Backing Paladin — a governance lending protocol

by Jascha Samadi, Sep. 30

We are excited to share that we recently led Paladin’s $2.55m seed funding round with participation from our friends at Galaxy Digital, NfX and Semantic.

Paladin is a decentralized protocol aiming to empower activists by enabling voting power as a financial asset – the protocol launched on Ethereum mainnet today. Governance token holders can connect through Paladin’s governance lending market and delegate their voting power to borrowers in order to earn additional yield on their governance token holdings. Governance activists on the other hand can borrow additional voting power in order to support certain proposals or reach a minimum quorum.

Decentralized governance has always been a core focus of our research with extensive pieces written in the past (e.g. contributions on the state of blockchain governance or long-term alignment in cryptonetworks/DAOs), which is why we are now particularly thrilled to be working with both founders, Romain and Valentin on one of the biggest problems in blockchain governance today, voter apathy.

Enabling governance activism

Voter apathy is one of the if not the biggest problem in blockchain governance today. The vast majority of governance tokens sit idle and are not being used for participation in decision making processes. Many governance proposals oftentimes require a certain level of technical or economic understanding of the matter at hand, it takes time (to educate) and money (gas) to participate with very little impact individually. In many cases, governance decisions are driven by a few influential token holders and whales who can justify spending the time and money and oftentimes seem to have coordinated off-chain prior to proposals and directional protocol decisions.

In this process the vast majority of smaller token holders either stand no chance when engaging in governance or (consequently) tend to not bother at all. Tools and instruments to effectively coordinate at scale are limited and thus large parts of the community are left out of any decision making process. Many DeFi builders have even become frustrated with their lack of influence over projects and the average professionalism of token holders (or lack thereof).

Crypto provides us with inclusive, permissionless and open systems, but the reality of blockchain governance today has turned into one of low voter turnout and participation, even with major directional protocol decisions and proposals of significant economic weight. This is even (more so) the case with DeFi’s largest protocols. Voter turnout for recent proposals of SushiSwap was generally between 3–5%, with Compound, Aave and Uniswap showing similar patterns. For comparison, corporate voter turnout in the US tends to be close to 80% on average (between 2003 and 2013), even retail investors show significantly higher participation rates with close to 30% on average.

Similar observations can be made when looking at delegations. Governance delegation is meant to be a solution to voter apathy that should enable professionals who spend their time understanding a matter at hand, staying up to date and conceptualizing the future of a specific protocol.

However, in reality things are very different. The top 10 delegates on Uniswap have almost all voted on 2 or less proposals representing mainly single digit numbers of token holders. Occasionally there are individual attempts by some protocols to specifically incentivize governance participation with rewards. Balancer offers LPs who participated in the last governance proposal a 1.2x reward boost, but in the end doesn’t show any strong improvements when looking at the participation rates of specific proposals.

Looking at Uniswap, recent developments have also shown how fragile a governance system with low participation rate can be, even for one of DeFi’s largest and well established protocols with one the broadest token distribution rates across more than 250,000 token holders. As in the case of the Uniswap DeFi Education Fund proposal, 96% of all votes came from only 10 addresses (including a wallet controlled by Harvard Law Blockchain and Fintech Initiative) showing that in many cases it is only a handful of participants driving these decision making processes.

All of this seems to be in stark contrast to what decentralized governance is intended to be, transparent, fair, inclusive, robust and resilient.

