Greenfield backs Idle Finance — a risk-adjusted lending aggregator

by Greenfield, Dec. 10

We are excited to share that we have backed Idle Finance in a $1.2m. Seed round together with Gumi Crypto, Quantstamp, Dialectic Capital, The LAO, and more.

Risk-adjusted lending aggregator

At Greenfield we have been investing in decentralized finance for a while and continue to be amazed by the pace of innovation and adoption. While the overall industry offers outsized lending returns if utilized optimally, it is too time-consuming and cost-ineffective to manage all of these protocols for the average user.

This is where Idle comes in and has shown to develop the most sophisticated lending optimizer on the market with a unique focus on security and risk-adjusted returns. Building on this strong foundation and investors such as Quantstamp, a reputable smart-contract auditor, Idle can further nurture its brand as the most secure lending aggregator on the market.

How does it work?

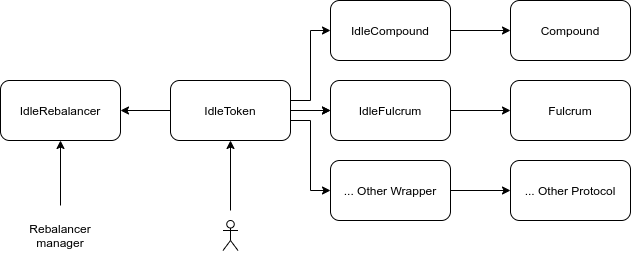

Users deposit their assets (currently DAI, USDC, USDT, sUSD, TUSD, or wBTC) to one of the corresponding Idle pools, which in turn places funds into lending pools at the currently optimal allocation. Rebalancers (users, bots, as well as the Idle team) monitor liquidity and utilization rates of integrated pools (currently Compound, Aave & dY/dX) to trigger rebalance events with a better allocation.

The calculation considers each pool’s utilization, the change of pool liquidity a rebalance is going to cause, and the resulting price impact. This reallocation ensures the optimal lending mix to maximize yield at each moment in time.

Users interact via e.g. the official web interface with the IdleToken contract. In this contract, pooled funds are held. Similar to other lending protocols, when someone deposits assets to Idle, another token that represents the user’s balance is minted (e.g. IdleDAI or IdleUSDC).

Beyond end-users directly allocating capital through the aggregator, those Idle tokens can be leveraged in a composable fashion by other DeFi protocols, as well as various front-end applications and wallets.

Yield-bearing lego brick for portfolio construction

This new risk-adjusted lending primitive can be used to build self-rebalancing portfolios with AMM protocols such as Mooniswap or Balancer. Here, the yield optimized Idle token (e.g. Idle-USDC) is used as one of the base tokens. One could have a portfolio consisting of 50% Ether (or any other token/basket of tokens) and 50% yield-bearing USD-stablecoins, which in addition to keeping the target ratio, earns trading fees as well as the yield from the Idle tokens. This design pattern could essentially replace the good old 50/50 stock/bond allocation strategy (or 60/40), while Idle manages the optimal mix among the fixed income (bond) part.

Strong focus on community-led governance

The purpose of community token distribution is to have the Idle protocol be community-owned and operated. Beyond aligning interests of different stakeholder groups it also serves to incentivize early adopters.

Idle stakeholders

- Liquidity providers: Users with deposited funds in Idle

- Operators: Users or bots that trigger rebalance function in Idle, submit a more profitable allocation, or create new allocation strategies (social strategies) that interact with Idle

- Integrators: Project and products using Idle’s yield as a service

- Builders: Developers helping with protocol improvements

- Champions: Users and influencers who recommend Idle to their colleagues and friends

