A crypto network valuation framework – applied to Celo

by Felix Machart, Mar. 17

Celo is an open platform which is based on the building blocks of decentralized, censorship resistant, stable digital & programmable money as well as self-sovereign identity — Celo makes financial tools accessible to anyone with a mobile phone.

At Greenfield we invest with a long-term view in early developer teams building towards an open, decentralized and more robust architecture of tomorrow’s web. Celo is an amazing example of a team with a great vision and also an economically sustainable model. In this blogpost we want to demonstrate some viewpoints, first qualitative, then quantitative, from which we try to evaluate an early-stage project.

Full-stack approach

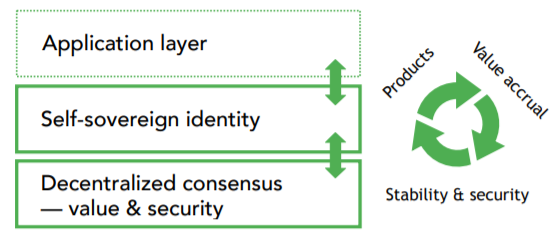

Celo is building a layer 1 blockchain with the native token $CELO which also serves as a utility and governance token as well as a part of the reserve assets in a digital, automated central bank. In this stability mechanism demand for $CELO increases with increasing demand for Celo stable currencies (elaborated on further below). In order to maximize the stability of the system, the reserve asset pool demonstrates a diversified basket of crypto-assets beyond $CELO. Moreover the team is building an identity solution (based on co-founder Sep Kamvar’s research in p2p reputation) as well as the initial products on the platform, starting with a mobile payment app.

While stable coins are the first products to be launched, the platform is designed to serve the needs for more financial products to be designed and introduced (e.g. insurance, lending, saving etc.).

The market need

Providing identity as well as financial services based on blockchain technology & low-end smartphones to billions of underbanked people can facilitate tremendous economic development. Once users are on-boarded they can participate in global-by-nature financial markets, powered by secure open-source software, allowing for rapid innovation to cater to local needs.

Various countries crave for easily accessible stable currencies, as hyperinflation is still prevalent and large parts of the population are underbanked (e.g. South America, Africa).

- 1.7 billion adults unbanked (World Bank)

- 1.1 billion people do not have an officially recognized form of ID (World Bank)

- ⅔ of the unbanked population has a mobile phone & adoption is rising quickly

Value capture: Clear connection of stable token adoption and $CELO

A crucial aspect in Celo’s design is the clear connection between the adoption of celo stable tokens (initially “cUSD” — a USD-pegged token) and $CELO. As usage of stable tokens grows (monetary expansion), Celo Dollars are minted and the reserve asset $CELO is algorithmically purchased on the market and locked in the reserve as collateral (detailed explanation). Further below, a quantitative valuation approach is provided in order to exemplify the mechanic in different scenarios.

Network effects from increasing volume / variety of stable tokens & apps

As different economic and cultural circumstances call for different currencies and monetary policies, Celo’s vision includes a multi-currency system that can share reserves for increased stability. Various regional medium-of-exchange (MoE — stable value) currencies are intended to be introduced over time. Both increased usage of an individual MoE and the usage of a shared reserve with various MoEs show properties of network effects, as there are positive externalities in an additional unit or type. Fluctuating demand for individual MoEs is diversified and thus aggregate shocks on reserve assets minimized. Further, changing relative supply of regional MoE currencies can be balanced by algorithmically buying/selling them against each other without needing to buy/sell reserve assets.

An increasing number of applications (mobile-based financial products) should drive demand for stable tokens on the platform. More stable token demand drives value accrual of $CELO, which in turn increases the value of the reserve pool and the security guarantees in Celo’s Proof-of-Stake (PoS) consensus layer. The more value resides in the reserve pool, the more stable tokens can be algorithmically purchased on the market in order to stabilize stable tokens against their peg. The more value embodied in $CELO, the higher the security guarantees in PoS, as it becomes increasingly expensive to corrupt the system. The more secure the platform is in turn, the more developers want to build on it and the more users will trust to use it. As a result, there is a flywheel dynamic inherent in the design, that strengthens the system through positive feedback loops.

Valuation

As mentioned above, $CELO is the token to capture value from increased adoption of Celo stable currencies used as medium-of-exchange. It is worth highlighting that the discussed approach is only a model, that will not fit reality perfectly, but is still interesting in order to evaluate the drivers that impact the value of $CELO and to understand how the system works. All information regarding Celo included in the model is publicly available and verifiable by anyone. The discussed model follows a specific method that has been co-developed with other investors in the space and looks at the features of the specific system analyzed in order to correctly attribute value flows towards the network (in this case a discounted cash-flow like approach has been chosen, as elaborated on later).

The value of $CELO is derived from monetary expansion of Celo stable assets (expansion value) and from increased utility (utility value) based on the fact that transaction fees can be paid in $CELO as well as from increasing scarcity of $CELO in float, as more and more is algorithmically purchased on the market and put into the reserve.

