Greenfield backs 1inch — enabling secure search for best execution and opportunities in decentralized finance

by Greenfield, Aug. 11

We are excited to back the 1inch team in a $2.8m seed round led by Binance Labs, as well as participation by Galaxy Digital, Libertus Capital, Dragonfly Capital, FTX, IOSG, LAUNCHub Ventures and Loi Luu (founder of Kyber Network).

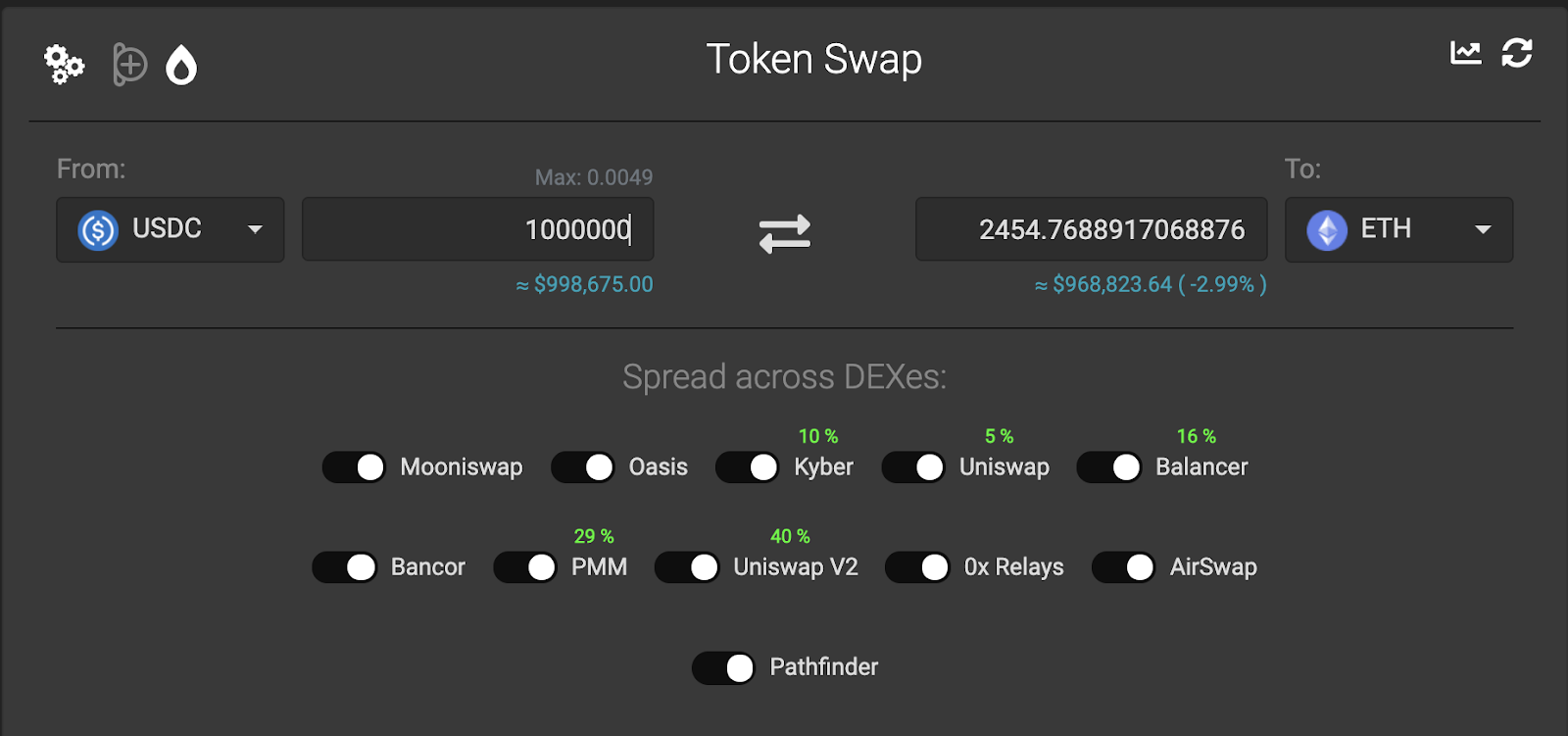

1inch is a decentralized exchange (DEX) aggregator offering traders highly competitive prices by splitting orders among multiple DEXes in one single transaction (smart-order routing). Their continuously improving Pathfinder algorithm uses connector tokens with common trading pairs and deep liquidity (such as ETH or DAI) to find the best trading routes for their users.

