Greenfield backs Multis — a crypto-first business banking platform

by Greenfield, Sep. 29

We are excited to share that we are backing Multis in a $2.2m seed round together with YCombinator, Coinbase, Digital Currency Group, White Star Capital and eFounders.

Multis is building a crypto-first business banking platform featuring a powerful interface to manage crypto assets (e.g. for payroll, expenses, etc.) and access decentralized finance (DeFi) protocols, while providing a bridge to the legacy financial system through integrated USD and EUR accounts.

Why is access to DeFi interesting?

Let’s elaborate.

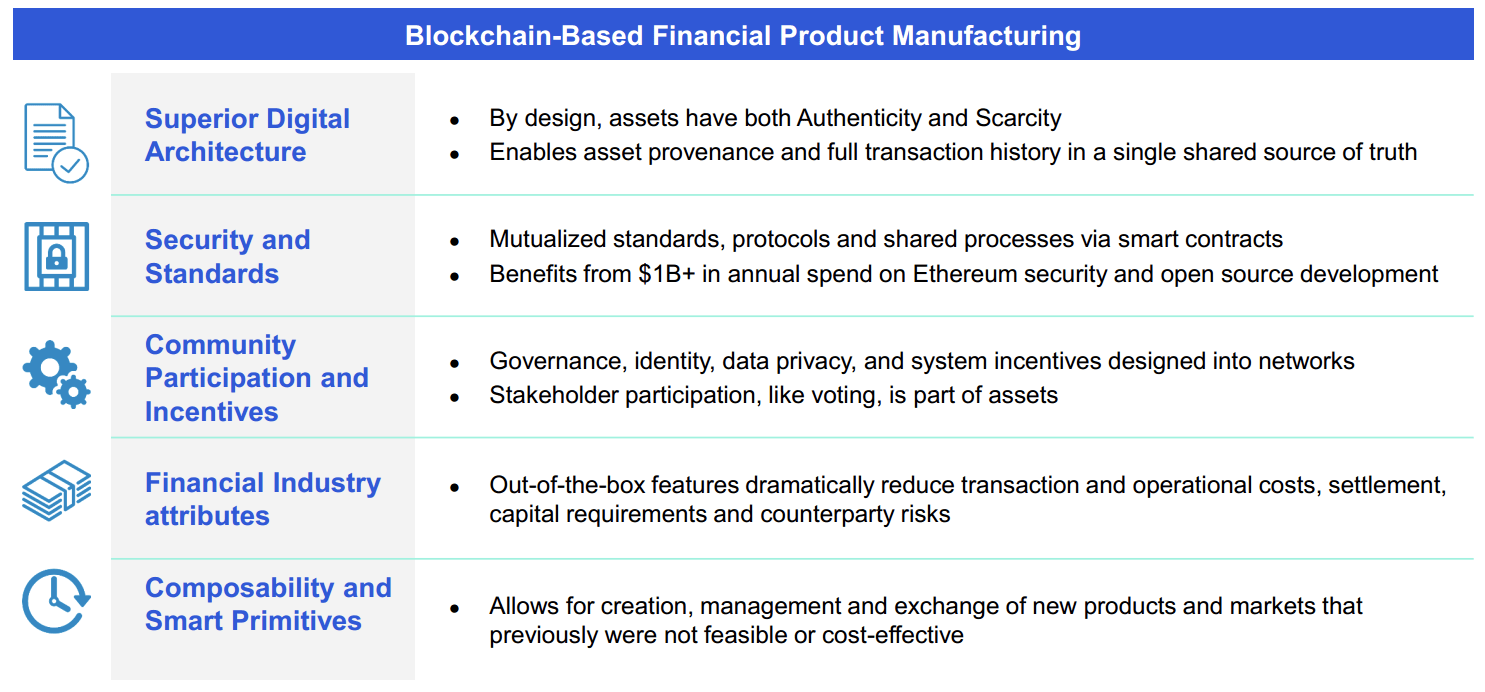

Decentralized finance protocols allow for unprecedented innovation in the manufacturing of financial services, decreasing costs (through automation), increased transparency as well as full control over one’s own assets (through self-custody).

