Greenfield’s Liquity Thesis: Interest-free algorithmic leverage and stability through complete contracts

by Felix Machart, Mar. 30

We are excited to share that we have backed Liquity in a $6M round together with Pantera, Nima Capital, Alameda Research, IOSG, AngelDAO, and others.

Liquity is a decentralized interest-free borrowing protocol that allows users to borrow the USD-pegged stablecoin LUSD with ETH collateral. The protocol achieves better capital efficiency than many other lending protocols through a novel pooled liquidation mechanism.

The protocol will be part of the wider decentralized finance (DeFi) stack, which has been growing tremendously in the recent year. DeFi protocols in general aim at providing internet native financial services in a peer to peer and transparent fashion, while minimizing the requirement for trust in intermediaries (thus reducing counterparty risk). Specifically, Liquity joins the ranks of algorithmic stablecoin lending protocols (of which MakerDAO leads DeFi in terms of value locked).

Stablecoin borrowing protocols bring algorithmic leverage with no re-financing costs

MakerDAO has been the first widely successful algorithmic stablecoin borrowing protocol, allowing users to mint their stablecoin DAI by locking up Ether collateral in a collateralized debt position (CDP/vault), with no re-financing cost for the protocol (as stablecoins are created out of thin air against a corresponding liability). Obviously there are systemic risks involved that need to be mitigated by having the protocol enforce certain risk parameters, not least through effective liquidations if such parameters otherwise wouldn’t be satisfied anymore. Governance token holders are responsible for responsibly adjusting parameters, while being diluted as potential shortalls are covered by auctioning off newly issued governance tokens. The project has inspired multiple adaptations such as Kava (ported over to Cosmos for cross-chain capabilities) or the more recently launched Reflexer (a MakerDAO fork with a floating peg and a roadmap to fully automate governance).

The innovation is huge: Anyone can draw credit in a permissionless fashion and rules for financial stability are enforced by code, transparently verifiable in real-time.

However, there are still problems with early implementations which has led to significant potential for differentiated designs:

Variable rate lending

So far stable-coin lending features mostly variable interest rates. In MakerDAO, a stability fee is charged, which is defined by governance and can fluctuate quite widely as it is utilized to maintain the peg to 1 USD.

Variable interest rates are hard to plan with for users however, which leaves room for UX improvements in terms of fixed rates or fees that are known at the time of loan origination.

Governance overhead & risk

In many cases, first and foremost with MakerDAO, governance token holders are supposed to actively manage economic parameters on an ongoing basis in order to maintain a given peg. This can entail increasing rates to deter borrowers and encourage savers to increase the stablecoin’s value and decreasing rates to deter savers and attract borrowers to decrease the stablecoin’s value.

The necessity for continuous manual governance of parameters means coordination costs as well as the risk of failure due to suboptimal decision making (or outright attack/bribery). In practice, there are naturally timelags from the point symptoms arise (e.g. the stablecoin losing it’s peg) until measures are implemented as all participating actors need to assess the current system state, discuss changes as well as come to terms (e.g. increase/decrease stability fees). Parameter changes then subsequently get translated into reactions of market participants (open/close CDPs — sell/purchase stablecoins), which should restore the peg.

Given the continuous effort required and system complexity, there have been relatively low turnout rates in MakerDAO governance (see Greenfield One governance thesis; The State of Blockchain Governance, 2020, p. 88), while a few large stakeholders control significant amounts of the token supply, which is at odds with the vision for decentralized governance (there is however a trend towards more decentralization over time — see).

There is definitely a need for multi-stakeholder governance in steering systems towards visions and goals that are often conflicting, complex and thus hard to implement in code. However, there is also tremendous merit in automating mechanisms with sufficiently narrow objective functions, in order to achieve improvements in reliability, reductions in transaction costs and thus social scalability.

Reflexer, removes Maker’s human governance over stability fees/interest rates by delegating the role of parameter changes to an algorithmic controller. While still relying on some residual governance the team has set up an ungovernance roadmap in order to make the vision more tangible and attract value-aligned stakeholders for self-selection (a community’s culture is crucial for effective coordination). Other elements of MakerDAO such as the liquidation mechanism have been retained (see problems below), while opting for a decentralization maximalist strategy in only allowing Ether collateral.

Centralized collateral types

With the launch of MakerDAOs multi-collateral DAI, collateral types beyond Ether are accepted to create loans, which has spurred criticism regarding the trust-lessness of the system in parts of the community.