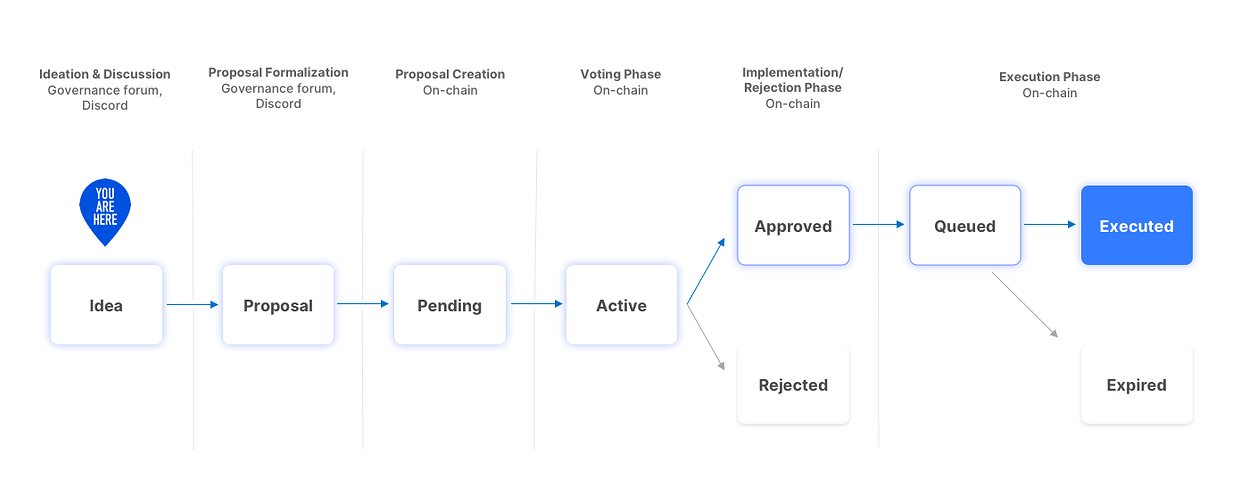

Idle’s governance is inspired by Compound’s governance module and Uniswap’s governance process, which is driven by token-holder voting with delegation. Before bringing up a proposal to on-chain voting, it is discussed in a governance forum, where the community already engages in lively debate (currently around the introduction of a balancer smart treasury). If it passes the debate, off-chain snapshot polling is employed to gauge the participation of voters. If on-chain participation can be expected, the outcome will be decided by on-chain voting.

Long Idle

We were particularly impressed by the thoroughness and long-term execution of the Idle community. They have been building and testing their products since 2019 in detail, long before launching a token, slowly attracting a core community.

