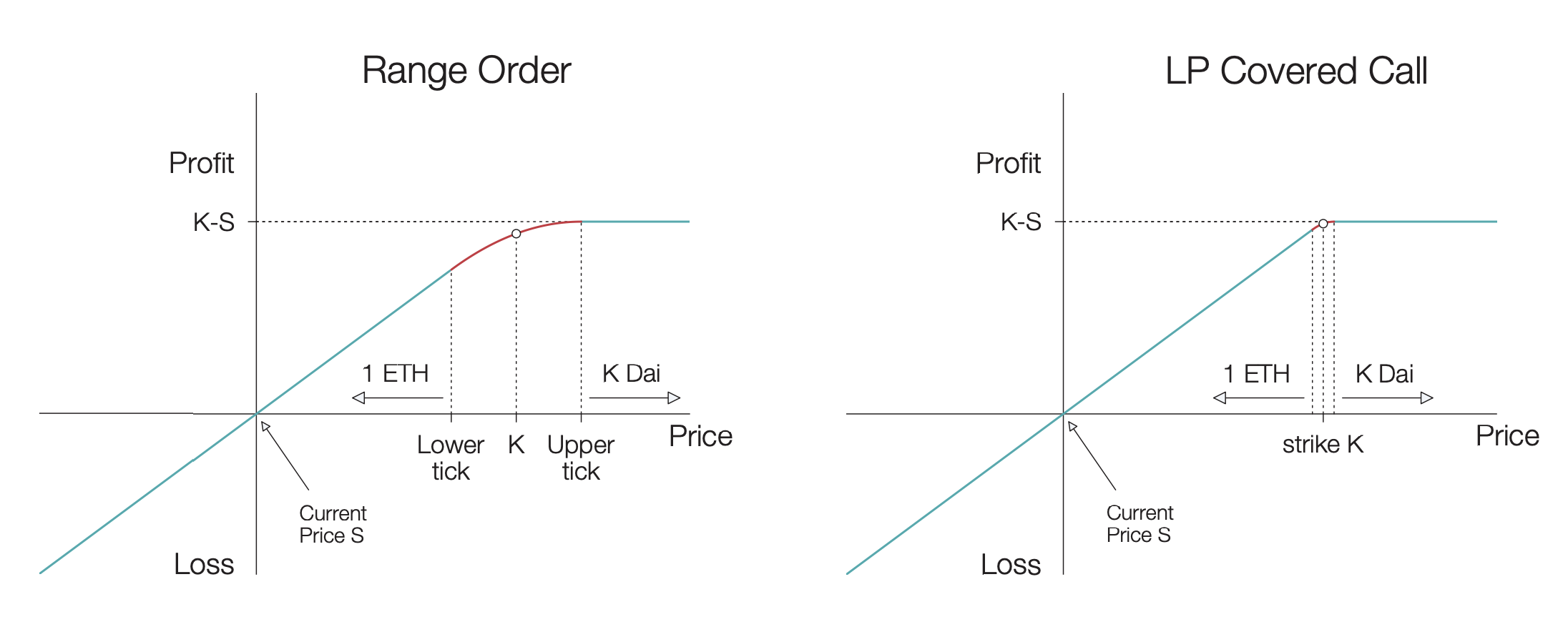

Uniswap v3 payoff curves compared to options | Source: Panoptic

AMM liquidity provisioning vs option selling

It turns out that providing liquidity on Uniswap, especially concentrated liquidity, has very similar payout structures to options, as illustrated above (Source: Panoptic whitepaper).

A Uni v3 LP position with a liquidity range from $2,400-2,500 will be 100% DAI above the range and 100% ETH below the range. This means the upside for the LP position is fixed, while the downside is infinite (until you close the position). In exchange, you accrue yield via trading fees inside the liquidity range. This is already pretty similar to the payout of selling a traditional covered call, but we can get even closer by only providing liquidity for a single tick instead of a range. With an ETH LP position deployed to a single tick, we find that the position will be 100% ETH exactly below the tick, and 100% DAI exactly above the tick – with the tick price being exactly the strike price. Depending on whether your strike is above or below the current price, the sold option becomes a put or a call.