Banking infrastructure has largely remained unchanged since the 1970s — while fintech companies have strongly innovated the front-end and customer-relationship layer of banking, they have still remained and been built on the same legacy financial stack though. DeFi protocols are innovating deep down to the bottom of the stack creating a new internet-native financial system built on decentralized blockchains with 24/7 global and borderless liquidity. The software that used to surround financial products is now baked into the product itself. Open standards allow for building and stacking financial services with internet native efficiency and experimentation. Technically anybody can start manufacturing financial products the same way anybody could launch a blog and create content with early web services. Stateful protocols allow for new non-custodial products to be built, reducing barriers to entry for novel financial products, as the user is always in control and thus the responsibility of service providers is considerably reduced. Therefore we expect to see an increasing amount of liquidity pools and other financial protocols, which will quickly become overwhelming for users (both B2B and B2C) and lead to a strong need for aggregating services on top.

Closely connected, permissionless access and innovation in the manufacturing of financial services allows users to easily switch providers while entrepreneurs can build compatible services with ease. This should result in decreasing costs blended with an increase in service quality (through competition & automation).

Composability of DeFi protocols enables a global financial stack being built in a modular fashion, with open-source software (based on permissionless access). This design pattern already showed its strength to create innovation in open-source software development: the possibility to find solutions for hard problems is not limited by the overall complexity of a problem, but by the ability to split it into small enough modules and allow for integration of them. What is more, the transparency of blockchains will allow for risks to be analyzed and managed in a superior fashion and at lower cost. Individual and systemic financial risks such as complex credit or derivative relationships can be viewed holistically while open-source code can be audited by anyone.

Already right now, a crypto banking platform such as Multis can offer cheap and almost immediate international transfers and earning interest through lending protocols that are multiple percentage points above what traditional neo-banks such as Wealthfront can offer (loanscan). Being able to store and transact in interest generating stablecoins, cryptocurrencies or others such as gold backed tokens becomes especially appealing in an environment of negative interest rates.

