Backing goodcarbon: Tokenizing nature based climate solutions to close funding gaps & create forward price signals

by Felix Machart, May 03

We are excited to be backing goodcarbon in their recent €5M+ funding round led by Planet A ventures who are the first European fund with their own scientific team to assess the environmental and climate impact of an innovation, with further participation by 468 Capital as well as a group of strategic angels.

While having been interested in the segment for a while, the team at goodcarbon stood out with their incredible and authentic drive to tackle this huge challenge. It also does not hurt that they have known each other since their studies, that they have built and exited successful online businesses before and that they built an extensive network in impact investing over the years with a whole range of good impact ventures, while teaming up with strong partners in climate science.

We believe that goodcarbon will be an incredibly important enabler for bringing together top-notch nature based climate solutions projects with investors and emitters.

The race to limit global warming

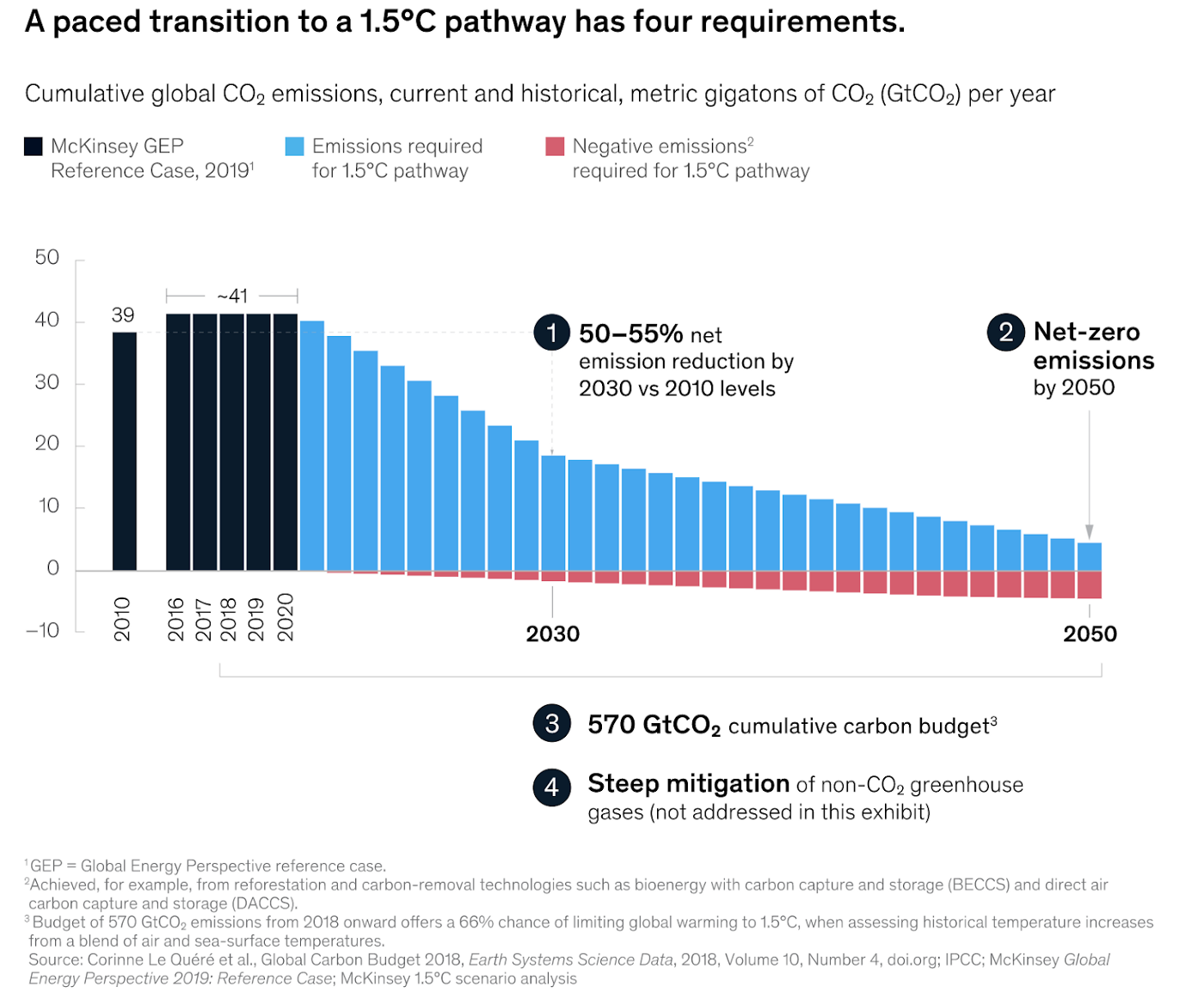

It is common knowledge that we should reduce greenhouse gas emissions in order to try to limit an increase in temperature to 1.5°C above pre-industrial levels in order to maintain earth as a worthwhile habitat for humans as well as many other species.

In a new paper in nature (see also twitter thread), it is argued that warming could be kept just below 2 degrees Celsius if all conditional and unconditional 2030 pledges submitted by 154 nations prior to the Glasgow Climate Pact are implemented in full and on time. Limiting warming to “well below” 2 degrees Celsius or 1.5 degrees Celsius, however, urgently requires steep emission reductions this decade, aligned with mid-century global net-zero CO2 emissions. Nature based solutions are seen to have significant potential but are not widely utilized yet.

Carbon markets and their problems

Markets are generally leveraged for efficient decentralized resource allocation.

In the case of carbon, compliance markets focus on a certain hard cap of emission rights that can then be traded in order to let the most valuable use-cases emit pollution. While there are mandatory carbon markets covering specific industries in the EU, the UK and California, the vast majority of the earth is so far not covered.