The goal of Panoptic is not to replicate traditional options on-chain but rather to work within the confines of the EVM and create a new, innovative primitive. True DeFi-native innovation often evolves within the confines of blockchains, similar to how Uniswap’s automated market maker (AMM) looks nothing like a traditional CLOB.

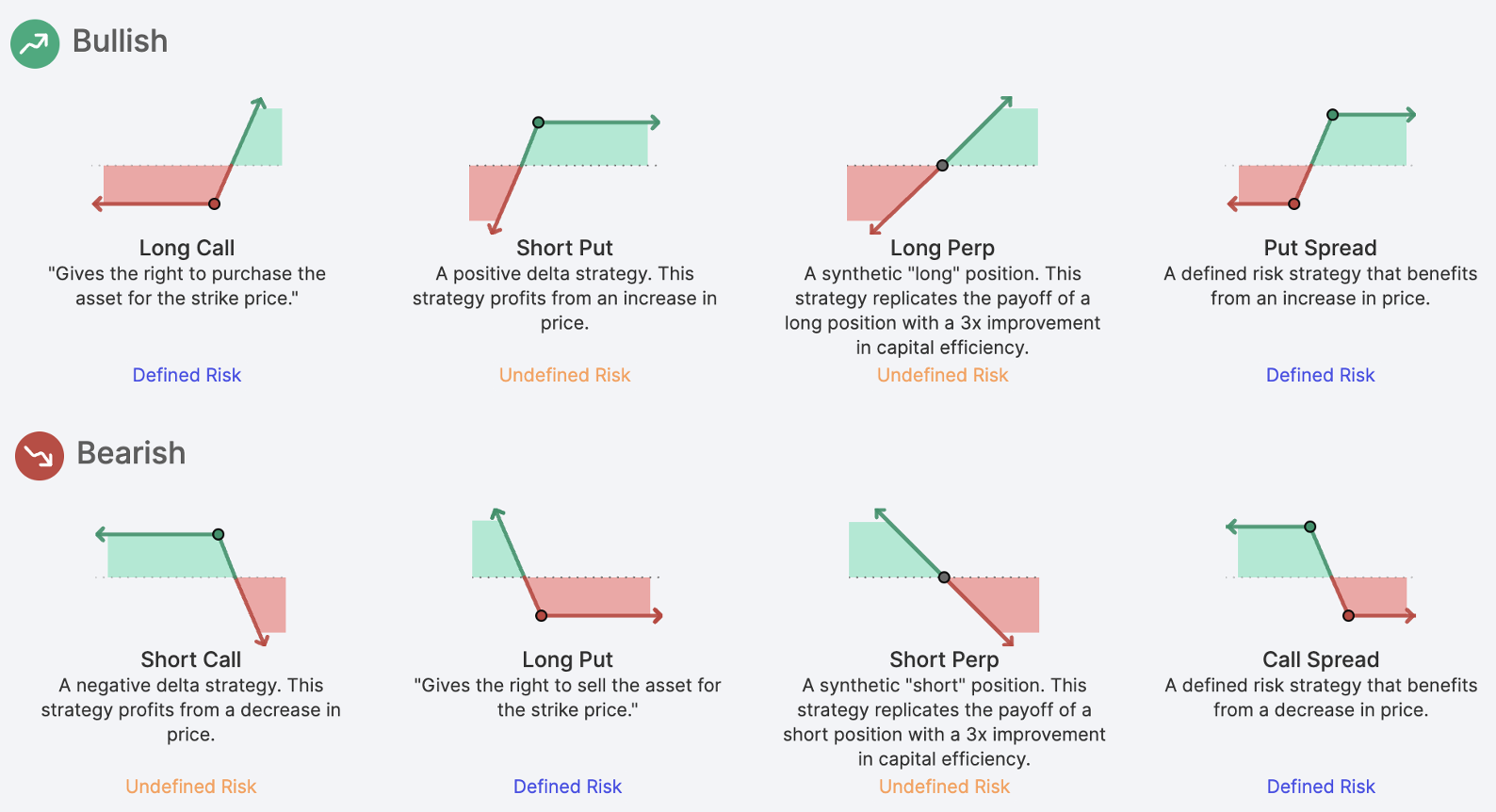

With the predefined strategies, Panoptic abstracts a lot of the complexity away for the end user and enables everyone to create sophisticated trading strategies with a simple click of a button.