Having assets such as USDC or USDT back a stablecoin introduces counterparty risk to the issuing entities, which many proponents of trustless cryptonetworks oppose. While one can make the argument that you can diversify reliance on individual counterparty risks by onboarding large sets of assets, we believe that there exists a market for fully trustless stablecoin borrowing. In addition, fully trustless stablecoins themselves make for reliable collateral.

High collateralization ratios

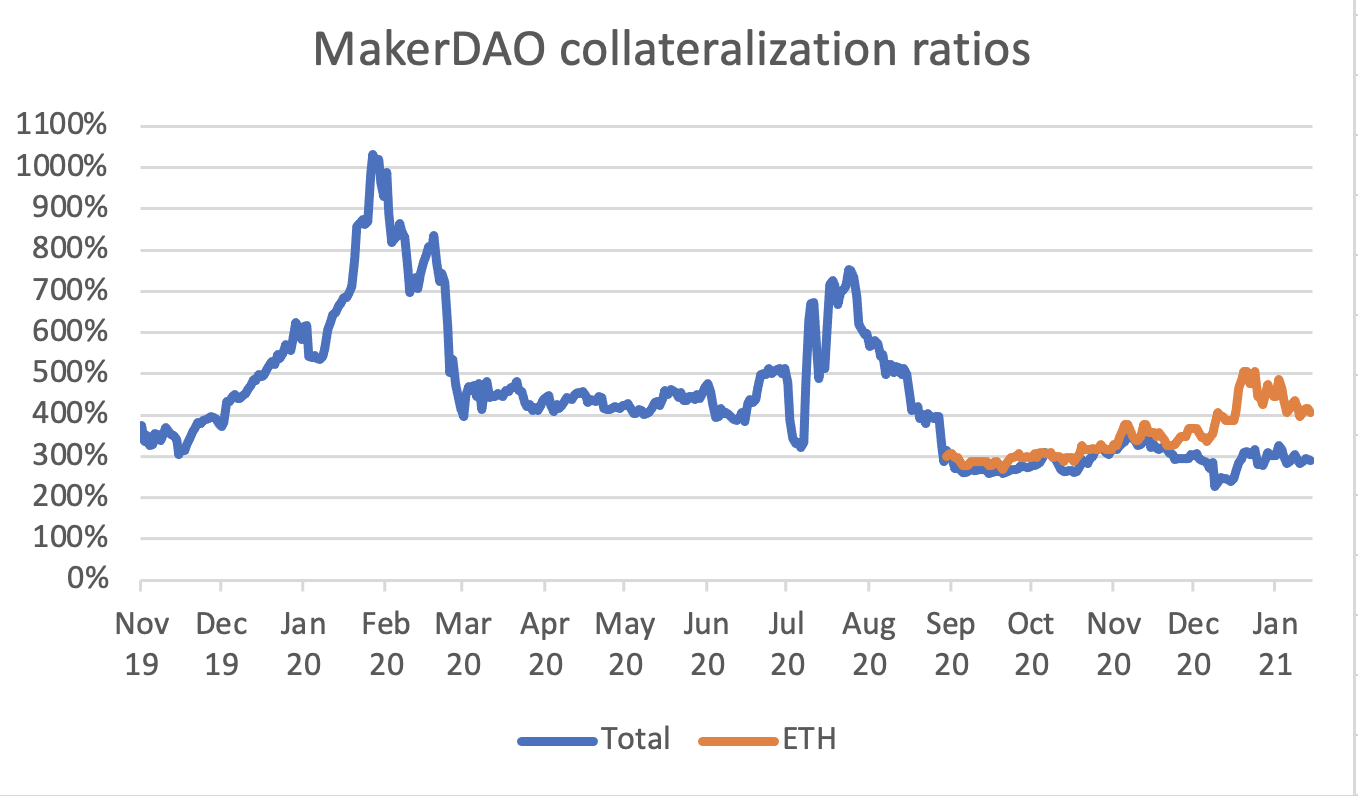

While the minimum collateralization ratio in MakerDAO and comparable platforms is usually 150%, in practice total collateralization is significantly higher (as users maintain a margin of safety against being liquidated).

Total collateralization has fluctuated quite widely, while mostly remaining above 300%. While collateral types that are more volatile than Ether usually command higher collateralization ratios, the average is mainly dragged down by stablecoins such as USDC and USDT, which require very low safe collateralization ratios.