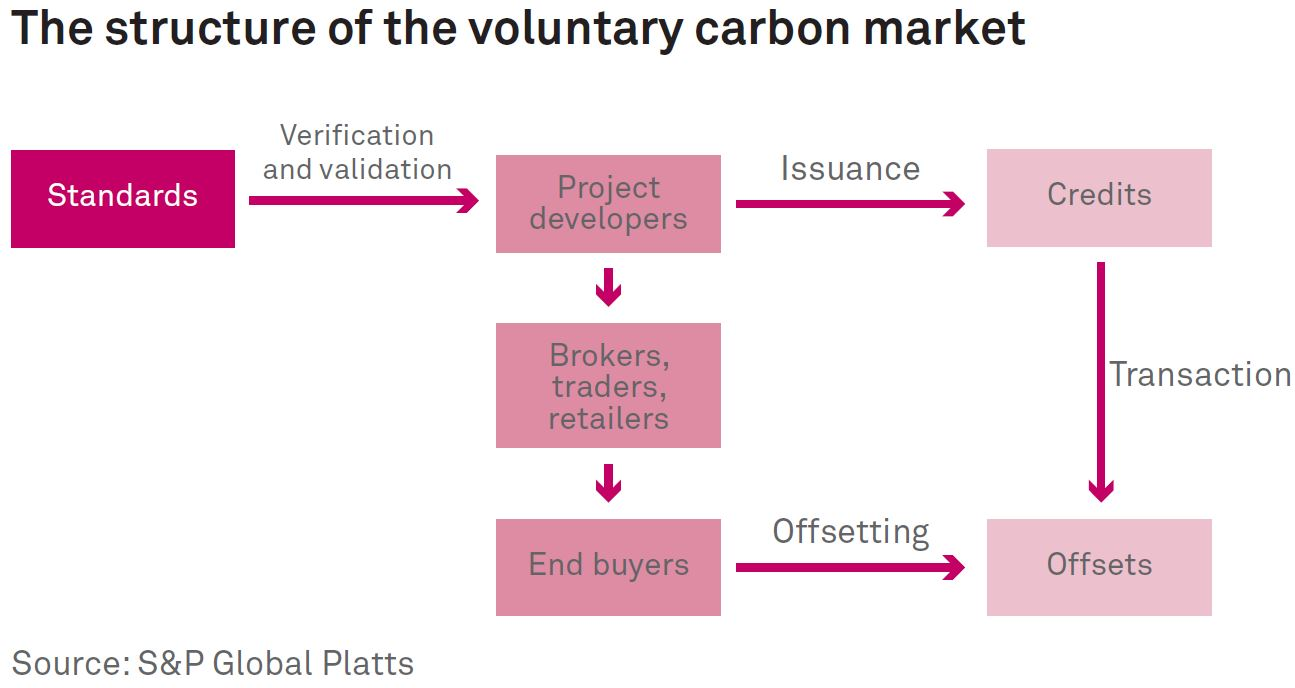

Other sectors have been inspired by compliance schemes and pledged to offset their emissions by participating in carbon markets voluntarily. These voluntary markets allow carbon emitters to offset their unavoidable emissions by purchasing carbon credits emitted by projects targeted at removing or reducing greenhouse gases from the atmosphere.

A verified carbon unit (VCU) represents a reduction or removal of one tonne of carbon dioxide equivalent (CO2e) achieved by a project, certified by standards organizations such as Verra. A number of quality assurance principles are confirmed through the project validation and verification process, which however leaves