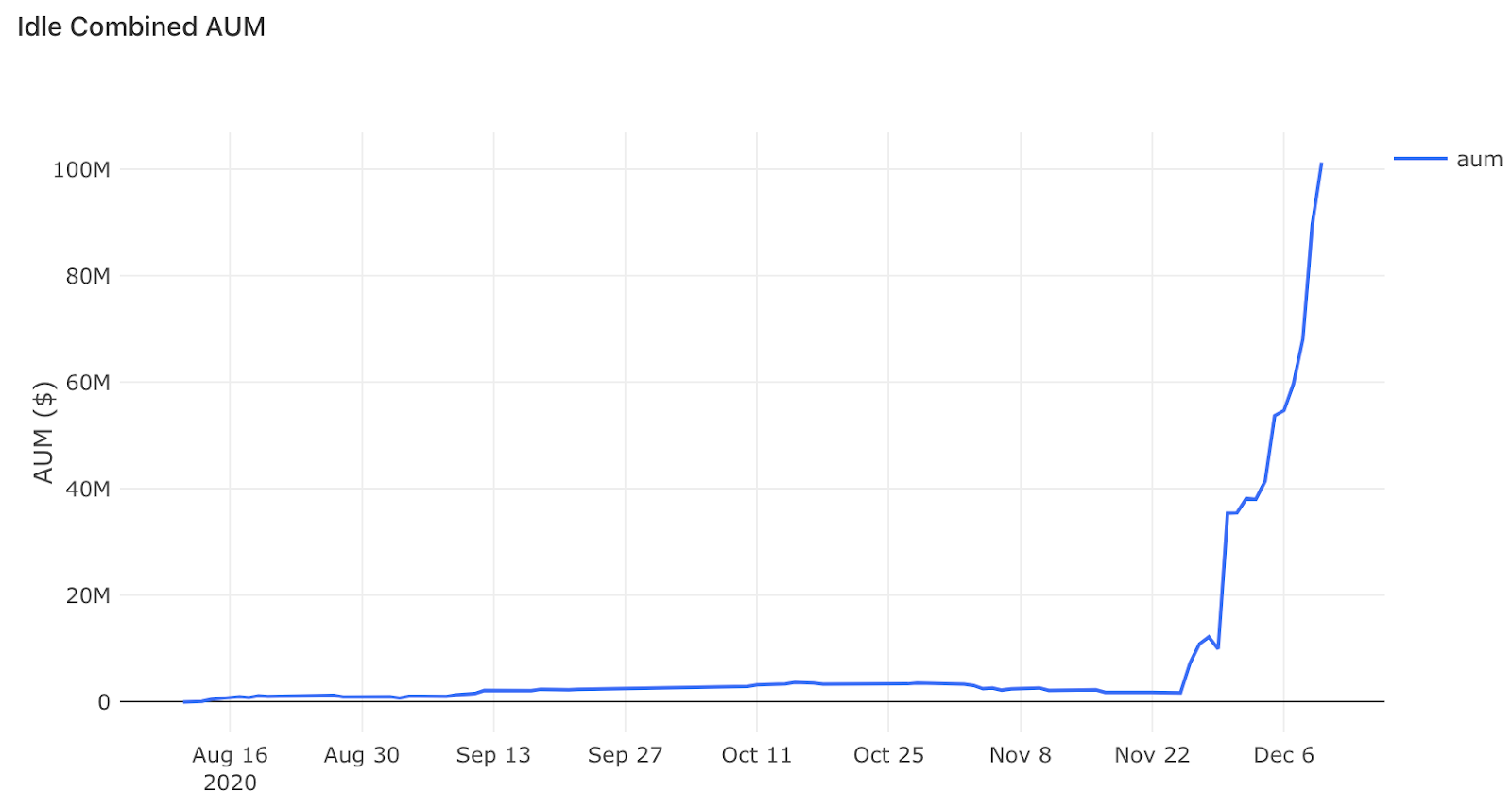

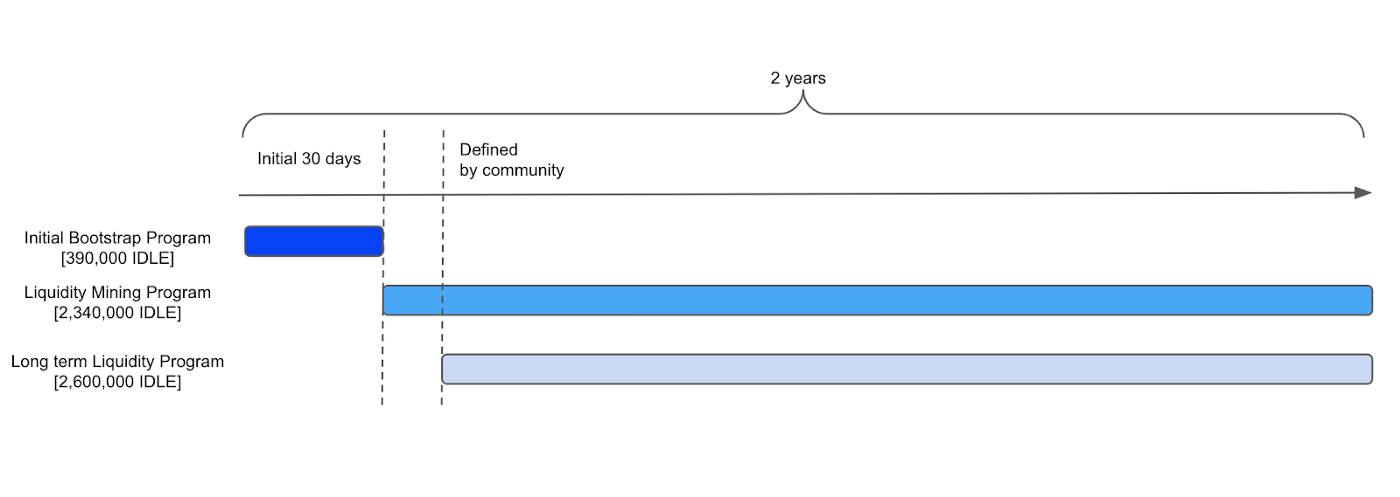

At the time of writing, Idle’s v4 smart-contracts have 611 unique users (depositors) and >$100m (see chart below) in assets locked. Admittedly, this is due to their successful liquidity bootstrap program, in which 3% of their governance token supply is distributed to early adopters.

While this current program is great to kick off the governance launch, the community is planning to implement long-term focused rewards. These should depend on the duration of liquidity provision in order to attract further loyal long-term stakeholders.

We believe that while DeFi is moving incredibly fast, this is a long game and we need to create reliable, battle-tested infrastructure that can serve as building blocks for the automated portfolios of the future that exist natively on the internet.

The Idle team has shown to ship excellent and secure code, implements the most sophisticated re-balancing algorithms and we see tremendous potential in yield-optimizing tokens that can be integrated into any DeFi product/portfolio in a composable fashion (such as AMMs).

Thus, we are really excited to be part of the Idle community, building one of the foundational, rock-solid lego bricks for the future of finance.

If you want to learn more, check out the website, documentation, the Github repository, and the Twitter profile. Also, join us on Discord and the governance forum to engage in this thriving community.