High collateralization ratios are mainly required due to relatively inefficient/slow collateral auctions. By the time a liquidation is executed, the collateral could have fallen further in value significantly, which necessitates a higher margin of safety.

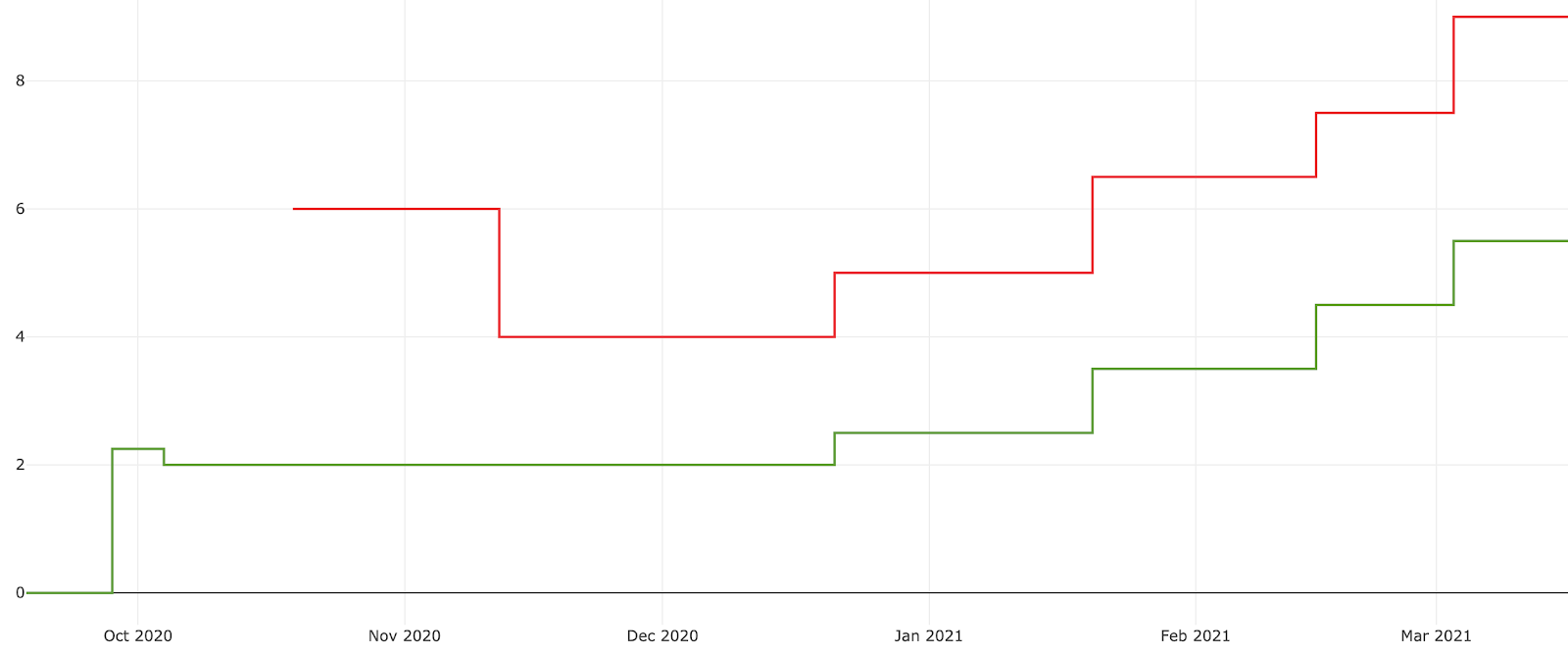

The incident in March 2020, in which the price of Ether sharply crashed, showcased flaws in the mechanism (which have been fixed by making it slower). Network congestion prevented most liquidation bots not successfully bidding in the auction, which enabled some liquidators to acquire Ether collateral for $0 (to the detriment of the owner of the collateralized debt position). As a result, the process has been made slower, with the duration of auctions has been extended from around 10 min to 6h (while being recently reduced to 4h).

No direct redemption mechanism

In systems like MakerDAO there is no possibility of direct redemption against the collateral by anyone which rules out direct arbitrage cycles, making it harder to maintain a tight peg (see Hasu). There have been recent improvement proposals though that instantiate a protocol controlled treasury — the Peg Stability Module — that acts as a CDP — automated market maker hybrid to alleviate that issue (anyone can mint/redeem DAI at 1:1 gross of fees as long as there is capacity in the direction of the trade).

