Building a DeFi bonding standard with Liquity – Chicken Bonds

by Henry Krause, November 17, 2022

The quest for liquidity among protocols has been one of the major concerns for every crypto startup. Indeed, the so-called Total Value Locked (TVL) and the protocol native token liquidity depth are two of the primary KPIs for the success of a protocol. This led teams to spend significant amounts on advertising and incentive programs to attract liquidity. As a result, individual users went from protocol to protocol with their liquidity to earn yields from the best incentive programs with very few becoming sticky and permanent liquidity providers. This unsustainable market of incentive programs could now be disrupted – with “Chicken Bonds”, the latest drop of our portfolio company Liquity.

With the “Building”-series we pay tribute to portfolio companies that have recently achieved a significant milestone or breakthrough, contributing to an open, decentralized, and more robust architecture of tomorrow’s web.

Liquity is a decentralized borrowing protocol that allows users to draw 0% interest loans against Ether used as collateral. Their original product is one of the most forked protocols on the open market. Chicken Bonds are now marking a further promising contribution to support mass DeFi adoption. Chicken Bonds are a new open-source bonding standard for DeFi. They aim to create permanent and sustainable liquidity for protocols and increase user yields. How do they try to achieve this?

Chicken Bonds will bond users’ LUSD into bLUSD. This bLUSD is an auto-compounding ERC-20 token. It is directly backed by LUSD deposited in the stability pool with a rising floor price against the underlying LUSD. Additionally, bLUSD holder will also earn extra yields from the curve pool.

The bonding process utilizes the ERC-721 token standard mostly known from NFTs. When a user decides to bond their LUSD a new NFT (bond) will be issued. During the process, the principal value of LUSD is not at risk and can be withdrawn at any time. The rationale of each user should be to hold the (NFT) bond until they can claim an accrued amount of bLUSD worth more than the bonded LUSD.

The target maturity date from bonding varies depending on the bLUSD market price, since once a bond has been purchased for X amount of LUSD the bond needs time to accrue enough bLUSD to hit the initial purchase value of your LUSD. If the market price of bLUSD is high, the bonding time decreases, and if the market price of bLUSD is low, the bonding time increases. To counteract larger time deviations there is an internal control mechanism that increases the accrual speed if the price decreases.

When a user decides to claim the accrued bLUSD out of the bond he can now choose to either supply liquidity in the curve pool or if bLUSD trades at a premium, sell the bLUSD back to LUSD and start over the process.

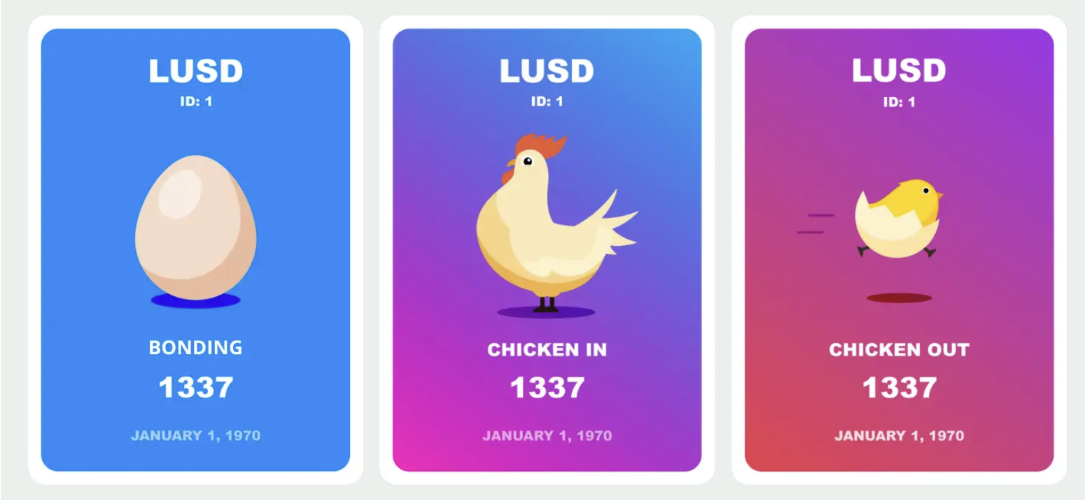

Introducing Dynamic NFTs

Liquity also wants to pioneer dynamic NFTs. These NFTs change depending on their owner’s on-chain activity and actions around bonding. With Chicken Bonds, each bond will initially have the image of an unhatched egg. If its owner waits until the bond matures, the egg will finally hatch into a proud chicken. If its owner decides to “chicken out” and withdraw LUSD, the egg will evolve into a scared smaller chicken. The rarity of each egg and chicken depends on previous and future on-chain governance interactions and voting regarding the Curve and Liquity protocol.

bLUSD will also be deployed on a new Curve-pool → bLUSD+LUSD/3pool.

There are further mechanics inside the bLUSD which will increase the yields and arbitrage opportunities for the entire Liquity ecosystem and ultimately increase LUSD adoption.

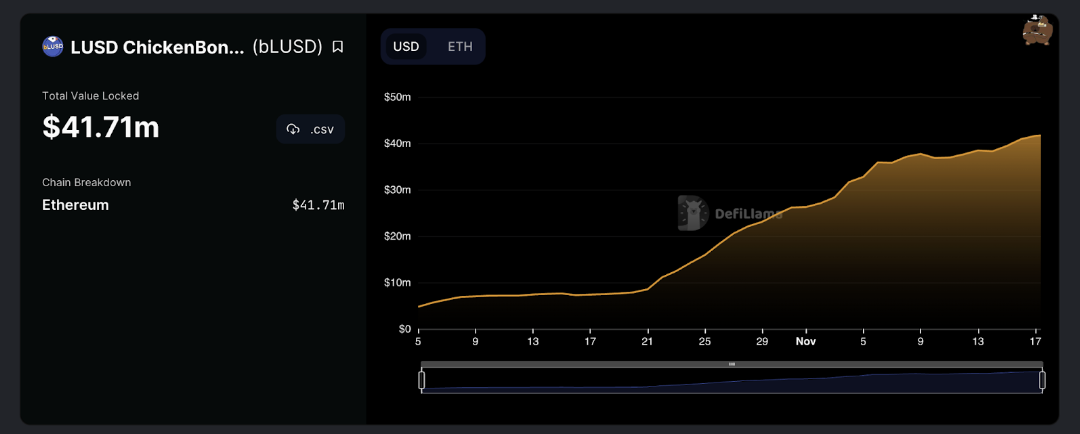

$5.3m has been deployed into the new Curve pool, which currently offers an extra APR of +18.67% paid in LUSD!

Within the first month since its inception, more than $41m has already been bonded.

Check out the Chicken Bonds Docs

For in-depth technical documentation check out the Chicken Bonds docs.

https://www.chickenbonds.org/blog-posts/lusd-chicken-bonds-introduction

https://docs.chickenbonds.org/faq/economic-design#_44lrt4qpho3a

Keep on building, Liquity!