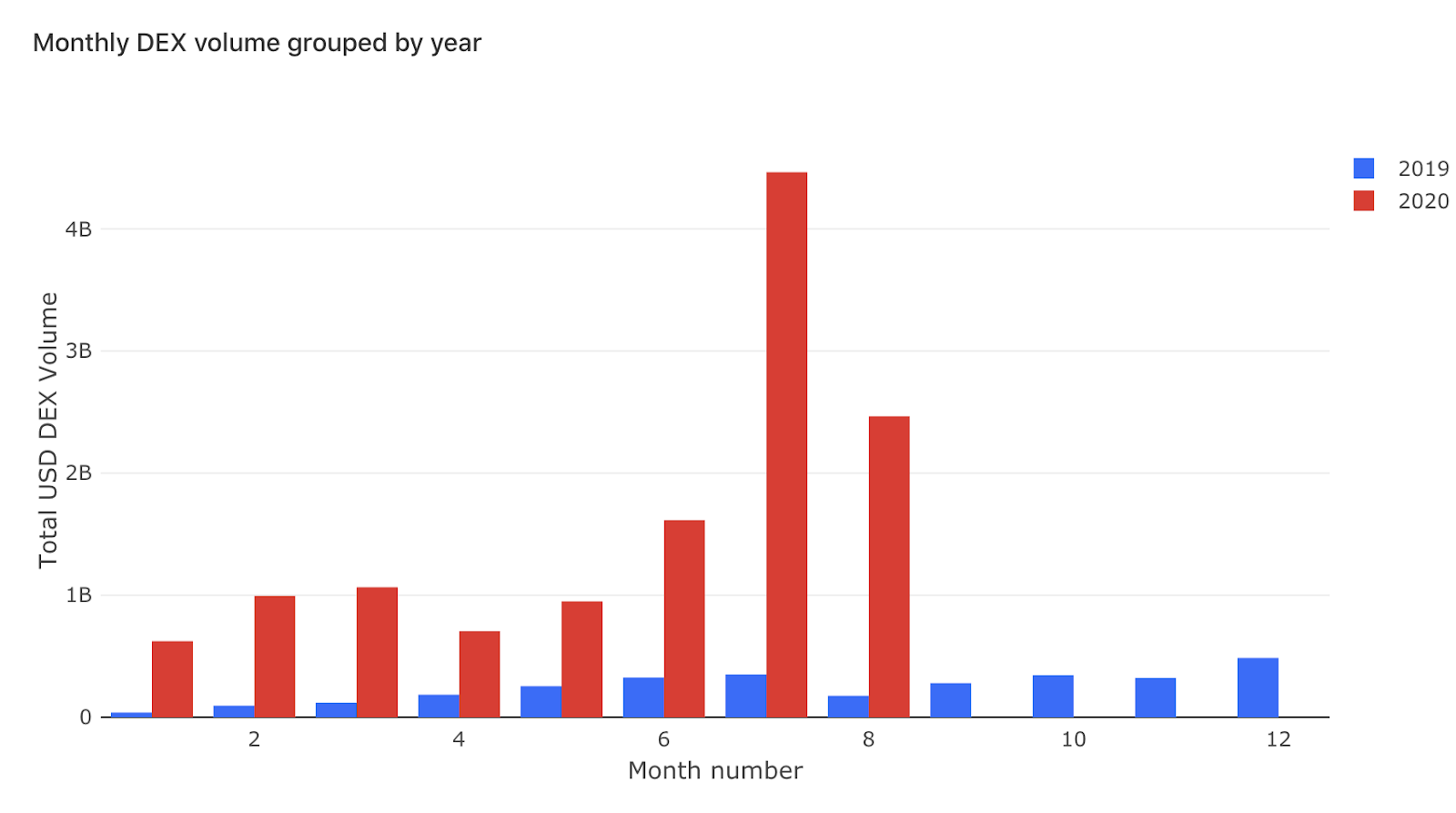

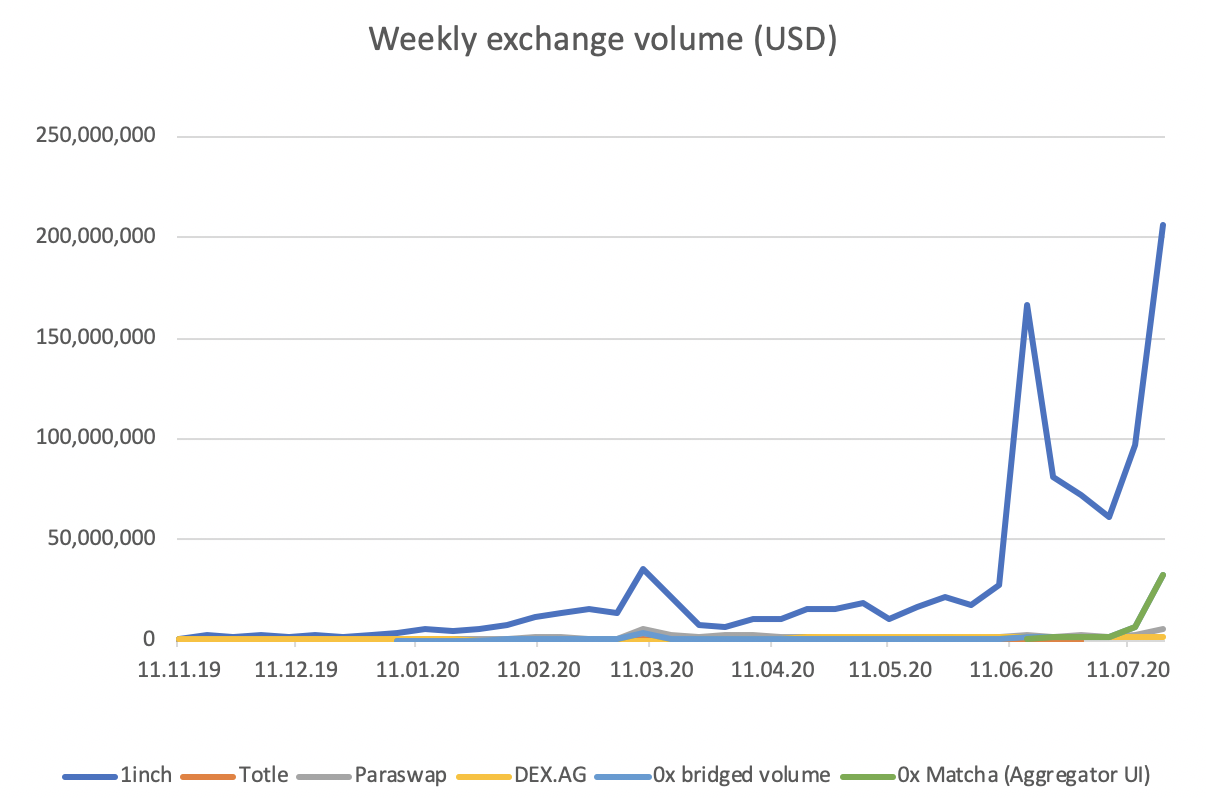

Growing at a breakneck speed, 1inch just surpassed $1.4b in total volume (check Dune Analytics for current data). Based on that traction, they are by far the leading DEX aggregator that has already integrated support from top DEXs including Uniswap, Kyber Network, Airswap, Oasis, Bancor, Balancer, Curve, and many more. 1inch’s daily active addresses have grown from 115 addresses last year to over 1.2k wallets in July 2020, totalling >17.7k addresses since launch.

The UI connects to their smart-contract in order to split transactions between various liquidity sources, also using Chi Gastokens to save on Ethereum fees (ca. 40% on average). Besides market orders, 1inch also enables fully decentralized limit orders through 0x mesh.