Liquity’s edge

Liquity is primarily designed as an interest-free collateralized borrowing mechanism, while leveraging the LUSD stablecoin as an enabler but not its primary product. The mechanism provides a differentiated and often superior proposition than fixed or variable interest lending, particularly for long-term borrowers (given fees are one-off). One of the core innovations is a more efficient batched liquidation process, which allows for lower collateralization, increasing capital efficiency and thus utility to users demanding leverage.

An immutable set of smart-contracts coordinates and incentivizes the different stakeholders involved: 1) borrowers (who provide collateral in ETH), 2) holders of the LUSD stablecoin (with an option to stake in the “Stability Pool”) 3) liquidators (who trigger liquidations), and 4) frontend operators.

The design specifically optimizes for low barriers of participation. The liquidation mechanism significantly reduces the capital requirement for liquidators (they only need to call a smart contract). LUSD holders willing to take additional risks and earn rewards from liquidations can stake LUSD in the Stability Pool without needing sophisticated infrastructure (such as liquidation bots in other systems).

Next to liquidations, Liquity utilizes a unique redemption mechanism to establish a price floor.

Co-founder Robert, concisely presented the mechanisms at EthGlobal, so we recommend watching the explanations first-hand here.

Zero-coupon leverage over indefinite time: The better fixed rate borrowing

In Liquity, no interest is charged, while instead one-off issuance and redemption fees are to be paid. While fees are dynamic between 0.5% — 5% depending on the rate of redemptions, which serves as a sensor for the stability mechanism (see below), they are known to the user at the time of opening or redeeming positions. As a result, users can adequately plan without sudden changes in cost over the lifetime of their position.

From the borrowers’ perspective, this setup basically mirrors a zero-coupon bond — they receive the loan amount net of the fixed issuance fee, with the difference that the loan is over an indefinite time period. Thus, the longer one retains the loan position, the lower the implied interest rate over time, which is especially favorable for long-term borrowers when compared with alternative products.

Liquity can offer loans with one-off fees only due to 1) the mechanism’s ability to mint stablecoin debt without re-financing costs and 2) due to the availability of “hard-peg” mechanisms without the need of interest-rate manipulation.

These mechanisms incentivize as well as enable rapid and direct arbitrage to restore the peg, when facing volatility. This is contrary to the previously described time-lags in ongoing governance intervention for managing a peg.