room for improvements in e.g. continuous transparency. VCUs are ultimately purchased and retired by an end user offsetting their emissions.

The structure of the voluntary carbon market is characterized by dominant standards organizations as well as an intransparent ecosystem of brokers/traders that take steep margins.

Demand for quality carbon offsets outpaces supply

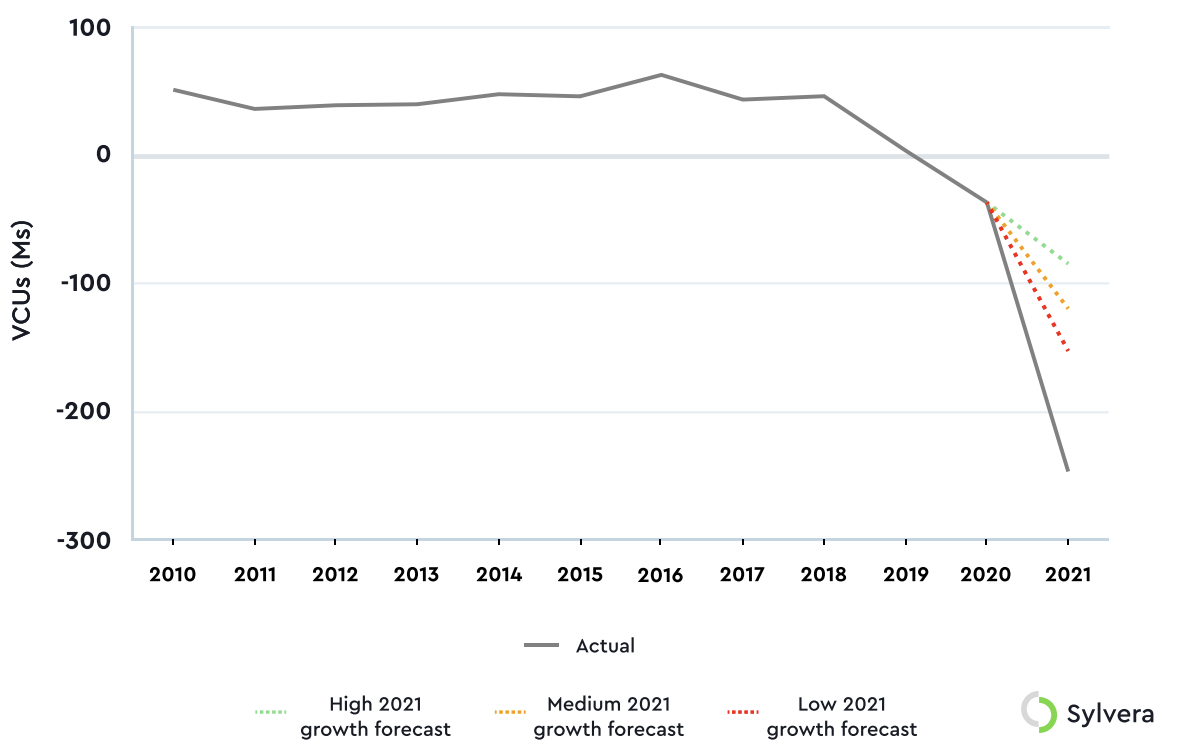

There has been increasing stakeholder pressure on nations, corporations and asset managers to make net zero commitments, with the number of large organizations making them more and more rapidly. Also crypto-native projects had a not insignificant impact in driving demand over the last year.