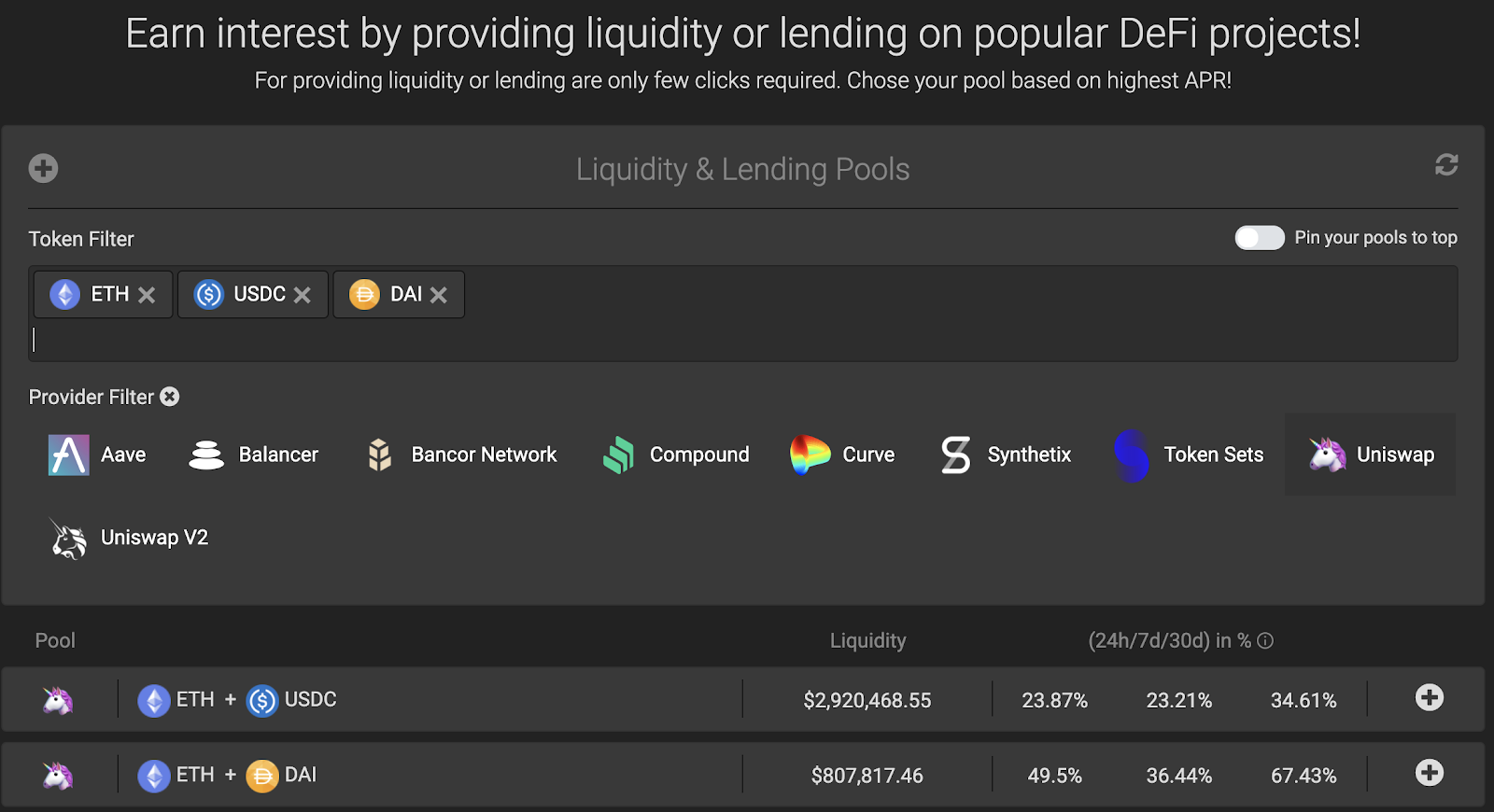

Starting with strong traction on the first core product, 1inch’s vision is to become an aggregator for various DeFi verticals, while also offering their own products and pools. Services are accessible through a web UI, desktop app, an API as well as directly through the smart contracts. A mobile app is to be released soon.

The project initially started as a hackathon project at ETH New York (May 2019). Until recently CEO Sergej Kunz worked for Porsche as a security engineer, while CTO Anton Bukov was part of the NEAR team and most recently built the NEAR — Ethereum bridge. Both founders are security experts, that have built themselves a strong reputation in the crypto and DeFi space for uncovering vulnerabilities and thus protecting users (e.g. Fulcrum exploits, >100 live audits in their crypto maniacs youtube channel), as well as helping to identify hackers (dForce exploit). They have proven to be able to perform proper due diligence on the security of critical infrastructure and quickly iterate with 1inch upon user needs. Over the last couple of months, the core team has recruited a dozen further developers, mainly consisting of Ethereum hackathon friends, who demonstrated their skills by winning multiple awards.