Hard-peg mechanisms

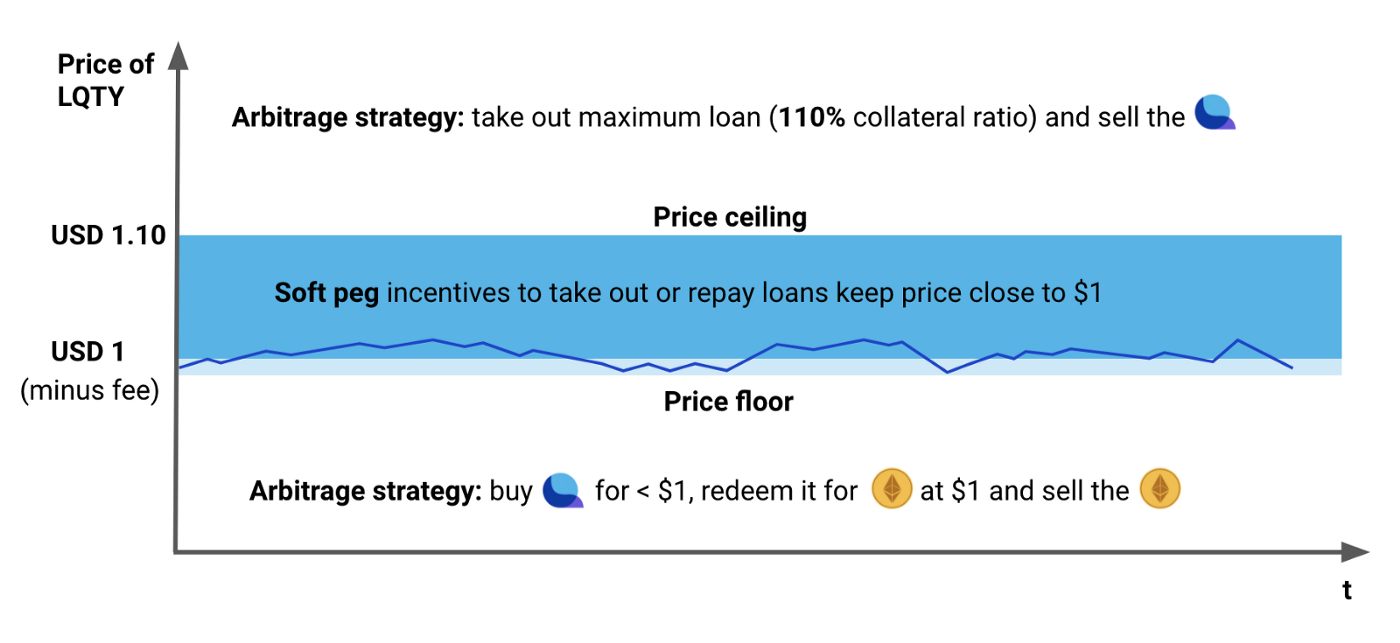

Price floor at USD 1 through direct redemption mechanism

The native stablecoin LUSD is redeemable against the underlying collateral held by the borrowers at any time at face value (e.g. $1 worth of Ether for 1 LUSD). The system uses the LUSD to repay the riskiest Troves (Liquity’s CDPs) with the lowest collateral ratio, and transfers the respective amount of Ether from the affected positions to the redeemer.

Price ceiling at USD 1.1 due to 110% min. collateral

On the flipside, if LUSD’s price appreciates beyond USD 1.1 arbitrageurs can take out a loan, and sell the freshly minted LUSD, pushing down the price again. As long as the trader booked profits net of fees beyond 1.1, he does not need to mind the threat of liquidations, as 100% of the collateral would be returned in the form of LUSD in that case.

Soft peg — Schelling point to 1 USD

While the hard-peg mechanisms reliably keep LUSD within the range of 1–1.1, a soft peg to 1 USD is maintained (similar to MakerDAO & similar systems). The main difference between the soft- and hard-peg mechanisms is that the latter functions on very short time-scales (direct arbitrage cycles), while the former depends on the common believe that in the mid-term LUSD will converge to the Schelling point of 1 USD, which is more likely the stronger that common believe is. This is due to the fact that as more people believe in the Schelling point, the more people could speculate on the stablecoin returning to its peg. As a result, the likelihood increases that any individual of those would act on that belief (e.g. sell LUSD above 1 USD), as they would estimate a higher probability of the peg being restored due to the fact that they think others think the same. This common belief gets stronger the more credible the hard-peg mechanisms are (as they limit risk in either direction).

As the lower bound of the hard-peg is 1 USD, only the question remains why LUSD should not drift upwards to 1.1 in the short-term? This is due to the fact that the higher LUSD rises in value in the short-term, the higher the incentive to short it (take out a loan and sell LUSD), thus driving the price back down. Over the mid-term, demand for leverage leads to downward pressure towards 1 USD naturally.

Dynamic fees

Both issuance and redemption fees scale with the base rate, which is dependent on the volume of recent redemptions. This is due to the fact that it is assumed that depegs below the target price of 1 USD are mainly caused by strong growth in loan issuance (users draw LUSD to sell for ETH), which leads to arbitrageurs buying LUSD below 1 USD for redemption. As a result, algorithmically increasing fees should dampen growth in loan issuance if the downward price impact on LUSD is large.

Summing up, the price of LUSD and dynamic fees form a market mechanism for the total cost for taking on leverage. This cost can be negative in case LUSD trades sufficiently above 1 USD, which creates the opportunity to get paid for taking out leverage.

Capturing value in LQTY token — incentivize Stability Pool & growth

Fee revenues are attributable to stakers of the LQTY token, which is continuously issued to incentivize Stability Pool stakers as well as frontend operators. The latter can choose a kickback rate from 0%-100% to distribute tokens to end users, which creates a market for efficient provisioning of a distributed network of integrators.

Low collateralization rates

Required collateralization rates are lower than competitors. As an absolute lower bound 110% collateralization ratios are required, while a safe ratio of 220% protects against 50% drops in collateral value (vs. 300% in the case of a 150% min. collateral value).

Sophisticated users should be able to max out leverage up until the low end of collateralization ratios (11x vs. 3x in MakerDAO). To execute that they need to make sure to maintain the minimum of 110%, while at the same time drawing new loans as redemptions cancel their debt without penalty (most likely abstractions will be developed to automate those efforts, as we have seen with defisaver in the Maker ecosystem).