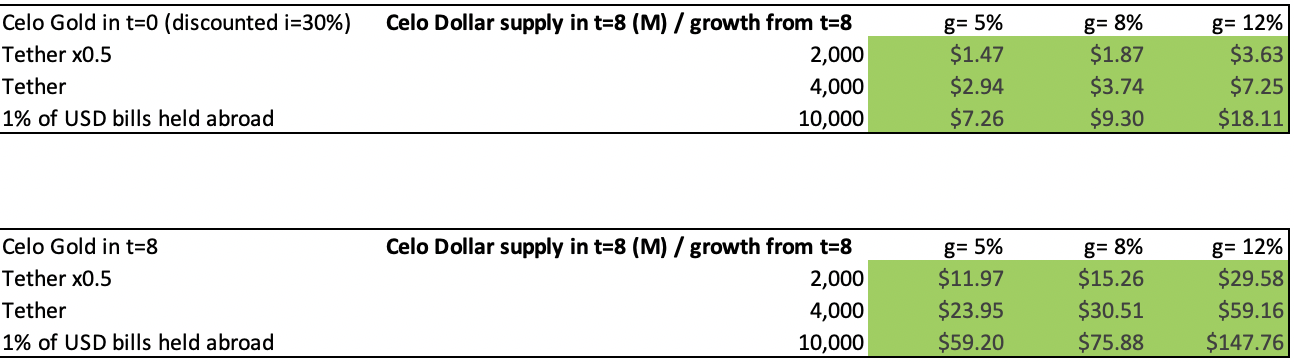

In order to argue about the value of $CELO, we provide a model that assumes different levels of adoption until year 8 (t=8) after launch (Celo Dollar in circulation) as well as expected growth rates from t=8 in several scenarios. The outputs represent fundamental values of $CELO in t=8, given the assumptions (see linked model for detailed calculations and assumptions). In order to derive the current value of $CELO in t=0, the t=8 values are discounted with a risk-adjusted interest rate (i=30%) for 8 years.

Expansion value

The expansion value derives from the fact that on expansion in demand for Celo Dollars, the protocol will purchase $CELO, effectively bringing future cash flows to $CELO holders (expected growth is priced into the current value of $CELO). As a result, the expansion value can be estimated by a variation of the Gordon Growth Model (which is based on growing discounted cash-flows).

Marginal demand in stable tokens leads to 50% marginal demand in $CELO, as the reserve is being re-balanced to a 50:50 ratio of $CELO vs. a diversified basked of crypto assets. Thus, 50% of the marginal (growth in) demand for Celo Dollars and the transaction fee of 0.5% represents a recurring cash-flow towards $CELO holders. In order to calculate the present value (in t=8) of the perpetual annuity, one has to divide this cash flow by the discount rate (i=15%) + expected dilution (3% — from e.g. block rewards) — growth in Celo Dollar demand — transaction fee.

Utility value

The utility value derives from the fact that transaction fees are paid in $CELO and put into the reserve (for UX optimization, a user can pay e.g. in Celo Dollars and behind the scenes there is a currency swap). The utility value is also calculated using the dividend growth model by assuming the cash flows constituting fee revenue, based on an average velocity of 35 (each Celo Dollar is transferred/circulated 35 times each year, thus causing a fee revenue each time; see Maker velocity at launch 140, now 36).

Scarcity of $CELO ($CELO in float)

Moreover the value of $CELO is dependent on the scarcity of its available supply in float, which in turn depends on the number of tokens that are still unvested in the allocations of team members and backers, yet unsold, yet unissued in the form of incentives and locked-up in the reserve (official update on supply schedule).

The exact level of float is hard to predict given that it depends both on how much of the $CELO that was sold in the sale was purchased back into the reserve (influenced by monetary expansion of stable assets as well as the then prevalent price of $CELO) and how much already vested backers and team members have sold. Such behavior is heavily influenced by individual holding preferences as well as expectations of the future. In the model, it is thus conservatively assumed, that all tokens subject to a vesting schedule are fully liquid and part of the circulating supply. $CELO, purchased back into the reserve, is assumed to be purchased by the average $CELO price from t0-t8.

In general it is to say, the better Celo’s platform and adoption will turn out to be, the longer individuals will want to hold onto their $CELO, thus the higher the price and thus the higher the expected future price.

Governance and backer tokens are fully liquid until t=8. Block rewards, as well as community & ecosystem grants are distributed linearly, with 50% being released until t=15.

The amount of $CELO purchased into the reserve takes liquid $CELO from the market and thus reduces float. It is derived from 50% of the value of total Celo Dollars in circulation and the average value of Celo Dollars in circulation multiplied by 8 years and an average velocity of 35. Then the average price of $CELO from t=0 until t=8 is used to define the sum of $CELO purchased into reserve. (approximated by iteration, as the result of the valuation — the price of $CELO— depends on the average price of $CELO)

Scenarios & outputs

The following tables summarize scenarios for Celo stable tokens (e.g. Celo Dollar) in circulation in t=8 as well as expected growth rates going forward. Expected growth has been modeled in a variation of the dividend growth model as it is assumed that market participants price-in expected cash-flows from $CELO buy-backs with expanding stable token supply (expansion value) and transaction fees (utility value).

Stable tokens in circulation have been estimated conservatively with values ranging from $2B, comparable to ca. 50% the currently largest centralized stablecoin Tether to $10B, which is equivalent to 1% of USD bills currently held abroad (Chicago FED), as well as growth rates of 5%, 8% and 12%.

The first table represents estimates of the current $CELO value (t=0), while the second table represents estimates in 8 years time (t=8). As mentioned earlier, the first table is based on the second, by discounting the result of the latter by i=30% over 8 years (which represents a risk-adjusted interest rate).

A higher transfer fee, velocity, Celo Dollars in circulation or demand growth rate would lead to a higher $CELO price. A higher discount rate, dilution percentage or $CELO token float would lead to a lower $CELO price. (see model for details)

Disclosure: This content is for general informational purposes only that expresses our opinion, and it should not be construed as legal, tax, investment, financial, or other advice. Nothing contained here constitutes a solicitation, recommendation, endorsement, or offer by Greenfield to buy or sell any digital assets or other financial instruments. All data used is derived from publicly available sources.