Liquid Governance

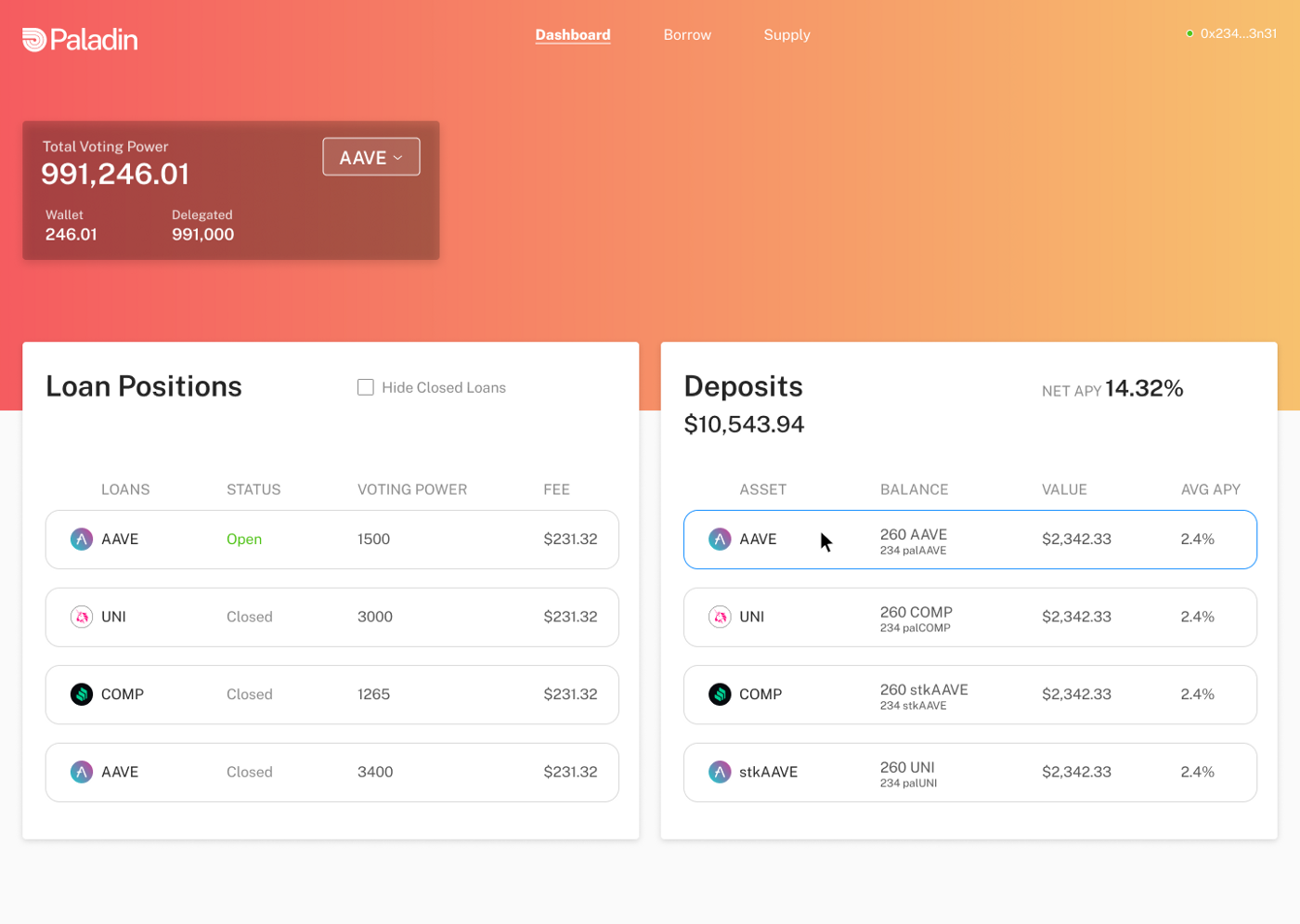

Paladin’s first product is a governance lending market. Governance token holders can connect through Paladin’s lending market and delegate their voting power to borrowers to earn additional yield on their governance token holdings. Governance activists on the other hand, can borrow additional voting power in order to support certain proposals, reach a minimum quorum or (ideally) utilize this instrument to mobilize and rally against questionable proposals driven by a small number of larger token holders.

One of the underlying assumptions behind Paladin is that DeFi protocols will open governance power to all derivative tokens like LP and staked tokens. From this angle, Paladin can even be seen as an upper money lego to utilize unused assets (StkAave or aBPT for example) or “components’’ of such assets (e.g. the respective voting power defined by the economic stake in a system) and generate a complementary layer of yield which one cannot get elsewhere. As such, these yields do not have to be competitive with farming yields.

At the same time borrowing rates and the general pricing structure are an important instrument for protocol protection and incentive alignment. It is a key driver to not allow borrowers game the system, use Paladin to exploit delegated voting power at scale and perform governance attacks. The initial design lets borrowing rates grow exponentially relative to the utilization rate of and the remaining borrowable voting power in a given pool. All of this is meant to be a compromise between punishing long term and large borrowers while still providing activists with a tool that would have the necessary impact and actually empower them to drive decisions.

As a lower end ballpark number, first indications for potential borrowing rates are targeting 0.5–1% of the token value per week (25%-50% APR).

Due to its conceptually controversial nature, there are cases of (prominent) critics who are either completely against token holder voting or refer to vote lending as on-chain bribery. And yes, there are cases where one could imagine a system like Paladin being used for governance attacks and other ways that could harm the underlying protocol, in particular by giving borrowers with no required financial exposure to that protocol voting power and influence over decisions. But in the end, we believe that crypto is a game of incentives and the question should rather be how to design such incentives in order to prevent an unbundling of influence over and economic interest in a governed protocol.

More importantly, what is also clear (and all of us investing in the space for long have at some point engaged in such behaviour) is that there is a lot of governance coordination happening off-chain and through backroom agreements between larger and influential token holders. Paladin is an instrument to bring such coordination on-chain, which is where it belongs. From this angle, the protocol is not enabling something new which has never happened before, the core intention is to move this coordination into an environment that is now transparent and allows other community members to follow, be aware of and potentially react to it.

There is also an educational angle into Paladin’s lending protocol, as we believe that at the end of the day, the most effective way to educate average token holders on why to participate and raise awareness for the actual value of voting power, will be demonstrating that there are actors in the ecosystem who are willing to pay for it. As such, it will serve as an extremely powerful “upper money lego” and meta-governance coordination layer that can mobilize the masses and eventually make blockchain protocols a lot more secure, robust and resilient than they are today by educating people on the true value of their governance token holdings, the ability to participate and drive decisions in the very same systems that they are users of — something that Web2 never allowed us to do.

We couldn’t be more excited to be working alongside the community on Paladin’s mission — if you want to learn more about the project, follow them on Twitter, check their Discord or start to lend/borrow voting power through the Paladin app.