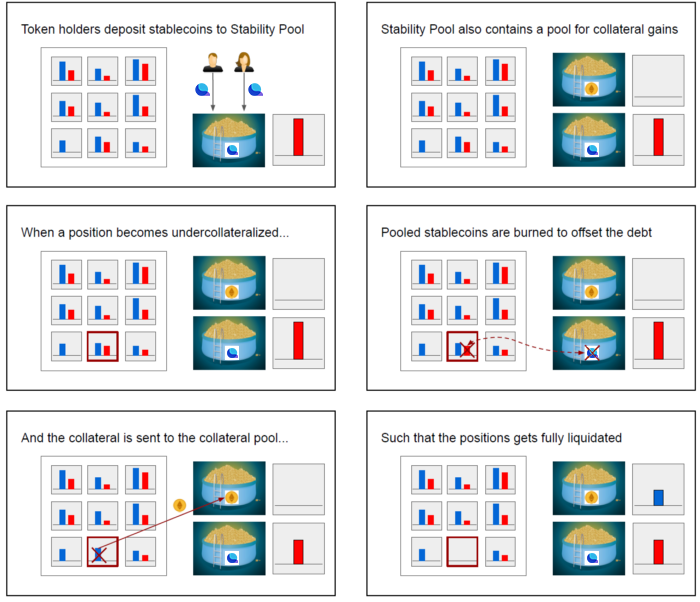

Efficient liquidations

Liquity has optimized liquidations ruthlessly for speed, which is crucial for the stability and capital efficiency of the system. The faster liquidations are executed, the less the collateral’s value can deteriorate from the time the min. threshold is reached and the time positions are liquidated.

Liquidations are executed instantly (in the same block) when someone calls the liquidate function, either by using LUSD funds in the Stability Pool to clear the debt or by redistributing the position’s debt and collateral to all other borrowers if the pool is emptied. As a result, the balance sheet is restructured and de-risked with the push of a function call (at current block gas limits, up to 85 positions in a single transaction).

Recovery mode

Liquity targets a total collateralization ratio over all troves (CDPs) of >150% in order to ensure sufficient solvency. If it falls below that value, the recovery mode is activated, which leads to the following liquidation triggers depending on collateralization ratios:

- Troves < 100%: Debt is directly distributed across other troves without previous Stability Pool offsets

- Troves 100% — 110%: Debt is offset against Stability Pool with the remainder distributed across other troves (like in normal operation)

- Troves 110% — 150%: Like above but only 110% of collateral is distributed to the Stability Pool with the remainder remaining claimable by the trove owner

Users of the system are incentivized to monitor overall system solvency in order to protect themselves against liquidations (which in turn promotes system solvency). As with other parts of the system, it is likely that services emerge on top of the system that automate these monitoring functions (Liquity gives out Gitcoin bounties for such initiatives!).

Complete contracts without residual governance

The Liquity team designs a governance minimized, immutable system, resembling a complete contract: No residual governance is necessary, as all contingencies are elegantly reflected in the contract code.

This is only possible due to the elegant design that hard-codes consequences of all future events, given input from the oracle (Chainlink with a Tellor fall-back) as well as the feedback mechanism of redemptions affecting dynamic fees.

As a result, users of the system benefit from increased trust-minimization and social scalability which specifically improves the chances that the borrowing and stablecoin protocol establishes itself a base layer in the emerging decentralized finance stack (as it is a maximally solid building block to be relied upon).

We have previously argued that this is one of the great potentials of public, permissionless and immutable blockchains: Institutional technology for governing human behavior in a more efficient, transaction cost minimizing way (see our paper and intro blogpost on blockchain governance).

It is however expected that there will be updates in the form of new versions of the Liquity smart contracts that stakeholders will rally around, as the benefits become apparent (similar to how Uniswap users switched from v1 to v2). Liquity also plans to deploy on other blockchains (they are particularly close to Dfinity due to founder Robert’s history as an early researcher with them).

In order to assess and tune Liquity’s mechanism design before mainnet launch the team has conducted extensive economic modeling with agent-based simulations in collaboration with Gauntlet (risk assessment regarding system stability) and Prof. Yulin Liu (Macroeconomic model). What is more the leading security firm Trail of Bits has performed a smart contract audit.

The founding team around Robert and Rick brings extensive both crypto-native experience as well as legal and an economics background, which are highly relevant areas for launching a decentralized financial protocol.

We are thankful for being able to support them and the Liquity community in their mission to create more efficient borrowing mechanisms for anyone and thrilled for their imminent mainnet launch.

To learn more and to also join the Liquity community, check out their Twitter, documentation, Youtube channel and join the Discord server!