A selection of prebuilt option products available via a single click on the Panoptics dApp | Source: Panoptic

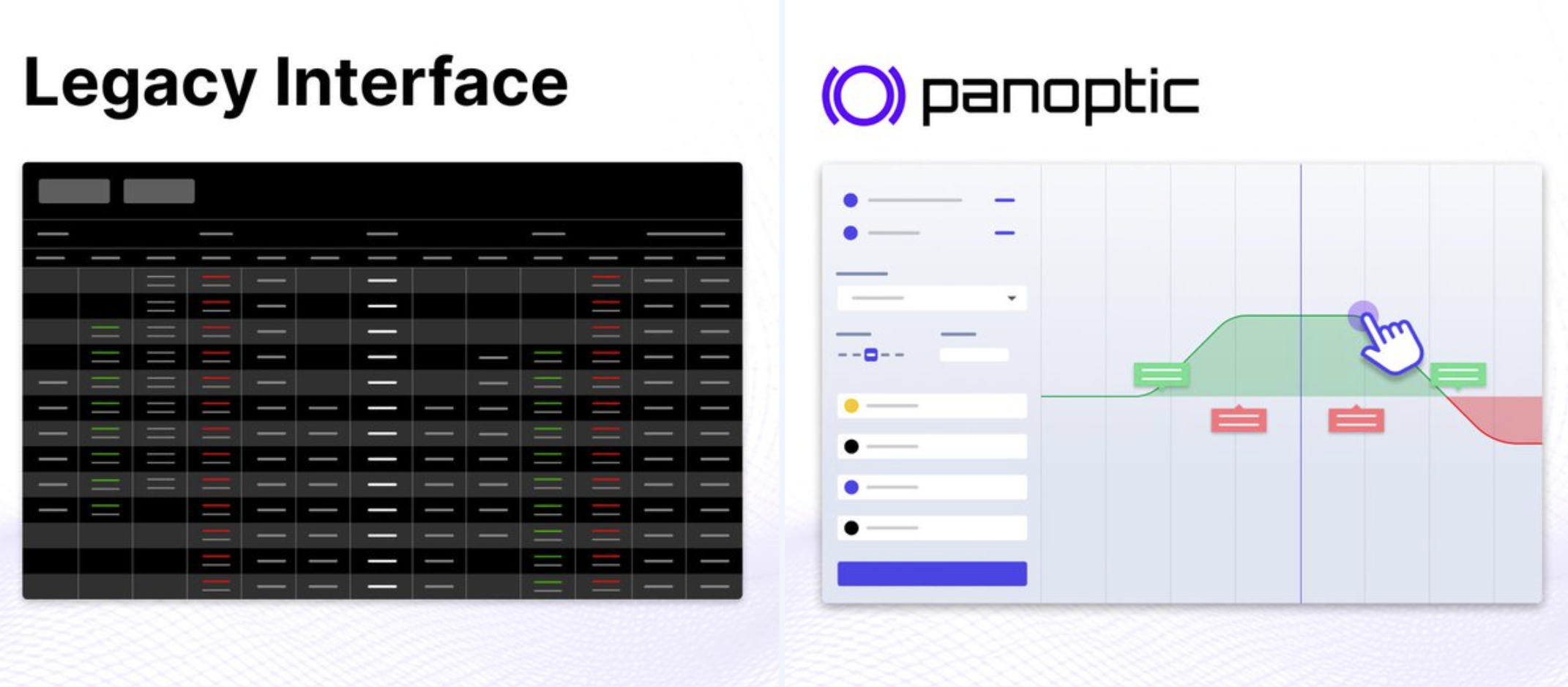

Another game-changing feature is their revolutionary, easy UX and UI. They have developed an easy drag-and-drop-like UI to make individual changes to create unique option payouts for any strike price and any assets without having to consider different expires.

Comparision between panoptic and conventional UI in the options space | Source: Panoptic

Get involved!

If that sparked your interest, Panoptic just went live on Basechain, and if you are whitelisted, you can already start trading!

Panoptic linktree: https://linktr.ee/panopticxyz