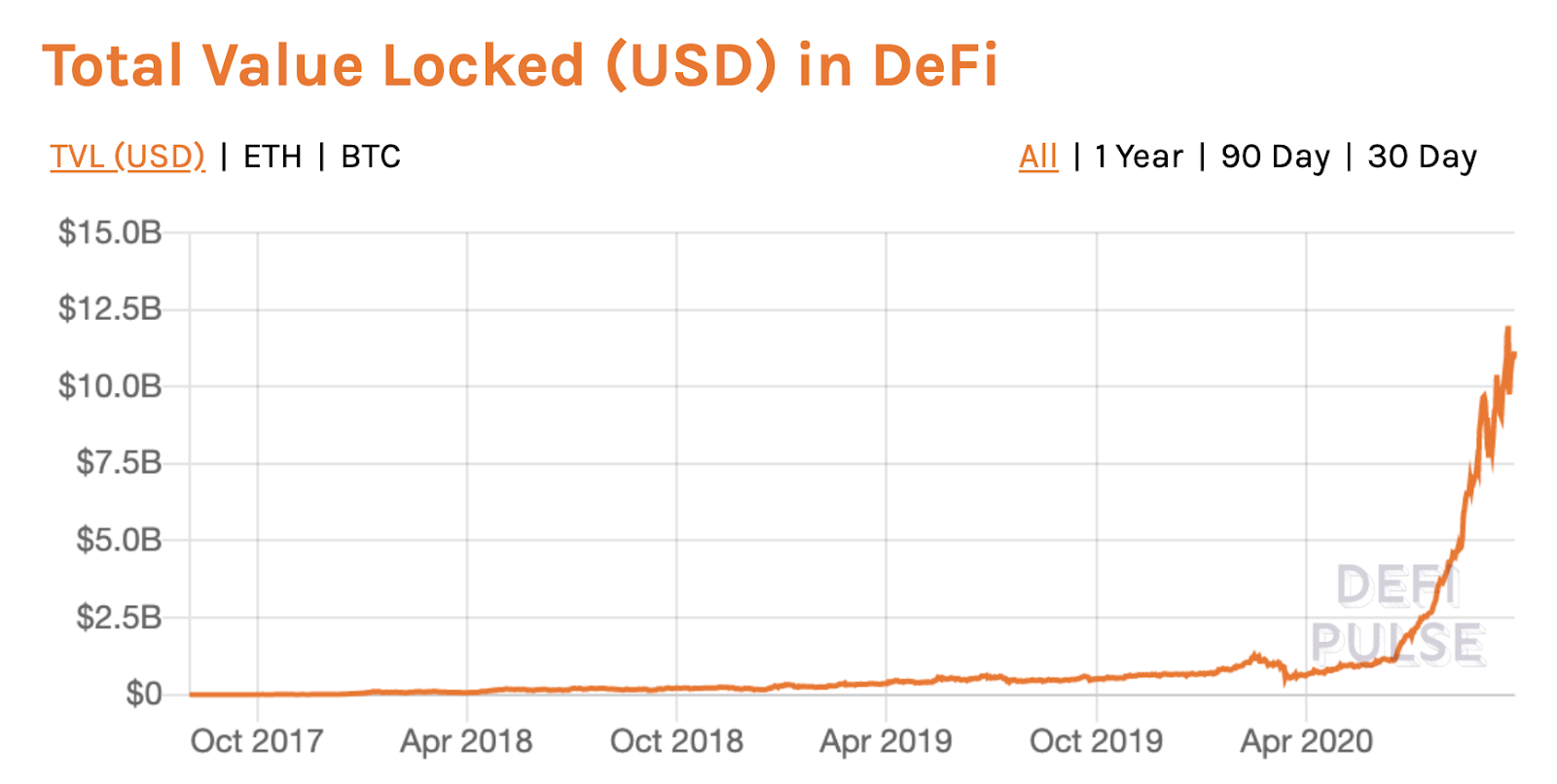

The total value locked in DeFi protocols reached an all-time high of nearly $12b USD.

Aggregators in DeFi

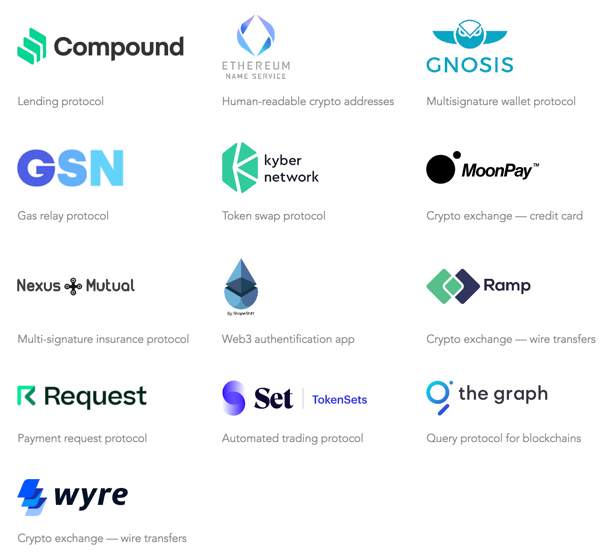

Aggregation theory has been coined as a phenomenon of web-based platforms that commoditize a previously integrated business activity such as creating content & distributing it through newspapers. Instead, an aggregator owns the user relationship, while the supply side is modularized. The best aggregators win by providing the best experience, which earns them the most users, which attracts the most suppliers, which enhances the user experience in a virtuous cycle.

In DeFi, as previously argued, the manufacturing of financial services is commoditized and modularized by software defined protocols and market mechanisms. Thus there is an opportunity to create a differentiated user experience and curate the best DeFi protocols for a specific market segment. Companies then do not have to spend time to select and test various protocols, but can utilize a one-stop-shop. Traditionally aggregators create lock-in effects by amassing user data and control over user assets. Unlike traditional web platforms, aggregators in crypto do not have such a moat around a data lock-in, so we believe that brand, trust and enhanced user experience layed on top of the aggregated protocols will be a differentiating factor for web 3 aggregators, while users remain in full control over their assets.