Thus, the inventory of carbon offsets has been decreasing by around 50% in 2021.

As a result carbon credit prices have been increasing significantly across the board, while varying largely dependent on quality and standards.

Natural is premium

Removal and sequestration credits (incl. NCS) generally trade at a premium to avoidance credits, due to higher levels of investment required as well as high demand based on the view that they are more effective against climate change. This is, since ultimately, not all processes will be able to be operated at zero emissions so there needs to be removal or sequestration in order to reach net-zero. Furthermore, NCS allow for significant potential for co-benefits such as bio-diversity and ecosystem functioning allowing for further differentiation and premium pricing (marketed separately).

Within NCS, goodcarbon focuses specifically on ocean-based solutions, which poses incredible potential, since about 25% of CO2 emissions are being absorbed by the oceans. It is estimated that ecosystems including seagrass, salt marshes and mangroves can store >2x the carbon compared to land-based forests, while being largely untapped by project developers so far.

Corporates react to a lack of supply

Large emitters have been looking to hedge against the risk of future price increases by buying entire carbon projects, or large stakes in them, as soon as they are certified and able to issue credits.

Demand is projected to further increase 15x by 2030 and 100x by 2050. 30% of this demand is estimated to be able to be covered by NCS, at a reasonable cost of $10-$40/tonne.

However, in order to mobilize this supply by a significant increase in project development (and connected long lead-times), a lack of funding needs to be solved at scale and fast.

Overall, the market is characterized by low liquidity, scarce financing, inadequate risk-management services, and limited data availability.

Suggested improvements to make the market more efficient:

- Strengthen verification methodologies & streamline verification processes

- Clearer demand signals to give suppliers more confidence in their project plans and encourage investors and lenders to provide financing.

- Creating shared principles for defining and verifying carbon credits.

- Standardized contracts — reference contracts would combine a core contract, based on the core carbon principles, with additional attributes priced separately.

- Resilient and flexible trading and post-trade infrastructure — to accommodate high-volume listing and trading of reference contracts (and contracts reflecting a limited, consistently defined set of additional attributes). Structured finance products for project developers can be built on top.

- Mechanisms to safeguard market integrity: establishing a digital process by which projects are registered and credits are verified and issued

- Verification entities track project impact at regular intervals, not just at the end

- Digitize process: lower issuance costs, shorten payment terms, accelerate credit issuance and cash flow for project developers, allow credits to be traced, and improve the credibility of corporate claims related to the use of offsets.

- Effective ways for buyers of carbon credits to signal their future demand to encourage project developers to increase the supply.