The DeFi opportunity

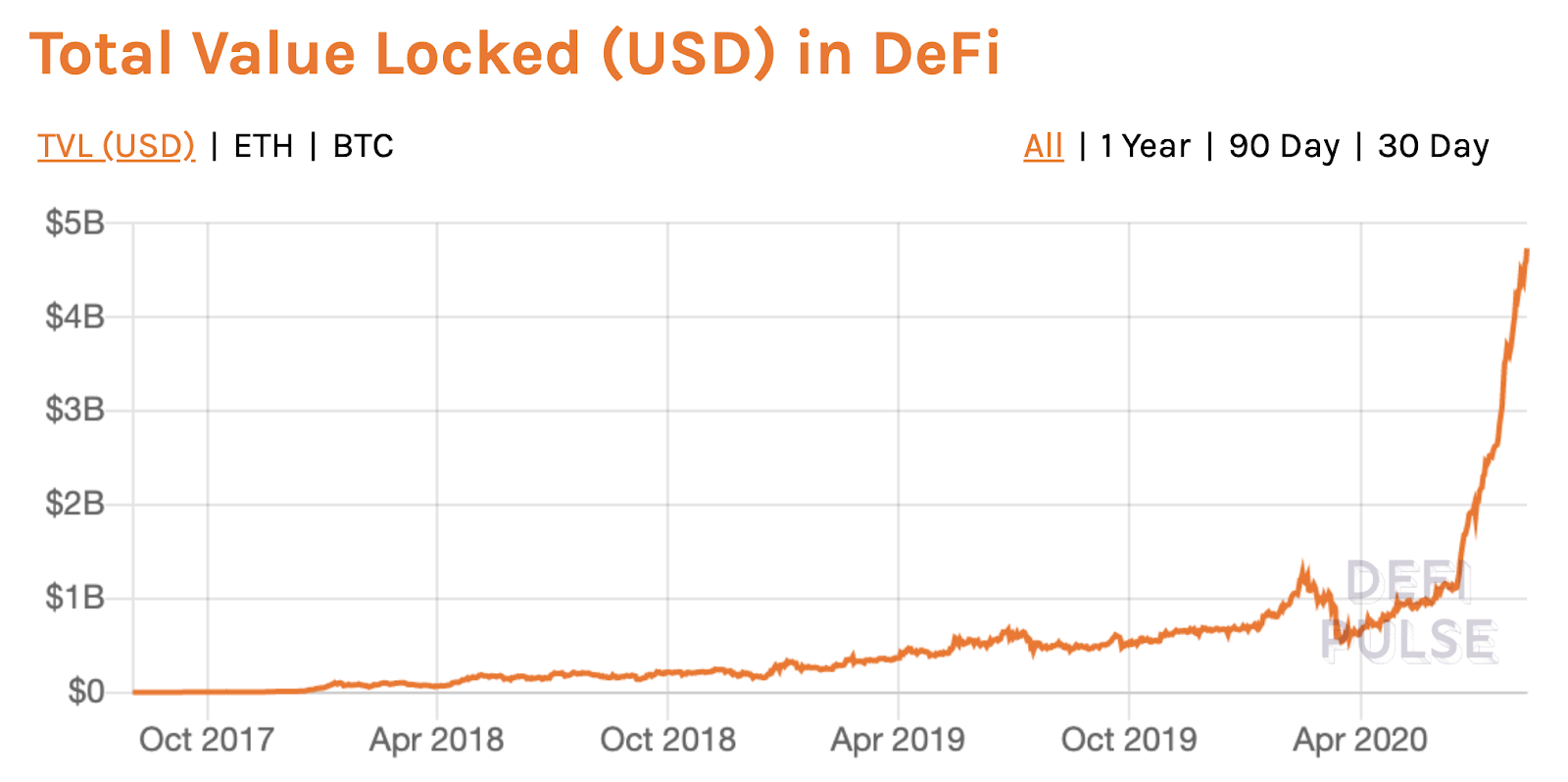

Decentralized finance protocols allow for unprecedented innovation in the manufacturing of financial services, decreasing costs (automation), increased transparency as well as full control over one’s own assets (self-custody). What Fintech did to the front-end- and customer relationship layer of banking, DeFi protocols are doing to the whole banking stack, down to it’s back-end, creating an internet-native financial system with 24/7, global and borderless liquidity. The software that used to surround financial products is now put into the product itself. Open standards allow building and stacking financial services at internet native efficiency and experimentation. Technically anybody can start manufacturing financial products the same way anybody was enabled to start a blog and create content with early web services. Due to decreasing barriers to entry for novel financial products we expect to see an increasing amount of liquidity pools and other financial protocols, which will quickly become overwhelming for users and lead to a strong need for an aggregator, which helps users search for the best opportunities.

Composability of DeFi protocols enables a global finance stack being built in a modular fashion (so called “money legos”) with open-source software. This design pattern already showed its strength to create innovation in open-source software development and other peer production: the possibility to find solutions for hard problems is not limited by the overall complexity of a problem, but by the ability to split it into small enough modules and allow for integration of them. What is more, the transparency of blockchains will allow for risks to be analyzed and managed in a superior fashion and at lower cost. Individual and systemic financial risks such as complex credit or derivatives relationships can be viewed holistically while open-source code can be audited by anyone. Zero-knowledge proofs can allow for differential privacy — individual accounts and transactions can be kept private, statements about the aggregate of a system or e.g. whether an individual correctly computed tax liabilities can be queried.