Multis — aggregating DeFi to better serve small businesses

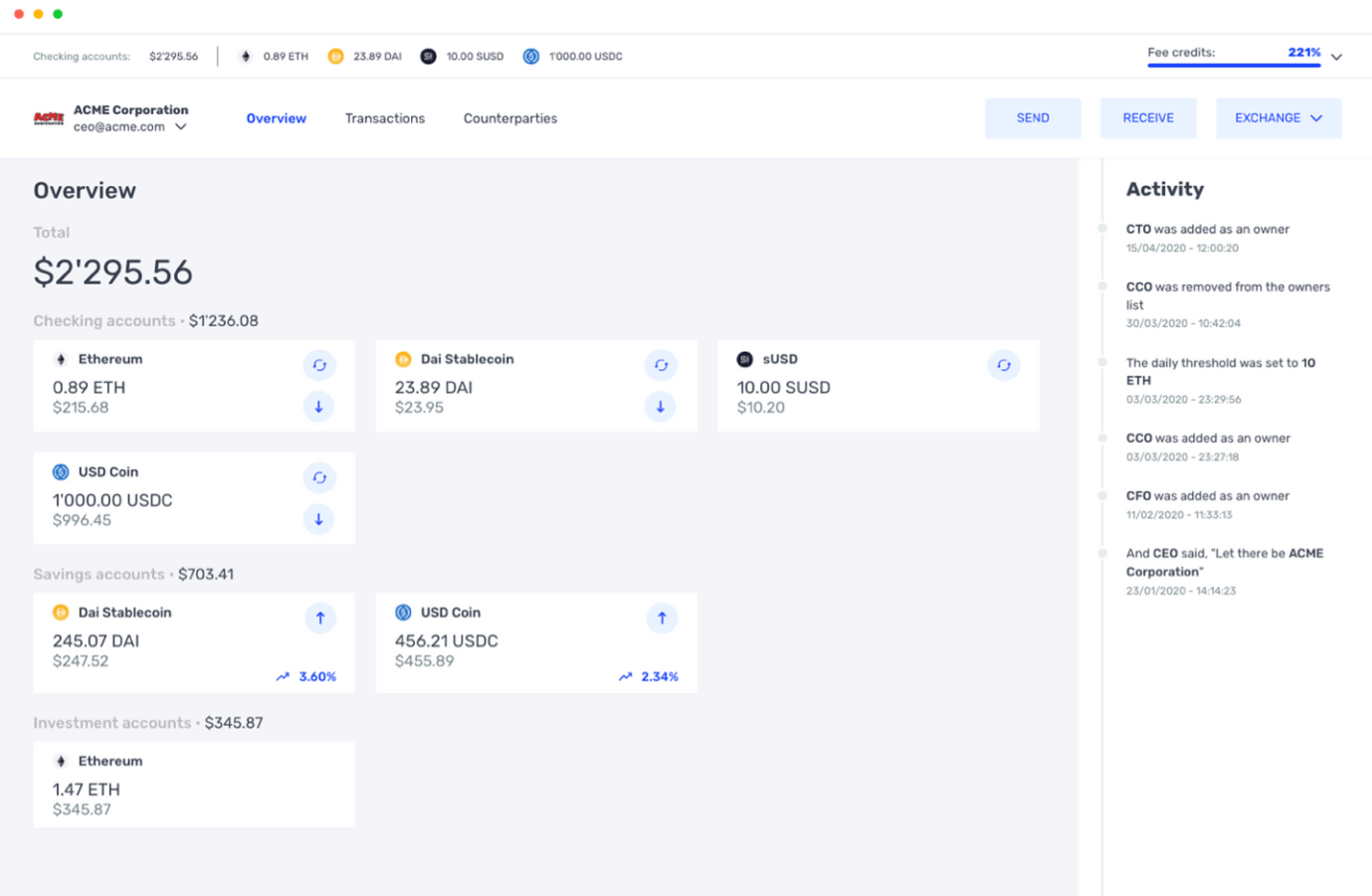

Currently, it is still hard for companies and individuals to use DeFi protocols. With full control over assets, comes also full responsibility, which needs to be managed in a secure and smart way. As a best practice several users within a firm should have full access to funds if they collectively sign transactions, while there is some redundancy built-in, if individuals should make mistakes or lose their keys (multi-sig). Such solutions have previously been more akin to developer tools than user friendly products.

We believe this to be the opportunity for a platform such as Multis with a compelling UX layer, that also smoothly bridges the legacy world from the same interface. Multis currently provides banking accounts for companies with crypto, allowing them to store assets safely with team access controls, earn interest on treasury with savings accounts, and streamline payments with instant currency transfers, even across borders. They will use the capital from this fundraise to build their premium offering, which will include Euro and US Dollar accounts and modern payment solutions including wire transfers and debit cards.

Multis´ focus on B2B instead of retail, like a couple of competitors, makes them a first-mover as well as enabling them to cater to an existing market of crypto-native companies that raised funds in tokens and/or equity and now need to manage them while navigating both crypto and fiat worlds.

We have been huge fans of both founders from the first day we met them — Thibaut and Théophile have a combined history in traditional finance and crypto and understand exactly how to converge both worlds into one platform.

If you want to learn more about Multis, check out their website and follow them on twitter.