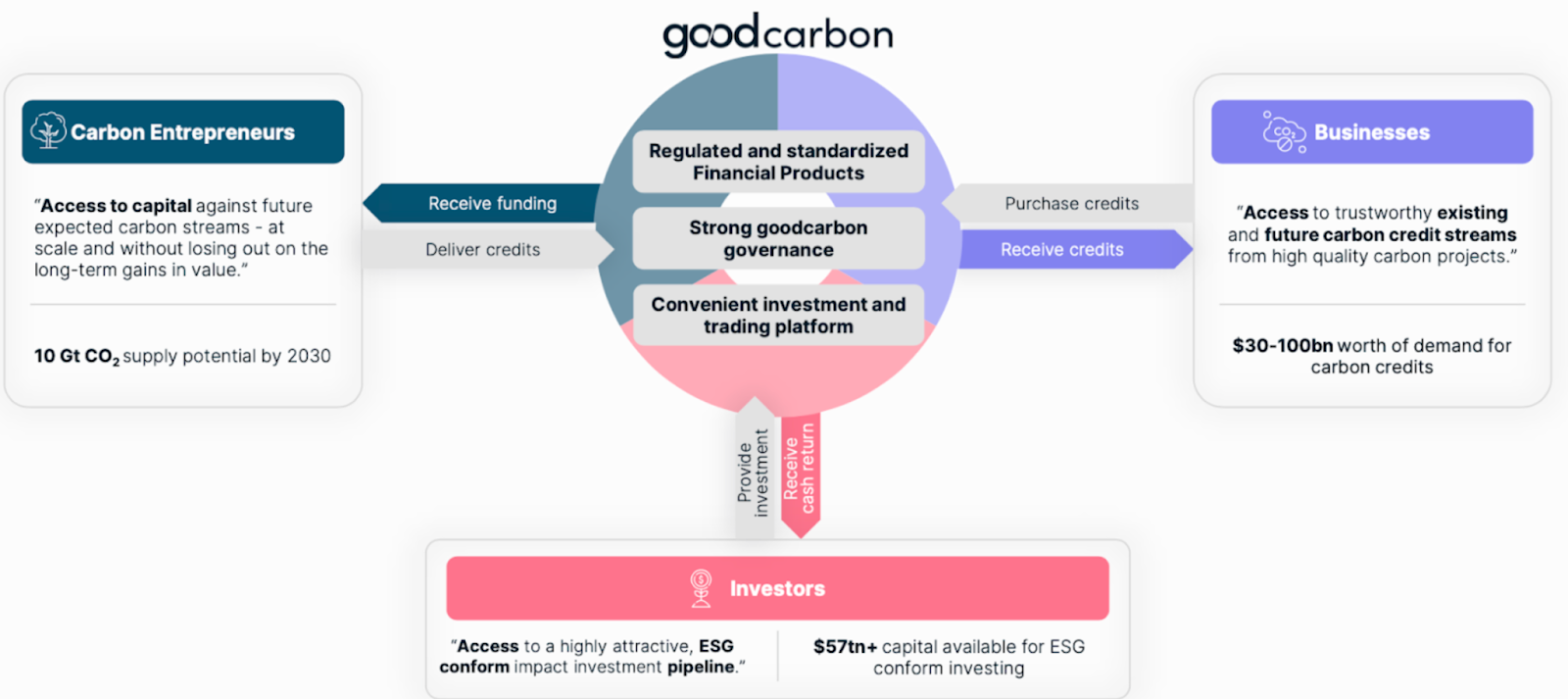

goodcarbon connects the dots

The team behind goodcarbon is building a compelling solution to the problems in the space by issuing tokenized and standardized financial assets which are subject to German financial regulation on a platform that covers the full lifecycle of funding offsetting projects incl. reporting, governance and secondary market trading.

Emitters (or investors) can invest into a diversified basket of project shares that generate a future stream of carbon credits with ease and high transparency through a simple user interface, while avoiding concentrated risk exposure and all the overhead involved in sourcing, acquiring and monitoring of stand-alone projects.

Carbon Entrepreneurs receive funding to develop their projects while being able to perform reporting tasks on the platform.

Emitters can also purchase forward credits in order to allow them and carbon entrepreneurs lock-in future prices already today. This sends important forward price signals to the market to spur further project development, while everyone involved has greater certainty in planning their business operations.

While leveraging leading independent verification methodologies, goodcarbon adds their own quality assessment including co-benefits such as bio-diversity enhancement. A verifiable audit trail is anchored on-chain in order to improve transparency.

Permanence is ensured through clever incentive design including an escrow mechanism to issue credits only once carbon reduction is verified, additional rewards for co-benefits and sufficient financial exposure of carbon entrepreneurs in their long-term project impact.

As a result, goodcarbon has the potential to improve upon the current market structure of carbon offsets across various dimensions such as transparency and providing incentive aligned financing solutions that meet the needs of carbon offsetting projects, emitters and investors. Thus, they can serve as a key-enabler to close the gap in the expected increasing demand overhang for quality carbon offsets, while having unique access to blue-carbon projects through their close collaboration with Oceans 2050.