The need for an aggregator: Overwhelming opportunities — limited skills & time

Going forward, as the internet of value reduces the barriers of entry to create financial products in a similar way the internet reduced the barriers of entry to create content, it is to be expected that there will emerge a plethora of products that quickly becomes overwhelming for users. What is more, there is a need for verifying the security of new protocols and smart-contracts before using them, which is difficult for individuals to perform (lack of skills or time). Thus, there is a huge opportunity for an aggregator to build the “search engine” for on-chain financial products and liquidity, that not only provides the best prices and deals, but also abstracts away the complexities involved in verifying the security of individual smart-contracts.

A product that continuously provides the best prices on the internet, while maintaining high levels of user experience as well as security, will be able to build a defensible brand moat around their reliable service, even though lock-in effects through data ownership and custody are expected to be substantially weaker than in web2.

Brand, trust, continuous innovation & community as a moat

As a first-mover, 1inch has been able to build a leading position amongst competitors, showing considerably stronger traction. While web3 is defined through full open-source auditability and trustless interactions if one verifies all software components, one interacts with, it is hardly possible for everyone to do so (even if an open source community as a whole watches out for, warns about and patches security vulnerabilities in a far superior fashion as centralized entities could do so). Most users will need to trust the interfaces they interact with to implement with only secure protocols.

Thus, 1inch can build a defensible product and brand by scaling their security expertise, as they continue to integrate the best DeFi protocols and optimize offerings for their users. Aggregating supply (liquidity) and maintaining direct relationships to users in a world with lowering barriers of entry for financial innovators and liquidity providers might prove to be a strong strategic position in the web3 ecosystem. What is more, as 1inch will decentralize the project further over time, they will be able to leverage a strong community of believers and supporters, which has been starting to form over the last year.

New product launch — Mooniswap: Yield optimized Automated Market Maker (AMM)

Bancor first implemented an automated market maker, which holds the proportion of a trading pair constant by a constant product pricing formula. As a result, liquidity providers have their portfolios automatically re-balanced to a 50/50 ratio by arbitrage traders, while at the same time earning trading fees (which is likely to turn out as a revolutionary building block of next generation ETFs and robo-advisors, as now investors get paid to have their portfolios rebalanced). Traders, on the flipside, have always available on-chain liquidity, while developers can integrate the mechanism into their products for automated swaps. The concept has been framed a 0 to 1 moment in decentralized finance, with various projects launching optimized versions for specific use-cases.

1inch’s core aggregation product taps into liquidity of all main AMMs in existence and allows optimized swaps in a single transaction, in order to minimize the amount of slippage a trader is experiencing. In addition, they provide an interface and smart-contract to filter as well as deploy tokens in the best performing liquidity or lending pools.

With slippage (caused by large trades) on individual AMMs, arbitrage traders have an opportunity to drive the price back to the market level, which allows them to earn in many cases considerably higher profits than the passive liquidity providers in the AMM liquidity pools.

As part of their product suite, 1inch just launched their novel AMM, which should drive a considerably larger share of those profits to liquidity providers, while also mitigating front-running by using virtual balances like in an idea shared by Vitalik Buterin. The concept allows the new AMM to keep most of the slippage revenue in the pool by maintaining virtual balances for different swap directions. In the case of price swings (through slippage or otherwise), the pricing formula improves exchange rates for arbitrage traders slowly, over a 5-minute time period, effectively creating a reverse auction. Competition among arbitrageurs leads to marginally profitable arbitrage trades to be executed at better rates for LPs than otherwise, which drives more value towards the pools. The team has simulated scenarios, comparing Uniswap v2 to the new design, which point towards 50% — 200% higher LP returns (with very volatile trading pairs returning even more). The standard trading fee is 0.3% with 5% of which demonstrating a referral fee towards wallets or aggregators such as 1inch, integrating Mooniswap.

1inch has established themselves as a clear market leader among aggregators

Having established a clear lead in the aggregator space, while rapidly iterating as well as launching new products, we are thrilled to support the 1inch team towards helping users explore and navigate the exploding space of decentralized finance and programmable money.

If you want to learn more about 1inch follow them on Twitter, Medium, Youtube and try out their products to make the most out of decentralized finance.